Top five takeover targets

Summary: The market is well placed for more takeover activity with cheap debt and fairly low organic earnings growth. Consolidation is expected among automotive dealerships, with AHE a likely target. Treasury Wine Estates' share price is still too high for fresh bids, mergers are likely among medium-sized telcos such as iiNet and pipeline operator Duet Group might catch one rival's attention. |

Key take-out: Despite recent interest in the Ten Network, the share price could drop if suitors walk away. This is not one for the faint-hearted. |

Key beneficiaries: General investors. Category: Shares. |

As we come to the closing weeks of calendar 2014 the wider market remains well positioned to trigger takeover activity. Debt remains cheap, equity markets are relatively stable and organic earnings growth fairly low.

Moreover, when it comes to the crunch most CEOs would rather run a larger company than a smaller one. As a result, more takeovers are on the agenda.

In recent times I've managed to “pick” some key takeovers in advance for Eureka subscribers, most notably Warrnambool Cheese & Butter, which was successfully taken over after a global takeover battle by Canadian company Saputo.

Though there is still the prospect of more action in the agricultural and food sector my main areas of interest are in industrials, utilities and one special situation in free-to-air television.

Here are my top five takeover targets right now.

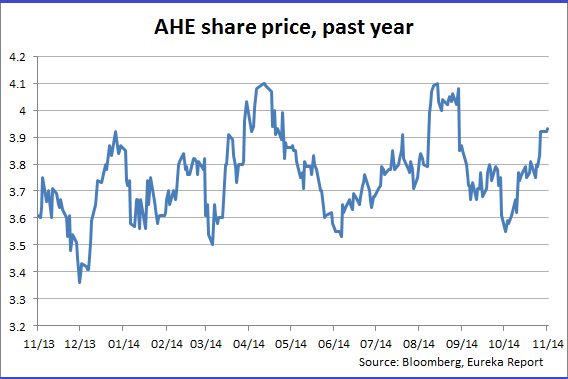

1. Automotive Holdings Group (AHE)

This company is a Perth-based automotive group that manages the largest number of car dealerships in Australia. It also runs a refrigerated logistics division. On AHE's register with a 19.9% holding is fellow car dealer AP Eagers (APE) – based in Queensland, and the second-largest such business in this country.

Both companies have market caps around $1 billion and record solid profits when Australian auto sales top one million vehicles per annum.

The widely fragmented car selling industry is ripe for consolidation. In my view it is only a matter of when – not if – APE approaches AHE with a merger proposal.

Combined, the two companies would account for over 10% of total new cars sold here every year. In the meantime AHE trades on a price-earnings ratio of around 11.5 times and has a cash yield of over 6%, both of which are comforting metrics.

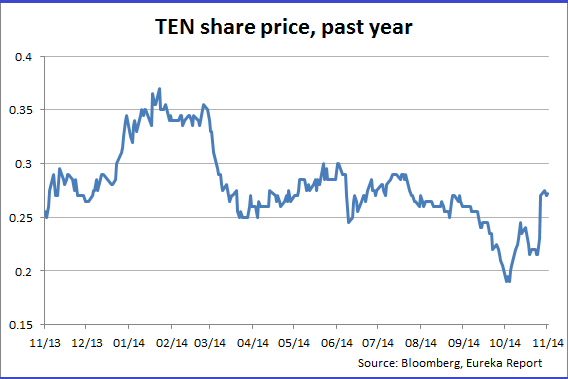

2. Ten Network Holdings (TEN)

For several years now Ten Network (TEN) has been a plaything of sorts for James Packer, Lachlan Murdoch and Gina Rinehart. Separately, it's also been a key investment for television tycoon Bruce Gordon who appears to be the least willing to sell.

Despite the collective abilities of this group, they have all dusted hundreds of millions since buying into Ten. Now potential suitors such as Discovery Communications, Time Warner, Paramount and private equity specialist Hellman & Friedman are running the ruler over Australia's smallest commercial free-to-air network.

Since rumours of bidding interest filtered out a fortnight ago, Ten's shares have rallied from 18c to 27.5c. At this level the indebted and unprofitable broadcaster looks expensive. Over the longer term, free-to-air TV will eventually succumb to the internet. The best companies like Ten can hope for are to generate as much cash as possible while older people still watch television. In a contested bidding war, Ten's price may get to 35-40cps – but if the potential acquirers walk away it'll be back at 18cps before you know it. Not one for the faint-hearted.

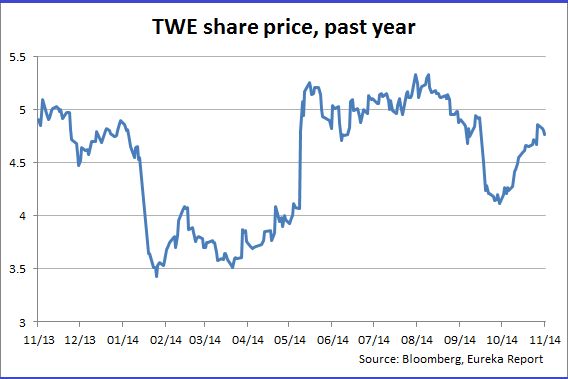

3. Treasury Wine Estates (TWE)

As one of the last great independent collections of wine brands, TWE was always going to attract merger interest – it controls Penfolds, Rosemount and Wolfblass to name just three.

