Value Investor: CSL's growth injection

On October 27, CSL announced the $275 million acquisition of Novartis' influenza vaccine business. The news excited investors, with CSL's share price is up 5 per cent since the announcement. Their optimism is understandable: CSL's past acquisitions have been very successful, achieving scale and operating leverage across the group.

Once integrated with bioCSL's existing influenza business, CSL will become the second-largest player (holding approximately 20 per cent share) in the $4 billion global influenza vaccine market, behind only Sonofi-Aventis, which holds 30 per cent of the market.

The acquisition will give CSL a strong position during influenza pandemics, when governments urgently buy vaccines.

Integration costs are forecast at around $US100m, which is high when compared with the cost of acquisition. CSL is expected to benefit from synergies totalling $US75m by 2020.

Novartis vaccines lost $138m in fiscal 2013. Although the acquisition is expected to dilute earnings per share for at least two years, management thinks it can create a global platform for bioCSL that could mirror the success of CSL Behring, its global protein science business.

CSL's full-year result announced in August was pleasing, with group revenue of $US5.5bn and net profit of $US1.3bn, both reflecting an 8 per cent increase.

Over the near term, CSL's plasma therapeutics business, CSL Behring, will continue to drive the business. With sales rising 10 per cent to $US4.9bn, the division accounts for over 90 per cent of CSL's revenues. The standout performers were immunoglobulin and albumin sales, up 12 and 16 per cent respectively on the back of strong demand from China.

As sales and profit growth slow in its core business CSL is increasing investment into research and development to drive future earnings growth in developed markets. The R&D program appears to be quite successful, with 17 new product approvals or registrations in the last decade. Successful licensing of innovative products should provide a competitive advantage and diversify earnings.

CSL can also introduce existing specialty products to new markets, benefiting from the strong performance of Kcentra, a coagulation factor replacement product used in urgent surgery after it received FDA approval in the US.

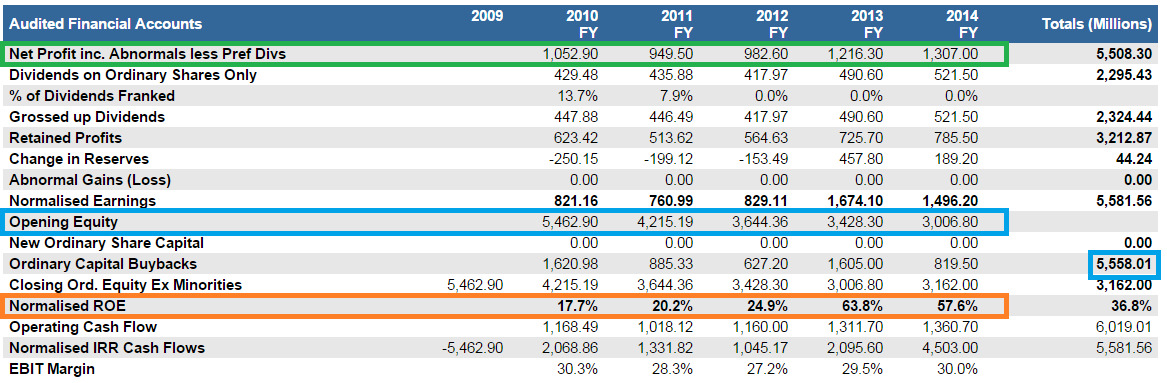

CSL has been an extraordinary generator of earnings from a declining equity base. Since fiscal 2010, earnings have grown by 25 per cent (green below) while equity almost halved due to share buybacks totalling $5.5bn (blue).

This caused return on equity to increase very substantially from 17.7 to 57.6 per cent (orange). Impressively, the increase in profitability was achieved while gearing levels remained manageable, with net debt to equity at 40.5 per cent on the most recent balance date of 30 June.

Figure 1 - CSL Historical Performance 2010-2014

Source: StocksInValue

Earnings could be affected by regulatory changes to government reimbursements or contracts. Although the company's plasma-derived products are non-discretionary, economic conditions are challenging as governments worldwide scrutinise their healthcare budgets. Other regulatory interventions are also possible, such as investigations into product safety, which would affect impact sales and business reputation.

Overall, CSL is a defensive investment with a strong corporate reputation for quality, innovation and reliability. Its successful acquisitive strategy made it a major player in the global blood plasma market.

It is cost-competitive due to economies of scale and its ability to make a variety of different products from a single unit of blood. Patents and licensing arrangements for its innovative products create substantial pricing power.

Earnings should be supported by growing healthcare expenditure in emerging markets, greater recognition of the benefits of immunoglobulin therapies and an ageing population in developed markets.

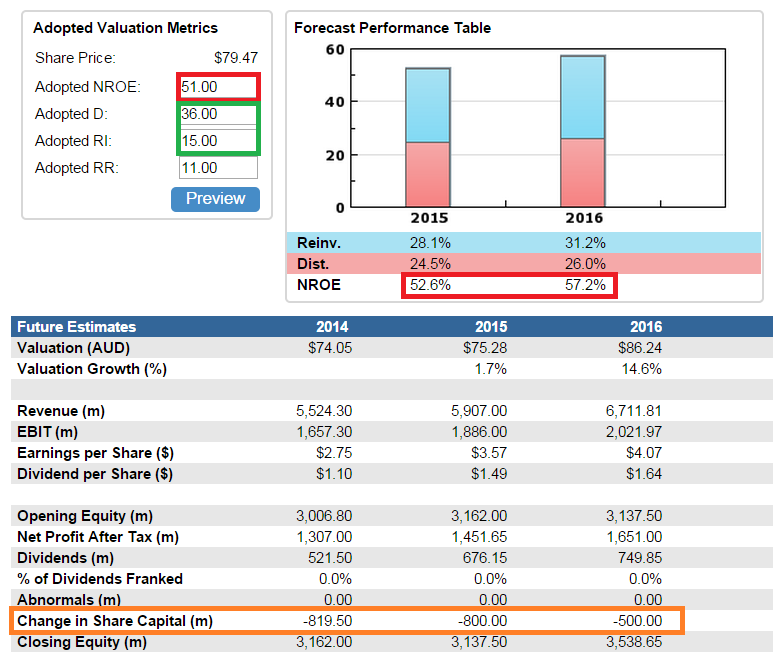

Our view of forecast sustainable return on equity of 51 per cent is slightly below consensus (red below). The required return of 11 per cent is low, reflecting CSL's dominant position in blood plasma therapeutics and strong operational performance.

Figure 2 - CSL Future Valuation

Source: StocksInValue

The dividend-reinvestment split (D:RI, green above) reflects expectations that around 70 per cent of capital will be returned to shareholders in dividends and buy-backs. This continues the existing capital management program and we have accounted for further on-market buybacks (orange).

Our fiscal 2014 valuation is $74.05, rising to $75.28 in fiscal 2015 (30 June 2015).

CSL is currently trading above intrinsic value.

By Brian Soh and Jonathan Wilson, Equities Analysts, with insights from Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.