Value Investing

Our Investing Strategy

Our strategy is known as Value Investing and it involves buying stocks that we think are priced a long way below our estimate of their value.

The value of any stock is defined as the sum of the net cash it can deliver to shareholders in the future, discounted to today's value, but in practice such calculations are fraught with danger due to the difficulty of predicting future cash flows. As a result, we use a variety of yardsticks – such as the price-to-book ratio, the price-earnings ratio, the dividend yield and the free cash flow yield – and set these beside our assessment of the durability of a company's business and a conservative estimate of its growth prospects.

If we can buy a stock for much less than what we think it's worth, then that discount will give us a margin of safety in case we're wrong as well as provide the source of our returns if we're right.

We don't, however, know when those returns might be delivered – that will depend on the short-term movements of the market, which we don't think can be predicted with any reliability.

Sometimes the market will reprice a stock quickly and we'll have an opportunity to sell for a speedy profit; sometimes we'll have to wait years. Often a stock will fall further before rising, which is fine by us – we'll re-examine our investment case and if we still see value then we'll buy more.

It doesn't in fact matter if the price of the stock eventually rises or not: if a company delivers a growing stream of cash to its shareholders but its share price doesn't increase to reflect that, then the stream of cash can be used to buy more of what will be an increasingly undervalued stock.

Of course we won't get it right all the time, but if we buy a portfolio of stocks at a material discount to their underlying value, then good things should ultimately happen.

Why it works

Put simply, the value investing approach works because of human psychology. When people are buying and selling real businesses, it seems obvious that their focus will be on what those assets can earn in future. But a strange thing happens when those businesses are sliced up into little pieces and traded on a minute-by-minute basis, day by day. Stocks rise and fall and – even if these short-term movements are unpredictable – large sums of money can be made and lost quickly.

The desire to make a quick buck – or to avoid losing one – plays to our instincts of fear and greed and draws people's attention towards the short term rather than the long term, and towards price rather than value. People stop thinking about the true underlying value of stocks, and start to think about which ones will go up in price in the short term.

There are a variety of ways people attempt to do this, from following 'price momentum' to trying to jump in ahead of the true value investors. But we don't think any of these short-term approaches work with any kind of reliability and, worse, they distract from the real source of advantage that investors can give themselves, which is value.

In fact it's these irrational behaviours that cause the mispricings from which value investors aim to profit – but in order to take advantage, you need to be rational yourself. That's harder than it sounds, but we're here to help you.

There's more about Value Investing in our book, Value.

Our Research Process

All our Buy recommendations go through a thorough research process, which culminates in a 'Dragon's Den'-style presentation made to the team. Only the very best ideas that have been carefully vetted by the team are recommended to members.

Our team is constantly scanning the ASX with a focus on what we call the ‘50/50 approach’. We constantly research the top 50 stocks that form the bedrock of most members’ portfolios; the banks, the major mining houses such as BHP Billiton and Rio Tinto, Woolworths and the like.

On top of this 'big 50', we also cover another 50 stocks (or often more) that we think are most likely to provide a good investment opportunity. Typically these will be businesses we especially admire, which we'd love to buy at the right price, or businesses that the market particularly dislikes, but which we think are not so bad – such as decent businesses going through a bad patch.

This doesn’t mean we’re only researching 100 companies – in fact it's typically a few dozen more and we're constantly scanning the market to fine new stocks to add to our coverage list.

The aim is to give you the best of all possible worlds; detailed, commission-free research on the biggest holdings in your portfolio and plenty of new opportunities.

As well as the thousands of words that we write, we use various tools to convey our opinion on stocks. The most important of these are our specific recommendations: 'Buy', 'Speculative Buy', 'Hold', 'Sell', 'Avoid' and 'Under Review'. These are described in greater detail lower down this page and in our article What we mean by Buy, Hold and Sell.

To help you use these recommendations to build and maintain a portfolio, we also provide price guides, risk ratings and recommended maximum portfolio weightings.

Price Guides

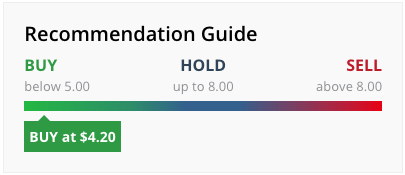

The price guides provide context around our recommendations, giving an idea of when we might consider changing our recommendation. This can help you personalise our recommendations – if you want to put together a portfolio of high-quality income stocks, for example, then you might consider buying these at slightly higher prices than we'd upgrade them to Buy for the whole of our membership.

Bear in mind, though, that our price guides are only guides and the price points are subject to a margin of error. The value of a stock will change from day today, perhaps because of something vague, such as the economy taking a slight turn for the worse, or because of something more specific, like the stock starting to trade without the entitlement to a dividend (ie going 'ex dividend').

Typically we'll view these things as coming within the margin of error and we won't immediately adjust our price guide (unless and until the small changes mount up to something more significant). To avoid chopping and changing too much as a stock price bobs about a price point, we'll also typically wait for a little clear space beyond a price point before changing our recommendation. Putting all this together, a stock could go anywhere from 1% to 10% beyond a price point before we change our recommendation.

Where a stock's value moves around too much due to external factors (such as with some pure commodity producers), or it is otherwise particularly hard to pin down (such as with some highly valued growth stocks), we might dispense with our price guide altogether so as to minimise the risk of confusion.

Where appropriate, we'll provide any clarifications about a stock's price guide in the text of articles. For a more detailed explanation of our price guides, take a look at our article What we mean by Buy, Hold and Sell.

