Value Investor: Will CBA's highs last?

Over the past 12 months Commonwealth Bank of Australia's share price has increased 22.5 per cent, outperforming the market by five percentage points. CBA shareholders have received impressive capital growth boosted by $3.83 per share in fully franked dividends. But is this performance sustainable?

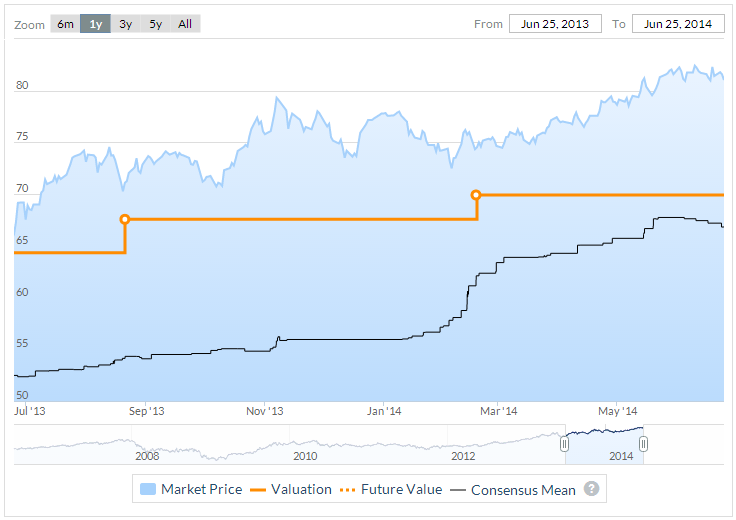

CBA's share price is grazing all-time highs and significantly above our fiscal 2014 valuation of $71.64. An investment at these levels would be high risk from a future return perspective.

CBA's purchase price needs to generate an adequate forward return to compensate shareholders for the risks of investing in the stock at this stage of the cycle. CBA appears to be entering ‘peak of cycle’ earnings and current performance should not be extrapolated into the future.

Although CBA delivered strong earnings momentum in the third quarter, it is unlikely this trend is sustainable. it's lost a source of strong revenue growth now that provisioning for bad debts has reached cyclical lows. In order to sustain its earnings momentum and justify its current trading price, the bank needs cost efficiencies, loan growth and income from non-traditional banking to accelerate.

CBA is a play on household and business confidence and conditions. Its large weighting to mortgages makes it particularly exposed to the Australian housing market, which has experienced a boom driven by low interest rates and rising prices. However with household credit growth restricted by a highly indebted household sector, it is difficult to see significant earnings upside from its mortgage business.

Further, a significant rise in unemployment, higher vacancy rates, a recovery in interest rates or regulatory changes (e.g. changes to negative gearing laws) may present downside risk to its mortgage portfolio. This risk is somewhat mitigated by CBA’s tight underwriting standards, high incidence of loan prepayments, low average loan to valuation ratios, and lending insurance.

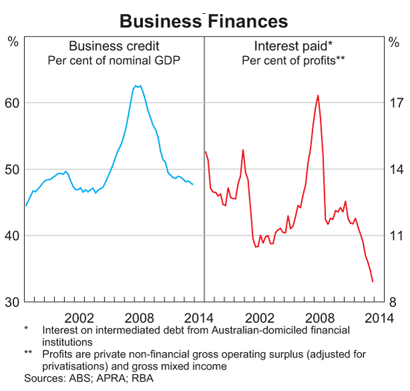

CBA’s share of business lending and deposits has traditionally been lower. The bank will need to shift its focus towards competing for business credit, which remains unstretched (see RBA chart below). However business confidence and conditions are patchy and it faces fierce competition from its peers.

Figure 1: Business finances

Source: RBA Chart Pack

The downtrend in CBA’s provisioning is a product of a benign environment for corporate and commercial bad debts and, we would argue, an imperative to deliver earnings and dividend growth for shareholders during a period of weak revenue growth.

An economic contraction of any degree is not our base case, but CBA’s historically low rates of provisioning for bad and doubtful debts exposes the bank to worse-than-expected economic outcomes. A return of bad debt expense and provisioning to historical averages would meaningfully detract from future earnings.

CBA has a strong brand proposition and is currently undergoing a transformative core banking modernisation. This should provide a competitive advantage in engaging customers, contribute to increased cost efficiency, and help support earnings growth in a period of weak revenue growth as the benefit of declining provisioning tapers off.

We adopt a return on equity of 24 per cent, which is slightly below consensus and the five-year average of 26 per cent. Current ‘peak cycle’ performance should not be extrapolated into the future given the cyclical nature of banking. We adopt a low required return of 11.5 per cent. Using our adopted metrics, we derive a fiscal 2014 valuation of $71.64, rising to $73.31 in fiscal 2015.

Figure 2: CBA Price to Value over last 12 months

Source: www.stocksinvalue.com.au

By Amelia Bott of StocksInValue, with insights from Stephen Wood and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.