Two views on the state of coal's decline

Yesterday we received two somewhat contradictory stories regarding the future viability of coal, although ultimately they are reconcilable.

On one side we saw the government release its Mid-Year Economic and Fiscal Outlook showing a noticeable deterioration in the budget deficit within almost six months of the May budget, due to changes in the economic outlook. According to the budget papers, “changes to the economic outlook since the Budget are driven by the sharper than expected fall in the terms of trade, including significant falls in prices of iron ore and coal, and weaker wage growth.”

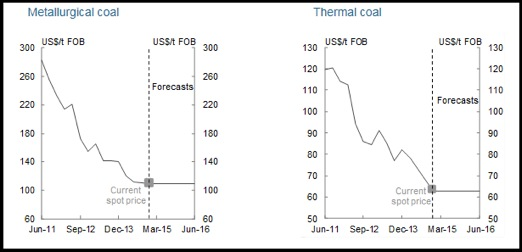

The price of iron ore has copped a hammering thanks to China's effort to rein in construction activity to ensure more sustainable levels of economic growth. This has of course had flow-on effects for metallurgical coal, with Treasury now assuming prices for metallurgical coal that are almost a third of what they were just 2½ years ago. In addition, Treasury is now assuming thermal coal prices of almost half what they were 2½ years ago.

Figure: Coal Prices (US$/t): Actual and Treasury's MYEFO assumption

Source: Institute for Energy Economics and Financial Analysis based on Platts, Bloomberg and Treasury information.

Tim Buckley, former head of Australasian equity research at global bank Citi, who now focuses on analysing the financial risks associated with carbon-intensive assets, suggested this should act as a warning to state and federal governments about sinking any more government money into building water, port or rail infrastructure to open up the Galilee Coal Basin – something Queensland Premier Campbell Newman has already announced he wants to do.

“We have long argued that once the $A10-14 billion of capital costs are taken into account, the Galilee coal projects are commercially unviable given the structural decline of thermal coal. It now seems the Australian Treasury agrees with us,” said Buckley, who is the director of Energy Finance Studies Australasia at the Institute for Energy Economics and Financial Analysis.

To emphasise the risks Australia faces from a dependence on coal Buckley highlights UK Energy Secretary Ed Davey's comment last week that fossil fuel companies could become “the sub-prime assets of the future ... investing in new coal mines is going to get very risky.”

On the counter side to Buckley, the International Energy Agency released its Medium-Term Coal Market Report suggesting that despite the decarbonisation push, global demand for coal over the next five years will continue marching higher, breaking the 9 billion tonne level by 2019.

This is in spite of the IEA projecting coal use in OECD member countries to decline over the next five years as growth in Turkey, Korea and Japan fails to offset declines in Europe and America.

In America while the agency notes the effect of shale gas on international energy markets has been exaggerated, that will, in combination with air pollution controls, lead to a 1.7% decline in US coal use per year on average.

In relation to Europe, it pours cold water on conservative think-tank propaganda about a revival of coal use in Europe, stating:

"The coal renaissance in Europe was only a dream. As announced in former Medium-Term Coal Market.

"Reports, coal use increase in Europe in recent years was a temporary spike ... after 2012, coal demand began to decline due to moderate economic growth, energy efficiency gains, increasing renewable energy sources and coal plant retirements. Nothing new has happened to change our views.”

Nonetheless, growth in coal consumption in China and to a lesser extent India and South-East Asia, overwhelms the decline in the OECD.

This is even though the IEA agrees with Buckley that the Chinese-driven coal boom is over. They both believe China' coal demand growth will moderate due to lower economic growth and a notable decoupling of economic growth from energy demand, as well as what the IEA calls “staggering” growth in China's use of renewables, nuclear and gas. Nonetheless the IEA expects growth in coal consumption will still be required and will not peak in the next five years, even though they also note “longer-term trends might suggest peak coal in China during the next decade”.

Due to the huge size of China's coal consumption, even this moderation in coal demand growth still means it completely overwhelms declines in the US and Europe over the next five years.

No doubt the coal lobby will favourably cite this new analysis by the IEA to suggest that Australia continue to hook its economic cart to the extraction of coal. However, the IEA also accompanied its forecast of continued growth in coal with a health hazard warning.

IEA executive director Maria van der Hoeven said at the launch of the report:

"Although the contribution that coal makes to energy security and access to energy is undeniable, I must emphasise once again that coal use in its current form is simply unsustainable."