Value Investor: Dogs! Three stocks to avoid

While investors like to focus on strong, attractive stocks, there's also much to be learned from companies that are facing difficulties or even destroying value. We see three clear examples: Macquarie Telecom, BlueScope Steel and Metcash.

Macquarie Telecom (ASX: MAQ), a provider of telecommunication and hosting services to corporate and government clients, announced a net fiscal 2014 loss of $776,000, as opposed to a $11.3 million profit one year ago. Revenue and earnings were down 5 and 27 per cent respectively.

A continuing trend for Macquarie Telecom is that customers of hosting services have been moving towards cloud offerings, which are cheaper than dedicated managed infrastructure. This move towards the cloud is driven by users wanting to outsource their technology platform, while reducing their own maintenance and upgrade costs associated with IT infrastructure.

This trend has seen Macquarie Telecom place particular emphasis on investing in the cloud environment to drive future growth. The current capital expenditure program is depressing near-term profits. With Macquarie Telecom forecast to lose money for the next three years, current dividend payouts are also unsustainable.

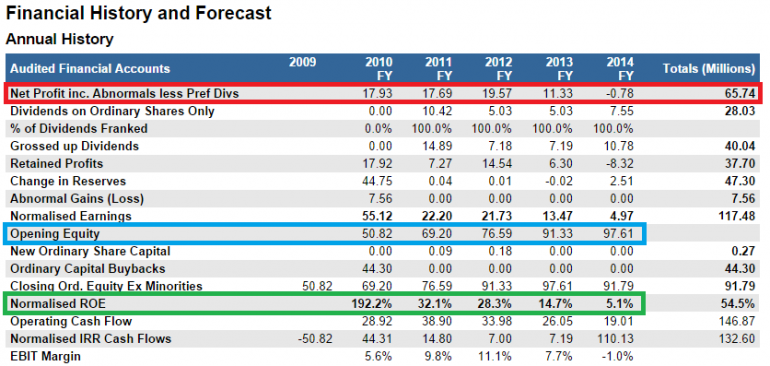

Macquarie Telecom’s recent historical performance has been poor. Over the last five years, net profit has stagnated (red below), equity has almost doubled (blue), while profitability, measured by ROE, has fallen from 32 per cent in 2011 to a current low of 5 per cent (green).

Figure 1 – MAQ Financial History and Forecast

Source: StocksInValue

Clearly, Macquarie Telecom is in a period of elevated investment and expects to deliver future growth. But can it deliver an adequate return on this investment?

The uncertainty around this question means we would rather watch from the sidelines until there is evidence of a profitable business model.

Despite adopting a generous return on equity of 10 per cent and a moderate required return of 14.5 per cent, we derive a fiscal 2014 valuation of only $2.08. Macquarie Telecom is currently trading 62 per cent above valuation.

BlueScope Steel (ASX: BSL), Australia’s largest steelmaker, announced a net loss after tax of $82.4m for fiscal 2014. The result was affected by an impairment of assets totalling $177m and restructure and redundancy costs of $56m.

BlueScope Steel has only declared a half-year profit once since 2010. And it has not paid a dividend since the first half of fiscal 2011!

Since the GFC, BlueScope has been affected by slower demand in Australia and North America, higher raw material costs without a corresponding increase in global commodity steel prices, and a stronger Australian dollar increasing import competition.

Other key risks to earnings are the oversupply in the steel industry, volatility in steel prices, rising costs facing Australian manufacturers and political instability in Thailand.

Longer term, BlueScope Steel should benefit from the lowering of iron ore and coal raw material costs relative to global commodity steel prices, and an increase in domestic demand for steel products. In addition, improvements in non-residential building and construction activity in North America are expected.

Like Macquarie Telecom, BlueScope Steel has issued equity, but has seen its profitability fall. Worse, BlueScope has operated at negative earnings margins for the last four years.

We adopt a low return of equity of 8 per cent and a required return of 14 per cent to derive a fiscal 2014 valuation of $3.49. BlueScope is trading above valuation.

Metcash (ASX: MTS) delivered a disappointing fiscal 2014 result. Although revenue increased 3 per cent, after-tax profit fell 18 per cent to $169m. This was mainly due to weakness in food and grocery, where operating earnings fell 20 per cent to $304m, along with the disposal of 80 Franklins stores.

Food and Grocery faces structural challenges, particularly intense competition in the Australian grocery space. It has been plagued by lower warehouse sales volumes, ongoing deflation and costly strategic initiatives.

Metcash’s competitive advantage is its convenience and ability to cater to local demands and specific requirements of the local community. However there is a consumer shift towards value over convenience, leaving Woolworths and Coles best placed to benefit. Metcash believes there is a 3 per cent price differential between its products and the majors.

To compete, Metcash plans to invest heavily to refurbish and reinvigorate its store network, improve supply chain efficiency and price match all products against Coles and Woolworths. The strategic plan will require capital expenditure of $575m-675m over the next five years.

While a credible strategy, Metcash is clearly a company in transition with a lengthy wait for better returns.

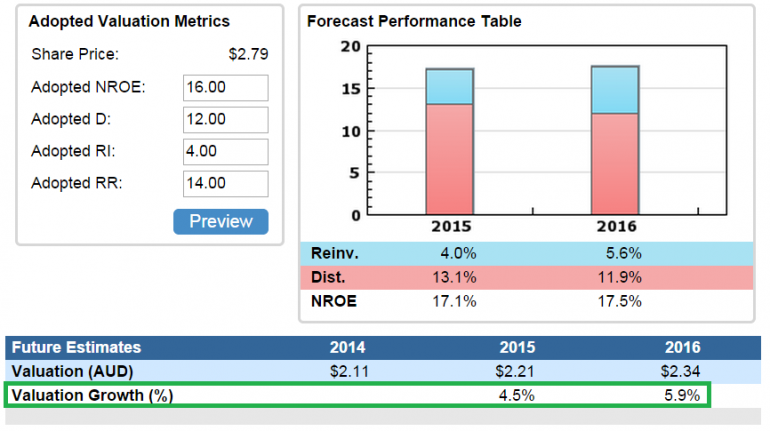

Figure 2 - MTS Future Valuation

Source: StocksInValue

We adopt a return on equity of 16 per cent, slightly below consensus, and a required return of 14 per cent. We derive a fiscal 2014 valuation of $2.11. Metcash is projected to deliver moderate growth in intrinsic value (green above). However, it is currently trading above valuation.

These three companies show the impact of structural trends such as changing consumer preferences, falling demand and intensifying competition. Both Metcash and Macquarie Telecom are in transition and it is uncertain whether they will successfully execute their strategies. All of this impacts our long-term views and valuations. We prefer to err on the side of caution and wait for evidence of change before investing.

By Brian Soh, Associate Analyst, with insights from Adrian Ezquerro and Alex Hughes of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.