What the banks aren't telling you about the housing market

Wherever you sit on the housing bubble debate, can we all agree that our major banks are far too conflicted to offer an unbiased view of the market?

In an interview with The Australian Financial Review yesterday, Bill Evans from Westpac, Alan Oster from National Australia Bank, Michael Blythe from Commonwealth Bank of Australia and Warren Hogan from ANZ emphatically declared that Australia does not have a housing bubble.

The interview followed comments by Jeremy Lawson, global chief economist of Standard Life and former senior economist at the RBA, who said that Australian property was overvalued “by between 20 per cent and 30 per cent” based on a new valuation model proposed in an RBA research paper in July (my assessment of that research is contained here).

Naturally that doesn’t sit well with the major banks. Australian banks have binged on mortgage lending over the past couple of decades, reaping record profits year-after-year, which has resulted in Australia possessing one of the highest levels of private debt in the developed world.

In recent years, they have taken it to a whole new level. Slowly but surely, they have undermined the very business sector that allows Australia to pay such high prices.

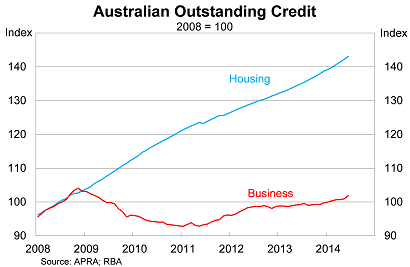

Mortgages to owner-occupiers and investors have accounted for more than 100 per cent of outstanding credit growth since the end of 2008. That means that credit to businesses actually declined. Mortgages now account for more than 60 per cent of total credit outstanding and is rising rapidly, up from just 43 per cent at the turn of the century.

“We simply don’t have the speculative credit element there to describe it as a bubble,” Hogan said.

Or do we?

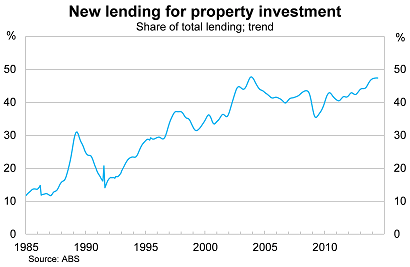

Assessing a critical limit on speculation is always difficult, but speculation is elevated, with investor loans rising to more than 47 per cent of loan approvals. Consistent with this, interest-only mortgages (much loved by property investors) increased to a remarkable 43 per cent of new mortgages in the June quarter.

The last time investor activity in Sydney was this high it resulted in a significant downturn. Real prices didn’t recover for a decade, but I doubt any of the majors provide that sort of information for prospective buyers.

In fact, given the extraordinarily low rental yields on most Australian property owing to generous negative gearing and capital gains policies, isn’t it reasonable to declare almost every new property investment venture a speculative one?

“Housing credit’s running at the bottom end of the range the past 30 years,” Blythe said. “You need to see banks easing their lending standards as they chase more dubious borrowers. That’s certainly not happening and you need a general expectation that house prices are going to keep rising forever.”

This is a common mistake. A housing bubble doesn’t require excessive lending in a historical sense, it simply requires lending to exceed growth of household incomes or the broader economy until it reaches a point where it becomes unsustainable.

Furthermore, credit growth is not low because banks are being prudent and households cautious, but because the stock of existing credit is now much higher. Lending growth was relatively stronger throughout the 1990s precisely because it was coming off such a low base. That’s hardly a tick in the favour of current lending practices.

We are seeing some modest easing of lending standards, though not necessarily worse than they were pre-crisis. As noted above, interest-only loans are at an elevated level, while loans approved outside serviceability have doubled over the past four years.

New loans with loan-to-valuation ratios greater than 80 per cent are several times higher than the recent speed limits introduced in New Zealand by the Reserve Bank of New Zealand -- a market where property is similarly priced compared with history.

Our major banks seem rather complacent about the challenges facing the housing market, which will threaten their entire business model. The reality is that the housing market has become increasingly cyclical. Following two decades of unprecedented growth, house prices have suffered three downturns over the past decade, with mounting evidence that another could be on its way (Watching the housing market for vital signs, August 21).

These downturns occurred despite solid income growth, low unemployment and the mining boom. What would happen if the economy suffers a genuine setback such as rising unemployment, a sharp fall in mining investment or China slowing significantly? How does a combination of the three sound?

Add in a variety of other issues such as negative real wages, university students potentially beginning their careers with six figures of debt and an ageing population, and it becomes clear how vulnerable the Australian housing market might be.

Not that you’d know this by listening to these chief economists. Don’t expect much discussion on the housing implications of a shift towards lower income growth. Certainly don’t expect them to offer a critical view of the systemic risk posed by the four ‘too big to fail’ banks and their exposure to an increasingly volatile asset class worth more than $5 trillion.

The unfortunate reality is that with hundreds of billions on the line we shouldn’t expect our major banks or their chief economists to talk sense about Australian property. If there really is a bubble or a housing downturn, you can be sure that our banks will be the last people to let you know. They can’t afford it to be any other way.