US recovery comes out of hibernation

Household spending and the labour market are back on track in the United States, after a couple of weather-related hiccups. The next step: another $US10 billion taper when the Fed meets next week.

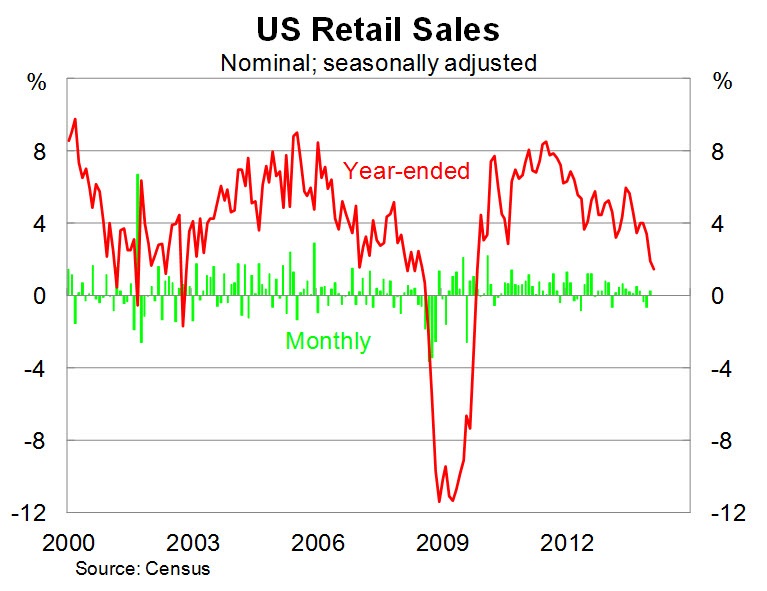

Retail spending in the United States rose by 0.3 per cent in February, slightly above expectations, to be 1.5 per cent higher over the year. This followed two consecutive monthly declines on the back of particularly poor winter weather.

Annual growth has fallen sharply in recent months, though this is likely to be temporary and is due to weather effects. Retail spending growth should pick up and may even do some catching up as the weather improves.

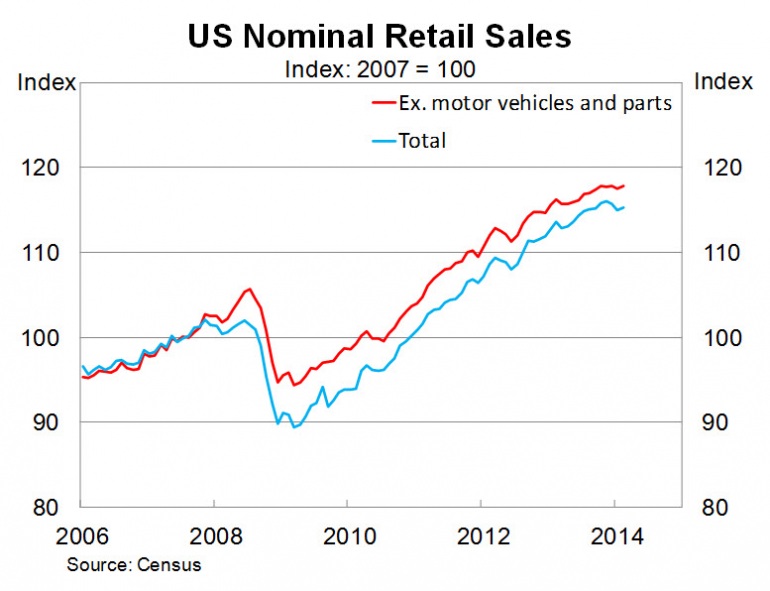

Core retail spending, which excludes motor vehicle sales and parts, also rose by 0.3 per cent in February, to be 1.3 per cent higher over the year. The core measure, which is also more highly correlated with consumption in the national accounts, held up better during December and January. But nevertheless household spending is likely, at best, to have only a very small positive contribution to March quarter growth.

Spending on food and beverages fell by 0.2 per cent in February but this was offset by gains in health and non-store spending. Spending on electronics and appliances also declined by 0.2 per cent, while department stores and recreational goods saw solid gains.

The rebound in consumer spending comes mere days after the labour market regained its pre-Christmas momentum, with payrolls expanding by 175,000 in February and upward revisions for December and January (The Fed’s labour booster shot, March 10). Initial jobless claims also beat expectations today.

Much like household spending, I anticipate that the labour market will pick up in coming months as businesses play catch-up once weather conditions improve. That will further support household spending over the coming months.

The Federal Reserve has played down the significance of the poor data in January and February, treating the weather as little more than a temporary economic problem. That faith now appears on the mark and the likelihood that the Fed will begin to slow the taper of its asset purchasing program has diminished.

The Fed meets on 18-19 March and is all but certain to cut its asset purchases by an additional $US10 billion -- the third such cut since December. New York Fed President William Dudley also hinted recently that the Fed’s sensitivity to poor data is perhaps not as high as many expected. It is clear that it will take a considerable loss of momentum before it changes its current path.

Retail sales only exceeded expectations by the smallest of margins but it is another firm indication that the economy is back on track after a wayward couple of months. The household sector looks to be in good condition, supported by asset prices and improving labour market conditions, and this will support a lengthy period of solid spending.