Value Investor: A Premier offering

While Australian retail conditions remain challenging, Premier Investments (ASX: PMV) is interesting for its unique product offerings from the growing brands of Peter Alexander and Smiggle, and its expansion into international markets.

Premier reported pleasing fiscal 2014 results, with earnings increasing 5 per cent to $73 million.

The Just Group (Premier Retail) includes around 1,000 retail stores and is Premier Investments' major segment, accounting for approximately 80 per cent of group operating earnings. Earnings grew 11 per cent to $92.8m, while earnings margins improved 44 basis points to 10.4 per cent.

The highlight was the increase in like for like sales across all of Just Group's brands in the second half of fiscal 2014. This was despite a significant fall in consumer confidence after the federal budget in May.

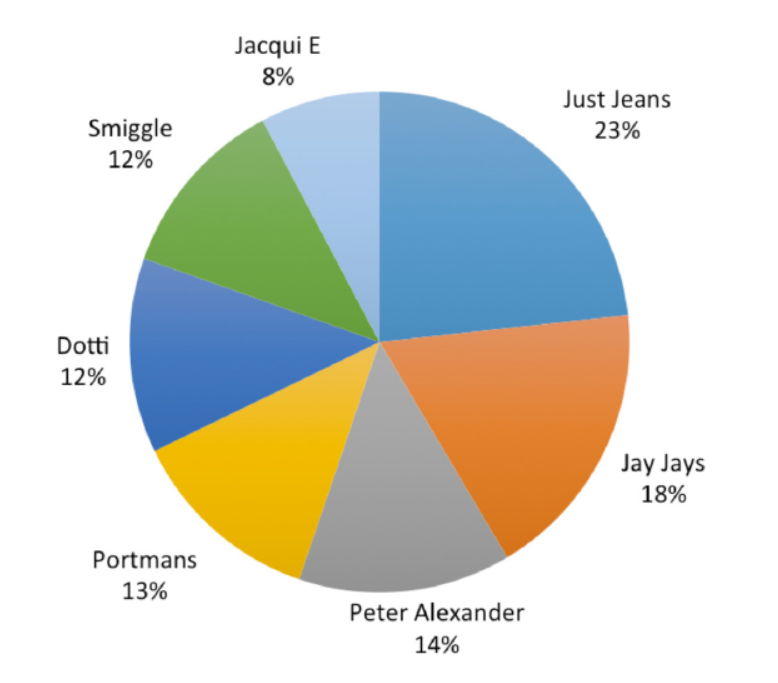

Figure 1 – Brands within Just Group

Source: Premier Investments

Premier Investments' mass market apparel businesses face increasing competition from international entrants such as Zara, Topshop and H&M. These entrants have scale advantages including supply chain efficiencies, wider product ranges and greater operating leverage. Online competitors hold cost advantages over bricks and mortar retailers from lower property, equipment and selling expenses.

Despite the increasing competitive pressure, PMV's gross margin has risen since 2011 due to direct sourcing initiatives and a focus on reducing markdowns.

Also its online sales grew by 30 per cent over the year, outperforming the Australian retail sector at 8.6 per cent. Management targets 10 per cent of group sales via online platforms in coming years.

As a retailer of discretionary items, Premier Investments' outlook is strongly tied to consumer confidence, which measures consumers' optimism about the general economy and their personal finances.

Performance has been dampened by the GFC and subsequent weakness in consumer confidence. Return on equity has been mediocre at 9.8 per cent over the last five years.

Consumer confidence remains patchy and only around long-term averages due to rising unemployment and job insecurity, stagnant real wages, rising electricity costs and disappointment with the political process. This is despite historically low interest rates and higher house prices.

However, profitability should improve under PMV's strategy to scale back the underperforming brands of Just Jeans and Jay Jays while expanding the more profitable Smiggle and Peter Alexander businesses. These brands have differentiated product offerings and are less exposed to the competitive threats facing other apparel brands.

