US exposure gives an edge

As third quarter earnings season in the US draws to a close, annualised earnings per share growth for the year comes in at 5.8 per cent. Solid earnings for US companies in the third quarter paint a bright picture for Australian companies operating in the US market.

Earnings in the US have topped estimates coming into the third quarter reporting season, with more than 75 per cent of companies outdoing analysts’ estimates. The result is a confident surprise by the market.

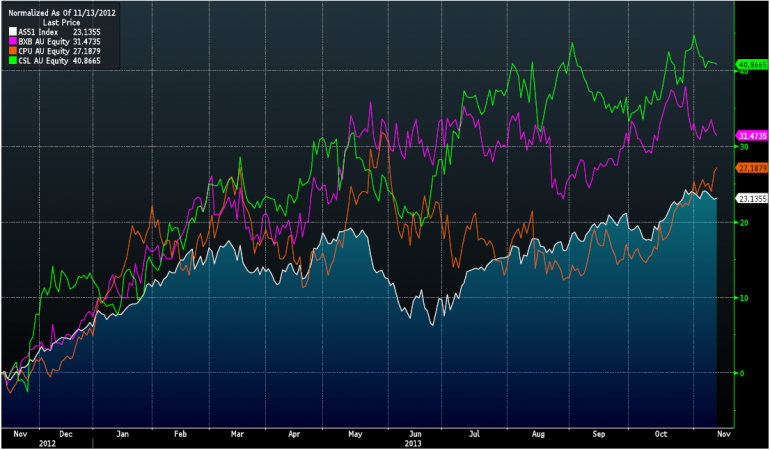

Taking a lead from the US S&P 500 index has seen selected US-oriented stocks outperform the broader ASX 200 over the past year – CSL (green line), Brambles (pink line) and Computershare (orange line) emphatically lead the way.

Source: Bloomberg

While James Hardie has trailed the ASX 200 index by around six per cent over the same period, things could be looking up for the construction company. US builders Toll Brothers, ending the financial year at October 31, experienced an estimated 65 per cent increase in revenue for the fourth quarter spurred by price increases and a pick-up in sales. James Hardie reports interim results tomorrow, giving the market a clear indication of current performance.

For Brambles and James Hardie, being cyclical in nature positions them well as the US economy finally gains traction. The purchasing managers index (PMI) is up nine per cent over the past 12 months; add to this a positive US GDP surprise and the picture looks complete for further growth.

James Hardie is also benefiting from housing affordability bordering on 40-year lows. Although affordability has slipped slightly, it is still comfortably below pre-global financial crisis peaks.

Despite being embroiled in a bribery probe, Computershare is well positioned to expand the outperformance against the broader index. The investor services company has plenty of opportunity to be involved with the expected increase in initial public offerings, both here and in the US and merger and acquisition activity. It is anticipated Computershare will use today’s annual general meeting to update the market on the corporate actions cycle.

An extra bonus for companies with a significant portion of earnings in US dollars will be a weakening Australian dollar. The catalyst for this will be when the Federal Reserve finally winds back the current bond buying program.

Fourth quarter earnings are expected to improve even further. The question now remains, how much upside is left for US earnings?