Turning Japanese? Investors hope so

A weaker yen has done wonders for the Japanese equity market.

It is expected Japan's policymakers will continue to undertake measures to influence the yen to trade at artificially low levels in 2014 as it strives to meet a 2 per cent inflation target. Consequently, investors have a level of assurance the yen will likely remain lower for some time yet.

A weaker yen has helped the struggling export sector and propped up the share market along the way. The relationship between the exchange rate of the Japanese yen and US dollar (pink line) is near completely inverse when compared with the Nikkei index (white line).

Over the past year the Japanese yen has deprecated 18 per cent against the US dollar but over the same time the Nikkei has added some 55 per cent. What international investors have lost on the currency has been more than made up for in equity market gains, making it a worthwhile investment.

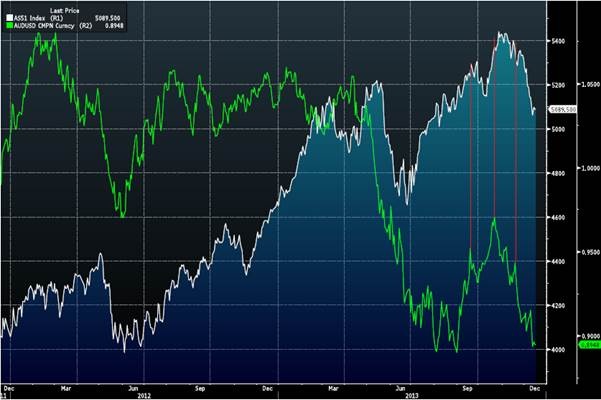

When it comes to the Australian market, international investors have lost 15 per cent on the currency (AUD/USD pairing) and only gained 11 per cent on the market over the past year, leaving offshore punters out of pocket.

Japan is an export-driven economy and directly benefits from a weaker currency, while Australia is moving away from commodity exports. For the Australian market, a weaker dollar needs to boost overall competitiveness, but recent movements perhaps suggest the market is not convinced this will eventuate - just yet.

If we take 85 cents to be a hypothetical value of an appropriate exchange rate for the RBA, that equates to a 4.4 per cent slide from the current level. To make up for this, the Australian market would need to gain this at a minimum. Taking a level of 5,100 points for the ASX 200 index, a 4.4 per cent increase would put the market at 5,324 points – a questionable achievement in light of current economic conditions and investor sentiment.

The relationship between the Australian and US dollar currency pairing (green line) is not clearly defined, but in the last three months, moves lower in the currency, highlighted by the red bars have been followed by a decline in the equity market (white line).

The Reserve Bank of Australia has been campaigning for a weaker currency for the past few months in a bid to spark economic growth. For international investors, the exchange rate matters and expectations the Australian dollar will decline further is a point for consideration.