View from Wall Street: Fading attractions of Aussie bank stocks

Summary: Analysts believe Australia's big banks are facing the most challenging period for earnings growth, as the weakening dollar prompts foreign investors to sell stocks and capital ratio requirement changes loom. Dividend cuts are also on the table should earnings fall and current payout levels become unsustainable. |

Key take out: If capital ratio requirements are raised, as expected, to 10.5 per cent, the big four will face a capital shortfall of $31 billion. |

Key beneficiaries: General investors. Category: Shares. |

Australian stocks are enduring their worst ever start to a year as investors dump the big four banks and mining giants BHP Billiton and Rio Tinto on concerns about China's weakening economy.

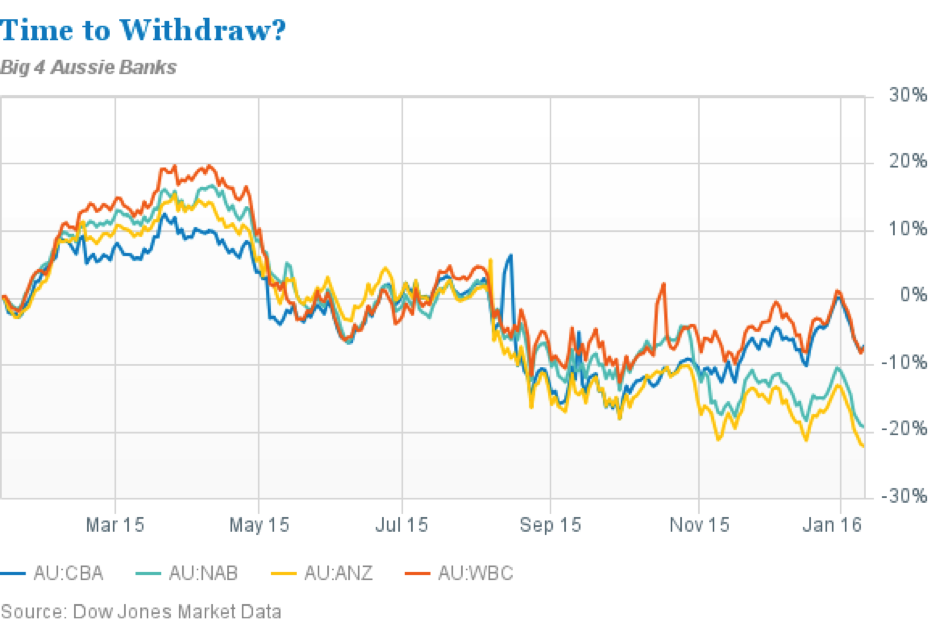

The S&P/ASX200 Index notched up its eighth consecutive daily decline on Tuesday, steering the benchmark down 7 per cent since the start of the year and hovering close to a two and a half year low. While miners like BHP Billiton ( BHP.AU ) and Rio Tinto ( RIO.AU ) have been under pressure since peaking in early 2011, the selloff in the major bank stocks reflects a major reversal of fortune for the lenders that had been eagerly bought by investors hungry for their juicy yields. The S&P/ASX200 Banks Index is down a quarter from its March 2015 highs.

The foursome of ANZ ( ANZ.AU ), Commonwealth Bank of Australia ( CBA.AU ), National Australia Bank ( NAB.AU ) and Westpac ( WBC.AU ), which together make up 30 per cent of the Australian stock market, are down almost 9 per cent on average so far in 2016. But while the recent declines may have brought valuations to around historic lows of roughly 11 times forward 12 month earnings, now is probably not the time to go bargain hunting, as there could more pain to come. CLSA's head of Australian banks research, Brian Johnson, sees a number of headwinds that could buffet the big four lenders.

Aussie bank stocks are no longer as attractive as they once were to US dollar-denominated funds, which have been notable buyers in recent years. While the juicy five per cent plus dividend yields offered by the big four banks, combined with a strong Australian dollar, had made the stocks a no-brainer for yield chasers faced with zero interest rates in the US, conditions have now changed. The Federal Reserve is raising interest rates, while China's slowing economy could further pressure the Aussie dollar. Additional weakening of the Aussie, which AMP Capital economist Shane Oliver expects to slide to as low as $0.60 by the end of the year from current levels around $0.70, could quicken the pace at which foreign investors sell bank stocks to avoid further foreign exchange losses. At the same time, US banks, which enjoy lower valuations than Aussie banks and offer reasonable dividend yields, are also looking in better shape with lower risks, says CLSA's Johnson.

Then there's also the risk the big four banks may no longer pay such generous dividends. “Sustainable bank dividend payout ratios are not linear - should earnings fall and capital intensity rise, the sustainable payout would fall,” says Johnson, who expects to see a 10 per cent cut in sustainable payout ratios. The analyst, who has an underweight rating on the sector, says earnings growth has never been as challenged for Australian banks.

Write backs of loan losses and strong trading revenues, which are highly volatile, have allowed Aussie banks to log higher earnings than they actually should. For example, Westpac would have recorded 23 basis points of loan losses rather than 13 basis points without write-backs in 2015, says Johnson. The difference meant reported earnings that were 8 per cent higher. However, the non-recurring nature of the write-backs mean loan losses will have to eventually rise, dealing a hit to profits. Meanwhile, fears of a housing bubble and the stress of weaker Chinese manufacturing on demand for commodities like iron ore also don't bode well for Aussie bank earnings.

The big four banks also face an estimated $A31 billion capital shortfall if Australian regulators raise a closely watched capital ratio requirement to an expected 10.5 per cent. Besides the inevitable drag on share prices if additional equity is raised, regulatory reforms that target liquidity and funding could constrain lending volumes and squeeze interest margins.

• This article has been republished with permission from Barron's.