Since fiscal 2011, a combined total of 100 Smiggle and Peter Alexander stores opened while 59 stores were closed across the other brands.

Peter Alexander, uniquely positioned as a sleepwear designer, has grown strongly in Australia. Management has expanded the childrenswear range and aims to enhance brand awareness by opening flagship stores and leveraging an exclusive relationship with Myer. In the last three years, Premier Investments doubled its store footprint to 76 stores.

A retailer of primarily children's stationery, Smiggle is a unique brand in a highly attractive market. A total of 63 new Smiggle stores have opened since 2011, including 19 in Singapore and eight in the UK.

Smiggle opened in the UK in February 2014. The focus is on further expansion into a $2.4bn personal stationery market, with 25-30 stores expected by the end of the 2014-2015 financial year. According to management, Smiggle UK could have 200 stores generating $200m in sales within five years.

Figure 2 – Sales by division, PMV

Source: Premier Investments

Sales from Smiggle and Peter Alexander accounted for around a quarter of Just Group's total sales. Assuming a similar growth trajectory across Just Group's stores over coming years, combined sales from Smiggle and Peter Alexander could be over 45 per cent of group sales by 2020.

The earnings contribution of the two businesses as a percentage of the group total will presumably grow at a faster rate; Premier Investments does not disclose profit or profitability figures by brand, making it difficult to accurately forecast the effect of the Smiggle and Peter Alexander expansions on Premier Investments' profitability. We believe profitability is likely to improve, however we will wait for evidence of execution and adjust our adopted value metrics accordingly.

Premier Investments also holds an equity-accounted 25.7 per cent stake in Breville, with a book value of $187m, as at 30 June 2014. Breville contributed $12.7m, or 13 per cent of group profit before tax for fiscal 2014. We view Breville Group as a quality business and, with its reasonable growth prospects and healthy balance sheet, it should continue to contribute to Premier Investments' performance.

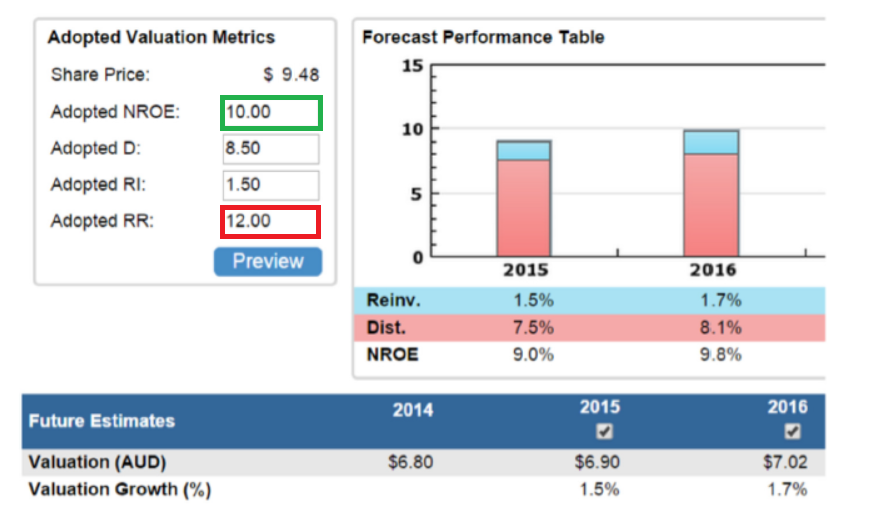

We adopt a 10 per cent return on equity (green), in line with consensus, reflecting our neutral outlook for consumer confidence and conservative expectations of an improvement to profitability resulting from the expansion of Smiggle and Peter Alexander.

Our required return of 12 per cent (red) is low, reflecting consistent operating cashflow and a substantial net cash position.

Figure 3 – PMV Future Valuation

Source: StocksInValue

We derive a fiscal 2014 (30 June) valuation of $6.80, rising to $6.90 in fiscal 2015. Premier Investments is trading significantly above value.

By Brian Soh and Jonathan Wilson, Equities Analysts at StocksInValue. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.