WEEKEND ECONOMIST: Still stimulating

Last week we confirmed our view that interest rates needed to fall further. We discussed our likely timing as the June board meeting but noted that such was the lack of encouragement from Reserve Bank communications that the timing might be a little later. Evidence from this week markedly strengthens the case for a move in June.

Accordingly we confirm our call for a June rate cut of 25 basis points. Consider the following evidence.

The Westpac Melbourne Institute Index of Consumer Sentiment fell by 5.1 per cent in April from 110.5 in March to 104.9 in April. This was a surprising result. The index had risen by 9.9 per cent over the previous two months and it appeared that, finally, after the Reserve Bank had been cutting interest rates for more than 12 months that the rate cuts and a more settled world economy were gaining real traction with consumers. While it was reasonable to expect the recent momentum in the index over the last two months to have slowed in April, a 5.1 per cent fall was not expected.

This result emphasises how fragile consumer confidence has become in the current environment. In fact, the index is now only 1.5 per cent above its level in November 2011, following the Reserve Bank's first cut in this easing cycle and only 0.6 per cent above the print from last November.

When rate cuts took hold in the previous two cycles the index surged by 37 per cent (2009) and 18 per cent (2002). The recent increase of 9.9 per cent, now marked down to 4.3 per cent, looks much less convincing.

Reasons for the April fall are probably best assumed to be around global concerns and an associated correction in the share market. Since the last survey the ASX had fallen by 4.5 per cent. The equity market probably best captures fluctuations in prospects for the global economy. The disturbing news around Cyprus with associated risks around European stability may have unnerved respondents.

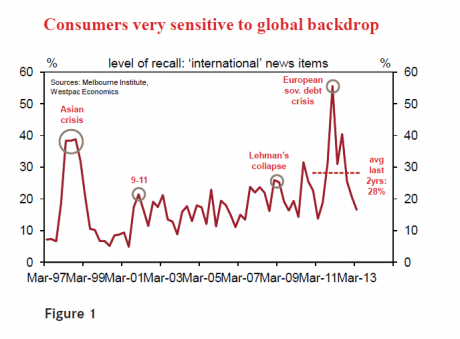

Figure 1 shows how consumers registered much stronger responses to the European crisis in 2011 than they did to Lehman collapse; 9/11; or even the onset of the Asian crisis. Accordingly it is reasonable to assume that coverage of Cyprus did unnerve consumers. There was also some media coverage locally around prospects of rising interest rates, perhaps as soon as year end.

The decision by the Reserve Bank to hold rates steady at its April meeting was widely expected but would not have allayed any concerns about rising interest rates. Some other news was generally positive. The report of a huge 71,500 gain in jobs in February should have buoyed confidence around job prospects while coverage of the housing markets has been registering price increases and prospects for further rises.

That jobs announcement failed to impress consumers. The Westpac-Melbourne Institute unemployment expectations index rose 1.3 per cent in April after falling 3.7 per cent in March. In this cycle, unemployment expectations peaked in September 2012 following a near 56 per cent increase since February 2011 – this compares to the 82 per cent rise seen around the time of the GFC (May 2007 to February 2009). Since the September 2012 cycle peak, unemployment expectations have declined by 9 per cent. At its current level, the index still remains some 12 per cent above its long-run average, highlighting that consumers remain cautious over job prospects.

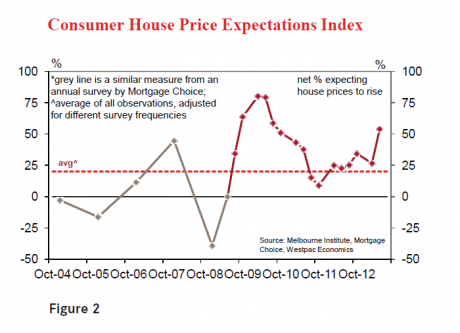

More buoyancy on the house price outlook was confirmed by our Index of House Price Expectations. The Westpac-Melbourne Institute Consumer House Price Expectations Index rose sharply in April, to the highest level since July 2010. The index, which is the net per cent of those expecting prices to rise and those expecting prices to fall, rose from 26.7 in January to 53.9 in April (recent peak was 80.3 in January 2010).