Risk Ratings

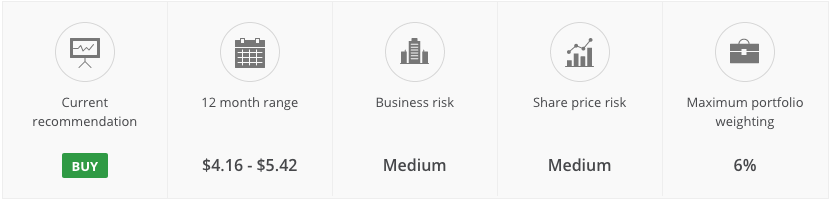

Our risk ratings are set on a range of very low, low, medium-low, medium, medium-high, high and very high, and they come in two flavours: 'business risk' and 'share price risk'.

The business risk describes the potential variability in a company's underlying business value, taking into consideration things like management, culture, business model, cash generation and debt levels, as well as external factors such as commodity prices.

The share price risk overlays our estimate of the sharemarket's sentiment onto the business risk, to give an idea about how much we expect a share price to move around. Although we take a long-term approach, we try to give you an idea of what you might expect. Often the two risk ratings will be the same, but if the market views a stock as more risky than we do (perhaps because it focuses on short-term factors), then the share price risk might be higher; where we think a stock is more risky, then the business risk might be higher.

Portfolio weightings

Our maximum recommended portfolio weighting provides our best estimate of the maximum an average investor might want to have in a stock at a given point in time. Note that this isn't the initial amount we recommend you invest, but the maximum you should ever hold. It also doesn't tend to change much with price and value (because, apart from anything else, the limit needs to account for the fact that we might get this wrong).

The weightings range from as low as 1% for highly speculative stocks, to as much as 8–10% for the likes of Woolworths, Wesfarmers and the big banks. Often it will make sense to buy much less than the recommended maximum when we first recommend a stock (perhaps half) to give room to increase your holding if it falls further (and becomes better value); when stocks rise, taking your holding beyond the maximum recommended, then we suggest taking some profit to reduce your holding to keep within the recommended limit.

Where appropriate, we'll make more detailed comments about weightings in the text of articles. For a more detailed explanation of our risk ratings and portfolio weightings, see our article Risk ratings and portfolio weightings.

Understanding Our Recommendations

Intelligent Investor’s recommendations are designed to help guide members’ investing decisions.

While everything we do is designed to maximise long-term investment returns and minimise losses, occasional losses are a normal part of investing.

Please use these recommendations in conjunction with our risk ratings and suggested maximum portfolio weightings.

Discover our current recommendations.

Recommendation types

-

Buy

These are stocks that we think offer a substantial margin of safety in their price, and most members should consider adding them to their portfolios.

-

Speculative Buy

These stocks have the potential to produce higher returns, but that comes with higher risk – often much higher – so they're only suitable for investors that are comfortable with that. Typically these recommendations will be accompanied by low maximum recommended portfolio weightings.

-

Hold

These stocks offer some value (if there was no value we'd say Sell or Avoid), but there's not enough margin of safety for us to recommend them as a Buy. Most stocks will fall into this category. As they move closer to our Buy price, they could make reasonable investments for some; as they move closer to our Sell price, it might make sense to take some profit (particularly where you're breaching our recommended portfolio weighting).

-

Sell

These stocks offer little to no value, and we therefore think that members should consider selling and finding alternative investments – if necessary holding cash in the meantime.

-

Avoid

These are stocks that have particular risks or business issues, which mean we think we're unlikely to see a price at which we'd want to Buy or even Hold the stock. As a result, we'd recommend that you steer clear.

-

Under Review

This recommendation means a review is pending. It’s used sparingly usually following an important announcement that could impact the stock’s previous recommendation.

Frequently Asked Questions about this Article…

Value investing is a strategy that involves buying stocks priced significantly below their estimated value. The idea is to purchase stocks at a discount, providing a margin of safety and potential returns if the market eventually recognizes their true value. This approach relies on assessing a company's future cash flows, business durability, and growth prospects.

The value of a stock is determined by estimating the net cash it can deliver to shareholders in the future, discounted to today's value. We use various metrics like the price-to-book ratio, price-earnings ratio, dividend yield, and free cash flow yield, alongside a conservative assessment of the company's growth prospects.

Human psychology plays a crucial role in value investing because it often leads to irrational market behaviors. Investors' instincts of fear and greed can cause them to focus on short-term price movements rather than the true underlying value of stocks, creating opportunities for value investors to profit from mispricings.

Our '50/50 approach' involves constantly researching the top 50 stocks that form the core of most portfolios, such as major banks and mining companies, along with another 50 stocks that present good investment opportunities. This approach ensures a comprehensive analysis of both established and potential stocks.

Price guides provide context around our recommendations, indicating when we might change our stance on a stock. They help personalize recommendations, but are subject to a margin of error due to market fluctuations. We typically wait for clear price movements before adjusting our recommendations.

Risk ratings assess the potential variability in a company's business value and share price. They range from very low to very high and help investors understand the expected volatility. Business risk considers factors like management and cash generation, while share price risk reflects market sentiment.

Maximum recommended portfolio weightings provide guidance on the maximum percentage of a portfolio that should be invested in a particular stock. This helps manage risk by preventing overexposure to any single investment, allowing room to adjust holdings based on market movements.

Our recommendations include 'Buy' for stocks with a substantial margin of safety, 'Speculative Buy' for higher-risk opportunities, 'Hold' for stocks with some value, 'Sell' for stocks offering little value, 'Avoid' for stocks with significant risks, and 'Under Review' for stocks pending further analysis.