Watch this year's oil bounce

Summary: Analysts predict that as global oil storage reaches capacity in 2016, there will be a period in which prices hit $20 as producers will be forced to sell their excess stores. By December this is expected to have rebounded back into the $50s as supply and demand evens out. |

Key take out: A return to triple digit oil prices seems unlikely for the foreseeable future. |

Key beneficiaries: General investors. Category: Commodities. |

Oil bulls, take heart. The last leg of the bear market that began in mid-2014 is probably in sight, as marginal producers fall by the wayside. Supply cutbacks should bring a rebound in the price of crude by the second half of 2016.

But before a rebound, West Texas Intermediate crude will probably continue to fall, perhaps as low as $20 a barrel, before vaulting to the mid-$50s by year end.

Stock market investors can also take heart. The stock indexes have been closely correlated with oil of late, moving up or (mostly) down, as the price of crude has gyrated. This perverse pattern has persisted even though the overwhelming majority of global companies benefit from cheaper crude, since they buy the refined products to help run their operations.

It's true that many oil exporters are in emerging market economies, and low oil prices have slowed their economic growth and put a dent in their sovereign wealth funds. Beyond this, stock traders may be subscribing to the misguided belief that low oil prices are signaling imminent global recession.

Our expected recovery in crude by the second half of this year will, therefore, probably bring a recovery in equities. And perhaps even before then, stock traders might wake up to the fact that the bear market in oil has mainly been reflecting a world awash in black gold.

While global weakness on the demand side has played a part in the buildup of excess supply, it has been weakness in the rate of growth, not an outright economic contraction. A further slowdown in global growth, especially from China, will also play a role, but here again, the supply side will dominate, as cutbacks in production bring a rebound in prices.

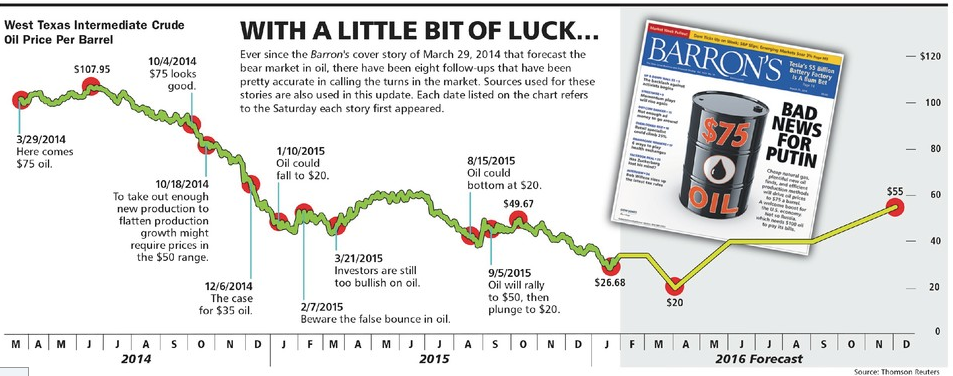

Barron's predicted $75 oil in late March of 2014, when crude was trading above $100. But the market soon overshot our contrarian forecast, as the slowdown in global growth curbed the growth in demand. We followed up on that story repeatedly, lowering our sights to $20 a barrel a year ago (see chart below).

World consumption of oil has held up relatively well. It rose in 2014 to 92.8 million barrels a day from 2013's 91.9m, a below-par increase of just 0.9m barrels. Consumption in 2015 rose to 94.5 million, for a relatively substantial rise from 2014. But, of course, that was due mainly to the price plunge that made oil dirt-cheap.

For 2016, in no small part because of the expected economic slowdown in China, Citigroup's senior energy analyst Eric Lee projects below-par oil demand growth of one million barrels a day, to 95.5m.

The supply side, then, has been the main driver of the oversupply that has wrought the bear market. And nowhere has the supply-side revolution been more dramatic than in the US. As recently as 2010, the US produced 5.5m barrels a day of oil. Due to the advent of hydraulic fracturing, or fracking—the extraction of oil from shale—production jumped to 8.7m by 2014. In 2015, production set another record, at 9.7m.

