Wall Street's bumper earnings season will shine on the ASX

Summary: The US earnings season is showing good signs for domestic retail investors, even those that don't hold global stocks in their portfolio. Already half way through reporting their results so far, just over 80% of US companies have reported positive earnings surprises and 61% have shown positive sales surprises. Moreover, the results are robust, with earnings growth in the last quarter well above the average. |

Key take-out: An uptick in the US earnings season is likely to follow through to Australian shares, particularly when they are so cheap relative to historic levels. On top of that, the outperforming stocks in the US have been in basic materials, telecom and financials – sectors which make up two-thirds of our share market. |

Key beneficiaries: General investors. Category: Shares |

What happens in the US matters for Australia. Not simply because the US is one of the largest economies in the world (first or second depending on how you measure it) and leading the global expansion in the advanced economies.

It goes beyond that – there are the cultural links, media links (fashions flow across the pacific) and of course, the US has the deepest and most liquid financial markets. All of that combined means that US markets set the pace. What happens there usually happens here, if with a lag. That's the historical precedent anyway and it's no coincidence that as the US equity market rallied on the back of stronger US earnings, the recent pull back on Aussie equities ended. Since then our market is up 5.5%, although it remains 3.8% below the peak reached before the pull-back began.

With that in mind there are some very positive signals coming out of the US earnings season, which have direct implications for domestic retail investors. Even if you don't hold global stocks in your portfolio you should know that what we are seeing is a very good omen.

The US equity market is nearly half-way through (41%) earnings season with 208 companies on the S&P500 index having reported. Of those, just over 80% have reported positive earnings surprises and 61% positive sales surprises. On their own, these are pretty good stats, although it has to be noted that positive earnings surprises aren't unusual in the US market.

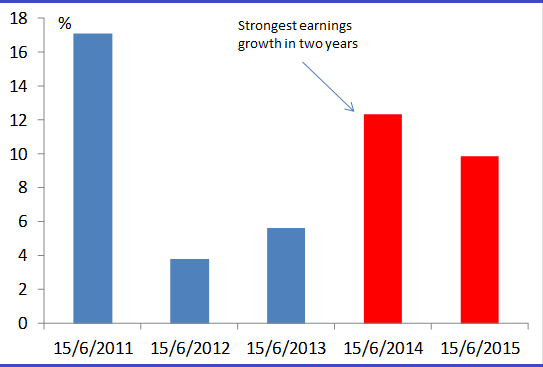

However, when you add in the fact that these sales and earnings results are, so far, quite robust – the earnings and sales surprises take on new meaning. For instance, earnings growth of 9% for the quarter is well above the average of 5.4% and it suggests that calendar year guidance of 12% is on track. This is a result that is double what we saw last year at 5.6%. It is strong growth (see chart 1 below).

Chart 1: Earnings growth of S&P500 companies

As you can see, this current earnings season points to the strongest growth in underlying earnings in about two years. Against that backdrop it's remarkable that US equities are still comparatively cheap. Using traditional valuation metrics – the price-earnings (P/E) ratio – we can see that on a one-year forward basis, the S&P500 is trading on an earnings multiple of about 14.8 times. This is well below the historical average (trailing) of about 18 times.

Recall that in a world of ultra-low rates, historical valuations need to be adjusted up. That is, you would expect stocks to be trading at a premium relative to their historical P/E ratio – not a discount. Pre-GFC the peak P/E ratio was 16.8, and I would suggest something closer to that would be more than reasonable given the fundamental backdrop of strong earnings and a very favourable macro environment.

US employment growth is very strong, on track to post the strongest gain since 1999, while economic growth itself has been running well above trend (excluding the impact of bad weather in the first quarter). Nearly all of the main lead indicators suggest that this very strong momentum will continue – the ISM index which is about 10% above average - all the regional Fed indexes etc. – and it doesn't seem that the market is pricing much of this in.

Now if you don't invest globally it really is time that you considered what is now an elementary diversification strategy in any portfolio. (Speaking of diversification into wider markets, you may have noticed Alan Kohler's column on Saturday (click here) mentioning our forthcoming International Investing Summit in Sydney on November 25 and Melbourne on November 27 where I will discuss these ideas in detail.)

In any event it's beyond doubt America's very strong reporting season – where we saw stocks as diverse as Apple and Caterpillar bring in better-then-expected numbers – did its fair share of the heavy lifting that put brakes on the recent stock market correction. Any uptick in US share markets will now follow through to ASX.

Indeed, remember that the ASX is an underperformer on the global stage. Earlier in the year I had thought the Aussie market would outperform, but that is not looking like it will be the case. If I'm right and we do see that US multiple expansion, that will automatically drag up the Aussie market with it.

Australian equities may not be the market darlings at the moment, but there comes a point in time (probably when US stocks don't look so compelling) where international investors will refocus their gaze back toward Aussie equities.

And, for their part, Aussie stocks have value already. On Bloomberg data (and estimates vary), the average P/E ratio of the ASX 200 for the last ten years or so (ex GFC) is about 17. Currently, it is on a one-year forward P/E ratio of 13.9. Australian equities look very cheap – the peak P/E ratio over the last few years is 23 on a trailing basis and about 16 on a forward basis.

Another good omen for the Australian market is that the key outperforming sectors for the US stocks this earnings season include basic materials, telecoms and financials – that equates to around two-third of our market. I realise there isn't a direct comparison as the markets and firms involved are slightly different. Yet it does show that businesses is good for those sectors, there is demand, sales and solid earnings growth in that space.