What is a Separately Managed Account?

You are allocated units which represent your investment and as the value of the total pool of funds increases or decreases so to the value of your units.

Do you know what a portfolio looks like if you manage it yourself? You don’t hold units of course, you hold the shares you buy and you get to see all the companies you hold and the number of shares you hold in each.

Like the sound of your own portfolio without having to pick the stocks and manage them? That’s what a Separately Managed Account (SMA) gives you.

An SMA is like a managed fund in the way you get a professional fund manager controlling the portfolio, buying and selling stocks to achieve the portfolios stated goal. Depending on the investment strategy, portfolios will have different desired targets.

The major differences come in the ownership structure of the portfolio. You don’t own units in a pooled investment, you own the underlying stocks. With that comes greater transparency with the portfolio. Typically, a managed fund will only show you a snapshot of the top ten holdings at the end of the month. By the time, you see the update the fund might have sold some of those stocks.

Another benefit that comes with the ownership structure of a SMA is the ability to transfer stock in and out of the account when setting it up or closing it down. If you hold several stocks the investment model already holds you can save yourself from having to sell and buy back those holdings, therefore avoiding brokerage and potential tax implications.

An important factor to your future returns are the costs associated with running your portfolio. With an SMA we can keep the costs down especially on the transaction side. Investors benefit from our wholesale brokerage with transactions costing 0.05% of the trade value and a $0.33 settlement fee.

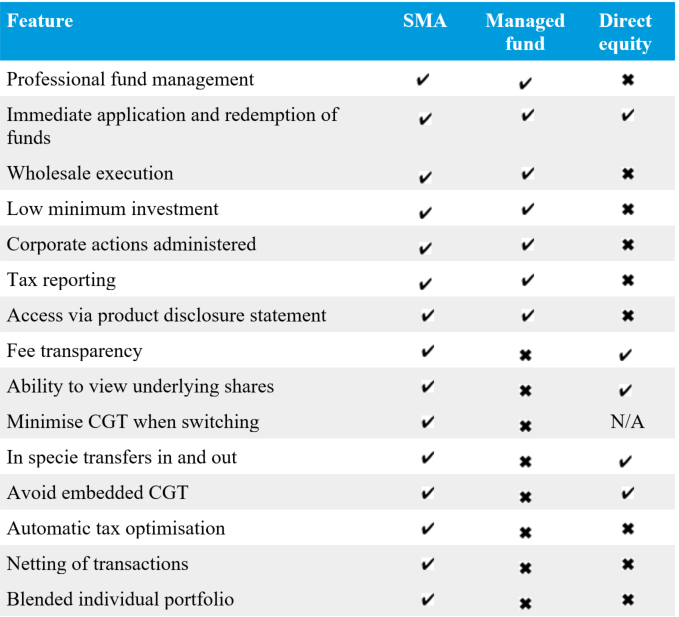

For more features check out the table below or contact us.

Frequently Asked Questions about this Article…

A Separately Managed Account (SMA) is an investment vehicle where a professional fund manager controls your portfolio, buying and selling stocks to meet specific investment goals. Unlike traditional managed funds, you own the underlying stocks, providing greater transparency and control.

The main difference between an SMA and a traditional managed fund is ownership. In an SMA, you own the underlying stocks directly, whereas in a managed fund, you own units in a pooled investment. This means SMAs offer more transparency and flexibility.

Owning the underlying stocks in an SMA provides greater transparency, as you can see all the companies and shares you hold. It also allows for easier transfer of stocks in and out of the account, potentially saving on brokerage fees and tax implications.

Yes, one of the benefits of an SMA is the ability to transfer existing stocks into the account. This can help you avoid selling and repurchasing stocks, saving on brokerage fees and minimizing tax implications.

SMAs typically have lower transaction costs due to wholesale brokerage rates. For example, transactions might cost 0.05% of the trade value with a small settlement fee, helping to keep overall costs down.

With an SMA, you can expect a high level of transparency. Unlike traditional managed funds that may only show a snapshot of top holdings monthly, SMAs allow you to see all the stocks you own and their quantities at any time.

In a Separately Managed Account, a professional fund manager is responsible for managing the portfolio. They make decisions on buying and selling stocks to achieve the portfolio's stated investment goals.

Using an SMA can offer tax benefits, particularly when transferring stocks. By avoiding the need to sell and repurchase stocks, you may minimize potential tax implications associated with capital gains.