Meanwhile, Saudi Arabia, long the Organization of Petroleum Exporting Countries' swing producer, has recognized that it is powerless to control the market, and has simply produced at full tilt, with the aim of earning as much as it can. Russia, too, was able to increase production last year, in part because the collapse of the ruble against the dollar meant that it earned more rubles by selling oil for dollars, despite the collapse in the dollar-denominated oil price.

The worldwide oversupply of oil is evident from the buildup of inventories. Storage-tank capacity outside the U.S. is virtually exhausted. Edward Morse, head of global commodity research at Citigroup, who was cited in our first story, says that warm weather in December caused a buildup of heating-oil supplies in Europe that is being stored on ships, since there's nowhere else to put the stuff.

The US is virtually the only nation remaining with storage space left. And even here, as the Energy Information Administration reported last week, “at 502.7m barrels, US crude-oil inventories remain near levels not seen for this time of year in at least the last 80 years.” That figure of more than 500m excludes the crude held by the US government in its Strategic Petroleum Reserve, at nearly 700m barrels.

The Strategic Petroleum Reserve is an anachronistic throwback to a time when energy insecurity might have been justified. Also anachronistic: federal restrictions that were long imposed on the US export of oil.

This is no time to start selling the Strategic Reserve, however nonstrategic it has become, but export restrictions were finally lifted by Congress in December. That's a sensible move, although one that should bear fruit only over the long run. For the time being, the market abroad for crude would seem to be close to saturated.

The chart above page reflects the likely trajectory, as seen by Citigroup's Morse and Lee. As fundamental analysts, they project the price in quarterly averages; Barron's has interpolated monthly prices that are consistent with these averages.

Also providing key insight: Steve Briese, publisher and writer of the Bullish Review of Commodity Insiders newsletter, who has frequently been cited by Barron's.

The price decline in January to an average of $31.70 from $37.20 in December—punctuated by a low of $26.68 touched on January 20—resulted from four factors: clear signals from China that growth of this powerhouse economy was slowing, thus curbing demand; mild winter weather, which caused a huge buildup of heating-oil stocks that the Europeans had to store on ships; investors shorting the market on the expected lifting of sanctions on Iranian exports; and the usual seasonal pullback in January of refinery utilization after the seasonal drawdown in December.

As Morse points out, “The only entities in the world that actually consume crude oil are refineries.” A price rebound in February and March is expected, due to the return of refinery demand and to the typical winter pattern of prices rising with the colder weather in February and March.

Briese cites a key indicator that affirms this constructive view of the next two months. He pays close attention to the Commitments of Traders Report released weekly by the Commodity Futures Trading Commission. The report tracks the long and short positions in futures and options on WTI traded on the New York Mercantile Exchange. This derivatives market is used by refiners that would naturally take long positions to hedge against a price rise, and producers who would take short positions to hedge against a price decline.

Briese long ago found strong evidence that in this, as in most other commodity futures and options markets, “commercials” as a group do not hedge by rote. Rather, they trade strategically—generally against the price trend.

As of February 2, the most recent date for which figures are available, the net-short position—longs minus shorts—was 270,008 contracts. Since commercials as a group are almost always net short, the key point for Briese is this net-short position was at the low end of the historical range. For example, in June 2014, at the market's last price peak, the commercials' net-short position came to 512,853.

The fact that, at 270,008, the net-short position of the commercials was relatively low is a signal for Briese that the “smart money” is optimistic on the oil price—but only mildly positive. For example, in December 2008, at the market's last price bottom, the commercials' net-short position was even lower, at 99,753 contracts, which signaled an even bigger vote for a price rebound.

For the second quarter, Morse anticipates a return to price weakness based on two key factors: a larger refinery-maintenance period worldwide, particularly in the US, and especially in April, which will bring a pullback in demand, and the expectation that by April, Iranian production will have a noticeable effect on supply.

