UIL Energy debuts with exciting Perth basin position and proven mangement

Former Bow Energy CEO John De Stefani and Arrow Energy founder Steven Bizzell are listing oil and gas explorer UIL Energy Ltd (ASX: UIL) on the ASX on Thursday 6 November following a successful capital raising. De Stefani was at the helm of Bow Energy when it sold to Shell and PetroChina for A$535 million, a 72 percent premium to the company’s stock market valuation while Bizzell helped steer Arrow Energy’s market capitalisation from $20 million to $3.5 billion in less than eight years.

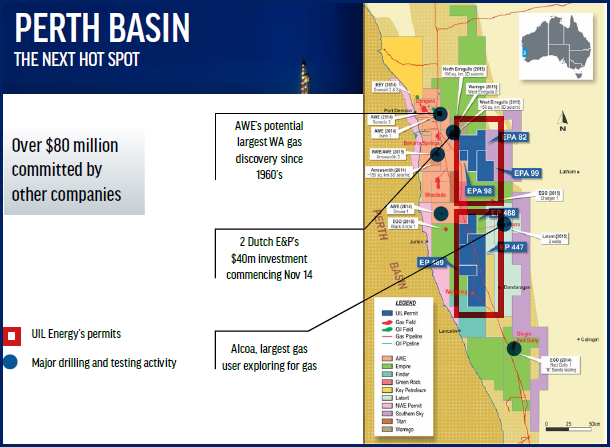

UIL Energy is focused on unconventional and conventional plays in Western Australia’s onshore Perth and Canning Basins where the company has secured close to 18,000km2 of exploration acreage.

The recent technical success enjoyed by several Perth Basin operators has increased enterprise valuations with leading institution Citi Research recently placing a valuation of A$200/acre1, a valuation considerably below Cooper Basin multiples which have exceeded A$850/acre1. At listing, UIL Energy will have an implied valuation of under A$30/acre offering investors considerable upside in a producing basin.

Managing Director De Stefani was pleased to see that investors were backing the company’s view that the Perth Basin would be the next hotspot for onshore oil and gas developments, “We are excited about the developments that are now occurring in the Perth Basin and believe that UIL Energy will benefit significantly having one of the largest acreage positions in the Basin.”

“Western Australia is the largest domestic gas market in Australia. Our permits are close to existing infrastructure paving the way for early commercialisation and easier delivery of product to market,” Mr De Stefani said.

In September, AWE announced it had uncovered potentially the largest conventional onshore gas discovery in Western Australia in over 50 years following drilling success at its Senecio field, next door to UIL Energy’s permits in the Perth Basin. A number of other companies including industry heavyweights Origin Energy and Alcoa, the largest gas user in Western Australia, are also exploring the basin’s potential.

The UIL Energy Offer, for 21 million shares at $0.20 per share, raised $4.2 million and places a capitalisation value of $21.6 million on the company. Bell Potter acted as Lead Manager to the IPO inconjunction with Corporate Advisor Bizzell Capital Partners. Simon Hickey, Executive Chairman, along with Mr De Stefani and Mr Bizzell have subscribed for substantial shareholdings in the company, collectively owning 35 percent at listing.

1 Citi Research dated 18 September 2014