Weekend Economist: Currency cocoon

Over the last six months the Australian dollar had traded in a very narrow $US0.925 to $US0.945 range. It currently stands near the middle of that range. This is despite ongoing attempts from the Reserve Bank governor to “talk down” the Australian dollar. In fact, he materially intensified his commentary on the Australian dollar in his statement following the September 2 board meeting by moving from describing the local currency as “high by historical standards” to a much more sophisticated, “remains above most estimates of its fundamental value”, a follow on from some remarks he made in Hobart previously.

However, he continued to note that “the most prudent course is likely to be a period of stability of interest rates”. As long as the bank is not prepared to adjust policy to accommodate a lower Australian dollar by adopting an easing bias or indicating likely intervention, rhetoric around an overvalued currency will have little effect on the value of the the currency.

With the bank now forecasting growth in the Australian economy of only 2 per cent (annualised) in the second half of 2014 and 3 per cent in 2015 (as of the August statement on monetary policy), both of which are below trend, adopting an easing bias, which would be likely to pressure the Australian dollar, seems to be a respectable tactic. However, there is more concern around overstimulating the housing market and house prices than directing policy towards broader growth and the Australian dollar. In a speech on September 3, he clarified that position with, “while we may desire to see a faster reduction in the rate of unemployment, further inflating an already elevated level of housing prices seems an unwise route to try to achieve that”.

Nevertheless, readers will be aware that we continue to expect the Australian dollar to weaken to around 90¢ by year’s end. Since the beginning of 2014, Australia’s terms of trade have deteriorated by 5.5 per cent with a further 0.7 per cent expected in the September quarter. Over the same period, the trade weighted index has lifted by 5 per cent. This imbalance largely explains the bank’s assessment that the Australian dollar has been defying fundamentals. We expect that there will be a catch up adjustment in the Australian dollar some time before the end of the year.

While our expectation remains that the next move in interest rates will be an increase we do not anticipate that happening until August next year. Accordingly, we anticipate that the bank will maintain its “period of stability” assessment through the course of 2014 and will not shift to a more threatening “policy is appropriate for the time being” until late in the March quarter. In that September 3 presentation he clarified his likely tactics by noting that “At some point before this language starts to box us in, I’d like to change it to something much more vague and that will probably be something like “policy remains appropriate”.

One key reason behind the strength of the Australian dollar has been the popular carry trade, particularly amongst hedge funds. Buying a high yielding currency such as the Australian dollar against a low yielder, particularly the euro, dominates the thinking of the hedge fund community. The decision by the European Central Bank to further cut rates on September 4 has only emboldened those investors – the AUD/EUR cross lifted by 1.6 per cent in the wake of that decision.

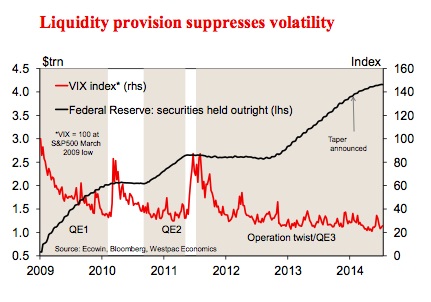

The key behind the “popularity” of the carry trade is low volatility. With low volatility traders believe that commodity currencies which are overvalued in a fundamental sense can maintain that overvaluation while markets remain calm. Typically, high volatility/uncertainty weighs more heavily on high yielding currencies than the more stable low yielders.

One “event” that is certain to occur – the curtailment of the Federal Reserve’s QE3 program in October - might be just that source of higher volatility. The chart demonstrates the historical lift in volatility following the curtailment of QE1 and QE2. On both occasions we saw a sharp lift in volatility within a month of the completion of the purchasing programs.

Both QE1 and QE2 had purchase targets and defined end-points, unlike QE3 which was open ended and was defined by a pace of asset buying. However, the Fed has maintained its tapering program since December last year and has even nominated October as the end date. At the completion of the two previous episodes of QE, volatility in US equity markets, as measured by the “VIX”, jumped from the 35 to 45 range to around 80 within the month. Recently volatility has been much lower in the 20 to 25 range exacerbating the risks of a sharper proportional increase in volatility.

Of course, on both previous occasions volatility settled down within a month with markets beginning to expect another “round” of stimulus. When QE3 ends, markets will not be focusing on further stimulus but the timing of the next stage of the policy tightening process – the first rate hike from the Fed. Such an environment is likely to be much less conducive to a settling in volatility as we saw in the previous two episodes.

We continue to be comfortable with our view that the markets’ complacency, which have been conducive to carry trades and an overvalued Australian dollar, may well be shaken when tapering concludes and they look toward the next stage of the Fed’s journey in normalising policy.

Bill Evans is chief economist with Westpac.