This is a substantial improvement, marking a breakout from the 'moderately positive' range the index had been stuck in since Jan 2012. After an extended period of uncertainty, Australian consumers now look to be much more convinced that house prices are on the way up. Concerns around a potential rise in interest rates may have also weighed on the index tracking views on 'time to buy a dwelling'. Despite prospects of rising house prices, this index fell from 144.5 to 128.4 (down 11.4 per cent). That compares with the fall in October 2009 following the Reserve Bank's first 25 basis point hike in that cycle when the index fell from 144.9 to 128.9 (down 11 per cent). Rising house prices can have a mixed impact on assessments on 'time to buy' with the potential for capital gains acting as a positive but reduced affordability for potential first home buyers acting as a negative. The sharp decline in April may be further evidence around the fragility of the consumer and their nervousness around any suggestions of rising interest rates.

Business confidence and conditions remain challenged. The latest NAB business survey showed the conditions index at the lowest level since May 2009. The business conditions index fell 3 points to -7, on a weakening of trading conditions. The March reading compares with an average of -5 for the December quarter. The conditions index has been below zero, the historic average for this series, for 12 consecutive months. This matches a 12-month run of negatives from July 2008 to June 2009. Recall that this has been a period of falling interest rates, highlighting, to date, the ineffective impact of rate cuts in this cycle on business conditions.

The profile of business investment over the course of 2013 and 2014 will be critical to prospects for interest rates. In that regard the ABS Capital Expenditure Survey provides the most credible guide. Recall that the last survey showed a marked deterioration in investment plans for 2012-13 including a stunning 30 per cent reduction in manufacturing investment. The survey which was released in February also showed a surprising boost to non mining investment plans for 2013-14. However, being the first estimate for 2013-14, its reliability is questionable, at best, when contrasted with the fifth estimate for 2012-13. The next survey will be released on May 30 and will provide a more reliable guide to investment plans.

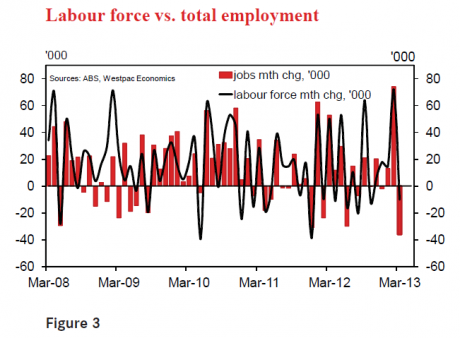

We also received the print for March employment report. Total employment fell by 36,000 in March. The unemployment rate surprised in the month, rising 0.2 percentage points to 5.6 per cent. That is the highest rate of unemployment since October 2009. The decline in the participation rate was broadly as expected in March, down 0.2 percentage points to 65.1 per cent. The employment to population ratio fell 0.3 percentage points to 61.5 per cent.

We see this result as being more representative of underlying weakness rather than a mere reversal of the February bounce. February's gain received significant support from the rolling in of a more-attached sample cohort (most notably in Victoria). This not only resulted in a strong jobs number, but also a 0.25 percentage point rise in the participation rate, which meant that despite a large jobs print the unemployment rate remained at 5.4 per cent in February. If March had been merely a statistical reversal of February the unemployment rate is unlikely to have changed. We expect the unemployment rate to exceed 6 per cent by year's end.

The Reserve Bank Board next meets on May 7. We do not expect any change in rates to result from that meeting. The board retains an easing bias but the tone of various communications from the board suggests it is comfortable to remain on hold. Westpac is forecasting that growth in the Australian economy in both 2013 and 2014 will be around 2.5 per cent, well below potential of around 3.25 per cent. With inflation firmly under control that suggests that there is a need for the economy to get more stimulus. It is our view that despite the bank's obvious reluctance to move on rates the case will be made following the release of the next Capex Report in May. We retain our call for a further rate cut in June.

Bill Evans is Westpac's chief economist.