Value Investor: How to spot quality stocks

At StocksInValue, we focus on ‘quality’ companies for investment. Conservative portfolios should prefer quality companies because they are more likely to provide higher total shareholder returns (from steady growth in intrinsic value and higher dividends); less likely to downgrade earnings forecasts; less likely to require dilutive equity raisings or run out of cash and enter administration; and typically less volatile in the sharemarket than low-quality companies.

Quality companies have several common features.

The first is a high and recurrent return on equity. The more productive a firm’s equity, the higher the dividends it can sustain and the faster it can grow intrinsic value.

Reinvestment of earnings makes more sense when the return on incremental, additional equity reinvested is higher.

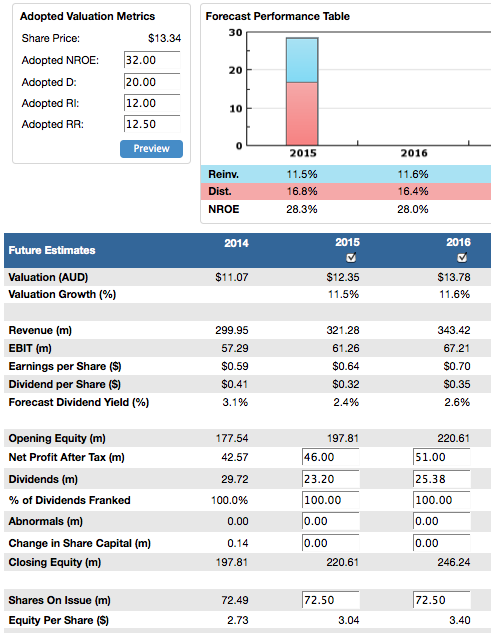

A good example is ARB Corporation, where a strong adopted ROE of 32 per cent, a 37 per cent reinvestment rate (= reinvestment of 12 per cent / normalised return on equity of 32 per cent) and steady earnings growth drive over 10 per cent growth in intrinsic value.

Figure 1. ARP double-digit intrinsic value growth

Source: StocksInValue

There do, of course, have to be sufficient opportunities to reinvest earnings at the existing ROE. If not, ROE will decline over time. A currently strong ROE can be deceiving if forward ROE is declining.

Secondly, the best companies to invest in do not resort to debt or equity funding to grow. They fund their organic growth internally from retained earnings, built up from net operating cash flows.

Flight Centre is a great example. It doubled earnings within the last five years without raising a material amount of new equity.

Any profitable business can increase ROE by increasing gearing, or the ratio of debt to equity. Extra debt can be used to buy extra assets, which should increase total profits. As equity remains unchanged, this will imply a higher ROE.

However, the highest quality companies do not need debt to artificially boost their return on equity. Further, if a business has strong profitability and growing value without debt, it can probably increase its returns further by taking on modest gearing when well-priced, strategically sound acquisitions or organic growth opportunities come along.

A great stock to look for is the quality company with an ungeared balance sheet during an industry downturn. These firms can pick up acquisitions at the bottom of the cycle and attain outstanding returns in the next upturn.

Fourthly, quality companies apportion their earnings sensibly between dividends and reinvestment. This does not mean distributing excessive dividends for the sake of dividends, such as to appease shareholders and their demands. Nor does it mean retaining earnings if growth dilutes profitability.

Telstra, with its large size and market share, can face difficulties in finding sufficiently large growth opportunities that do not breach competition constraints or reduce return on equity. Its high dividend payout ratio is therefore rational.

While one can achieve good returns in cyclical stocks, timing is essential. Companies which grow intrinsic value steadily are more forgiving and tend to provide higher average shareholder returns.

Over the last eight years, Ramsay Health Care saw its intrinsic value per share increase at 24 per cent per annum, compounded dividends per share at 17 per cent annually and paid a higher dividend every year. Unsurprising, ROE increased over this period -- an outstanding outcome.

Business quality and financial health go together, being causes and features of each other. To enable quick comparison of the financial health of listed companies, our fund partners, Clime Asset Management, developed and back-tested the Clime Quality Rating, which weights and aggregates various solvency, liquidity, profitability, cashflow, debt-servicing and leverage ratios into a rating out of 10 stars. Expressed as a percentage, the rating is known as the Quality Rating Score (QRS).

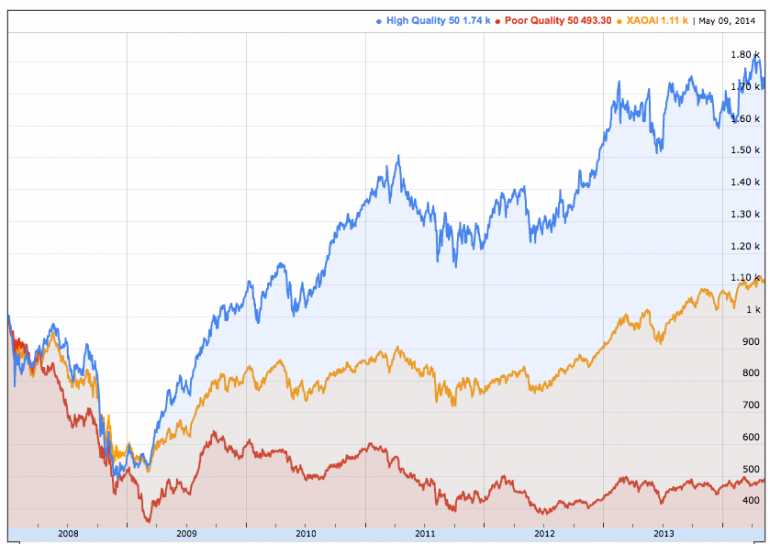

We can see the difference in performance of the top quality 50 stocks Clime values (High Quality 50 below) and the bottom quality 50 (Poor Quality 50). These indexes, named the 'High Quality 50' and the 'Poor Quality 50' respectively, are indexed, with the All Ordinaries Accumulation Index, to 1,000 on 31/12/08.

The results over this period are compelling.

Figure 6. Relative strength of the top quality 50, bottom quality 50 and the All Ordinaries Accumulation Index, December 2008 to May 2014

Source: Clime Asset Management (George Whitehouse)

This chart clearly shows how quality companies outperform others and the market as a whole, and reminds us why value investors should always keep quality in mind.

By Brian Soh and David Walker, Equities Analysts at StocksInValue, with insights from George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.

Disclosure: Clime Assets Management holds shares in TLS.