Early this year a group of funds led by buyout specialists Kohlberg Kravis Roberts (KKR) lobbed a $5.20 per share bid on the table.

After several months of deliberation the TWE board claimed that 50% of the company's shareholders felt the offer was inadequate and the bid was rejected.

Since then TWE's shares have hovered around the $4.50-$4.60 mark. When a takeover falls apart I like to see the erstwhile target's share price decline at least 20% before buying in. Right now TWE is in no man's land with its shares just 11.5% down from KKR's offer.

While the lower Australian dollar is positive for TWE's large but unprofitable US business, KKR et al won't be back until the TWE share price declines further. I'd expect action again once this stock slips to around $4.20.

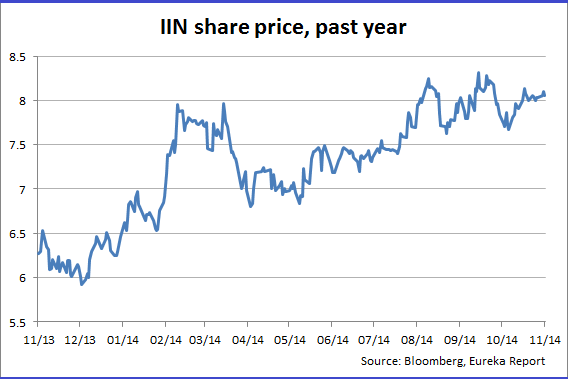

4. iiNet Ltd (IIN)

Although I've written about this second-tier telco a number of times before, industry momentum still suggests a round of consolidation amongst the medium-sized players. Right now locally-listed Vocus Communications (VOC) is moving to take over Perth-based Amcom Telecommunications (AMM). Combining their respective east and west coast-based fibre optic networks makes a great deal of sense.

Unfortunately, fellow mid-cap telco TPG (ASX code TPM) refuses to hand victory to VOC on a plate and has recently purchased 6.7% of AMM.

To date TPG has described this stake as merely a “strategic investment”. Clearly this is nonsense. TPG will either demand a higher price for its shares (from which all other AMM shareholders would benefit) or make a bid of its own. Either outcome is good for AMM.

This land grab for customers will not cease any time soon. Assuming the NBN is eventually built, all telcos big and small will be able to offer broadband customers largely the same speed and service. Profitability will be determined by size, with the larger companies outperforming the smaller.

iiNet and TPG are the next cabs off the rank here. A merger between the two is quite possible. Alternatively, the combined VOC/AMM might have a crack at either or both. In the meantime broadband spend is a bright spot in an otherwise tepid Australian economy.

5. DUET Group (DUE)

Notwithstanding threats by US Federal Reserve chair Janet Yellen to lift American interest rates sometime soon, cash yields remain at multi-generational lows. This keeps investors hungry for strong and stable dividends, and local utilities have proved adept at supplying these.

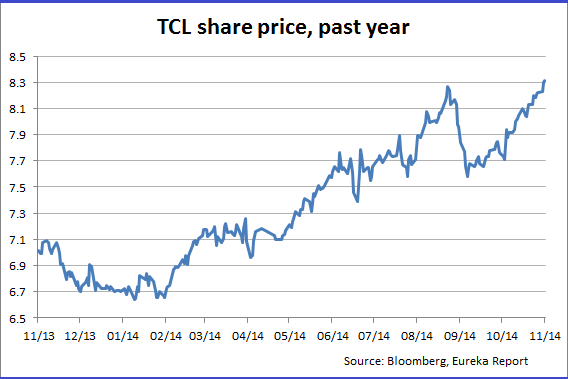

Right now we hold toll road operator Transurban Group (TCL), electricity carrier Spark Infrastructure Group (SKI) and pipeline operator Duet Group (DUE). These stocks' respective cash yields range from 4.2% to 6.6%, and all enjoy the relative freedom from competition that makes good utility companies great.

TCL has been the subject of takeover interest before from various Canadian pension funds. Its attractiveness hasn't declined in the intervening period, and I expect it'll be bid for again at some stage.

Just months ago Cheung Kong Group successfully acquired Envestra (ENV), trumping a rival bid from pipeline operator APA Group (APA). Because super profitable utilities are a game of scale, DUE might eventually catch APA's attention also.

SKI enjoys similar regulated returns, and should therefore prove attractive to predators in the medium term. Due primarily to their strong and defendable dividend yields, all these businesses are ones I'd be happy to hold in the absence of any bids. Any further merger proposals in the infrastructure space would be icing on an already attractive cake.

Tom Elliott is a director of Beulah Capital and MM&E Capital.