From Briese's perspective, this could set the stage for the $20 capitulation low he has long been expecting, and which Barron's has cited several times. As of Feb. 2, the large speculators held a huge long-only position of 579,266 contracts, nearly 36 per cent of all the open positions in crude held on Nymex. As the fundamentals start to weigh on the price, forced liquidation of this long position could briefly push the price as low as $20.

Citigroup's Lee also foresees an interim scenario for $20 oil driven by supply/demand fundamentals. As he points out, if storage supplies build up to the point that no capacity is left, even in the US, then any production that comes on-stream would have to be sold immediately. Such distress sales could mean that prices briefly drop below $20.

But by the second half, the bull market will return. “We think,” says Morse, “that the world is poised to lose a lot of oil production in the US, Colombia, Mexico, Venezuela, China, and then potentially in Russia, Brazil, and the United Kingdom sector of the North Sea.”

Russia is in a bind, he explains. The government has a dwindling amount of hard-currency reserves. So unless it decides to spend those reserves down to nothing, it will need to raise taxes, and likely targets are the oil and gas companies. The companies will therefore be forced to reduce their production, thus partially killing the golden goose that has been Russia's main source of hard currency. And because of financial sanctions on Russia, the companies have no ability to borrow.

Morse projects a $50 average price in the fourth quarter, from which Barron's extrapolates $55 by December. As a sign of how much the environment has changed, note that when we predicted $75 oil in March 2014, it was an outrageously bearish prediction. A $55 prediction now looks quite bullish.

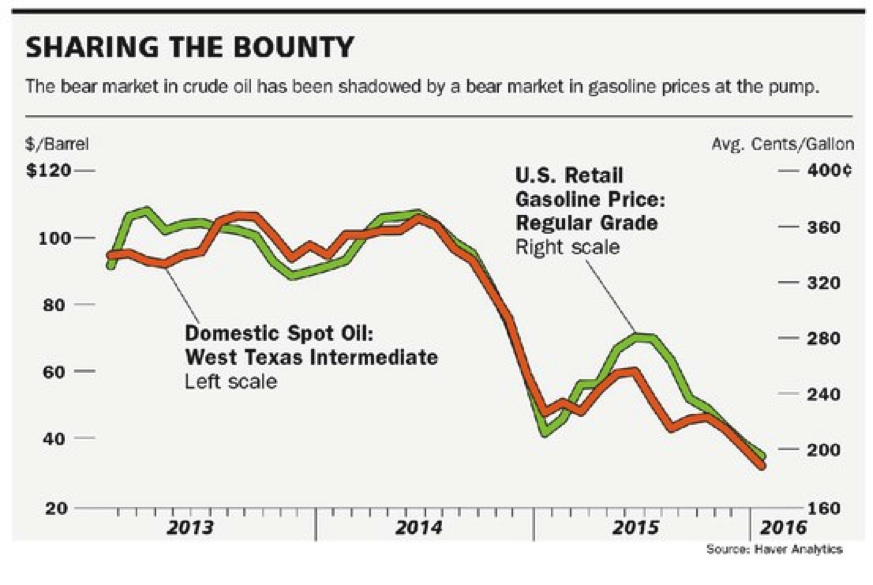

As the nearby chart shows, the price of crude really does influence the price of gasoline, although not one-for-one, since the price of the refined product has other costs built into it that are relatively fixed, especially labor costs. When the WTI price was at $105 per barrel, the gasoline price averaged $3.70 a gallon; at $55, the price at the pump should run $2.50 a gallon.

As noted in our first bearish story predicting $75 oil, over the past five years, the world has found a trillion extra barrels of oil—the equivalent of 30 years of extra supply—with a third of it coming from shale, a third from deep water, and a third from oil sands. Over the past year, the costs of recovery from these sources has noticeably fallen. A return to triple-digit prices on crude oil is unlikely for the foreseeable future.

*This report was republished with permission from Barron's.