Venture Capital explained

Two leading Australian venture capital funds have been granted government recognition for their support to local start-ups and entrepreneurs. But is this a big deal? And how much money is actually invested by venture capital firms?

As reported on Thursday Australian start-up accelerator BlueChilli has been named as the newest Registered Early Stage Venture Capital Limited Partnership (ESVCLP) by the Department of Industry, one of only ten funds to gain such recognition since 2007, while Queensland-based ilab was been named as a Conditionally Registered ESVCLP.

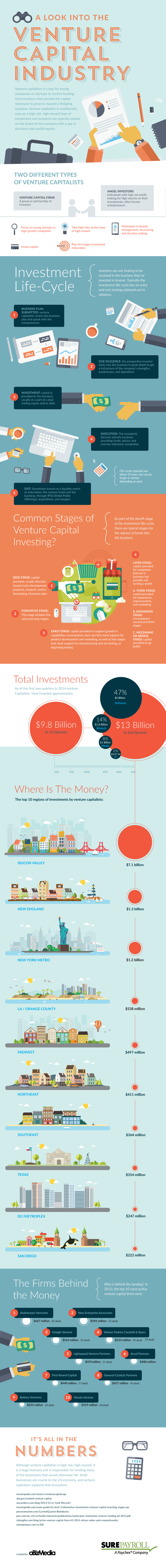

Both venture capital funds are increasingly important players in Australia's nascent venture capital scene, which makes it ideal timing to learn more about how the venture capital industry actually works in the US. Check out the infographic below, courtesy of SurePayroll.