Tobin's lesson on logic and banks

This is the second part in a two-part series. To read the first part, click here.

In my article yesterday I showed how Paul Krugman had used the views of a young James Tobin to dismiss the relevance of banks to macroeconomics – even though those views were later drastically revised by James Tobin himself. The contrast between the theories advanced by the young James Tobin and Tobin the Elder were stark, and a salutary lesson in the benefits of always remaining open-minded to new information. But the question remains, which Tobin should you believe?

I suggest you believe neither, but consider simple logic, and also consider which perspective makes sense of the empirical data. On both fronts, the ‘banks don’t matter’ view is a total loser – as Tobin the Elder came to appreciate.

On logic, table 2 compares lending by a non-bank (such as a ‘Savings and Loans’) with lending by a bank (the Table applies the convention of the Open Source – i.e. free, go on, download it! – monetary macroeconomic modelling program Minsky of showing assets as positive sums and liabilities as negative, and a transfer from an account as a positive and into another account as a negative) using the accountant’s logical tool of double-entry bookkeeping.

Table 2: Lending by a non-bank versus lending by a bank

Assets | Liabilities | |||||||

Action | Reserves | Loans | S&L | Firms | Gold Dealer | Workers | Money /- | |

1 | Non-bank lends | S&L Loan | - S&L Loan | Nil | ||||

2 | Bank Lends | Bank Loan | - Bank Loan | Bank Loan | ||||

3 | Buy Gold | -Gold | Gold | |||||

4 | Withdraw Cash | -Cash | Cash | -Cash * | ||||

Lending by an S&L (Row 1) transfers money from its bank account to the borrower’s account, and therefore does not alter the total amount of money in existence. Lending by a bank (Row 2) increases both the bank’s assets and its liabilities and thus increases the amount of money in existence. If workers try to get out of money and into gold (Row 3), they reduce their bank accounts but increase those of the dealers from whom they buy the gold.

The only action that can take money out of the banking system is a withdrawal of money as cash (Row 4) – which is why a bank run is so disastrous, since there is far more money in banks than there is cash, and if we all try to do it, we can’t (and it’s also why causation runs from the public’s demand for cash to how much central banks print, as the recent revelation of airlifts of billions of euros to Greece and Crete illustrate, and not the other way around). And even then, unless the money is buried beneath the proverbial mattress, it continues to circulate in the economy – hence the “*” next to the “-Cash” measure of the change in the money supply.

And no, the fact that endogenous money exponents focus on the change in the quantity of money doesn’t mean, as Paul Krugman said that we have “suddenly become strict monetarists while I [Paul Krugman] wasn’t looking”. It means that we take changes in the quantity of money and debt seriously (as well as changes in its velocity), and we use a realistic endogenous model of money creation (that also includes creation of fiat money by the State when it runs a deficit), rather than Milton Friedman’s monetarist fantasies of money being only exogenously created, and of a government that drops dollar notes out of helicopters. “Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky…” Friedman said.

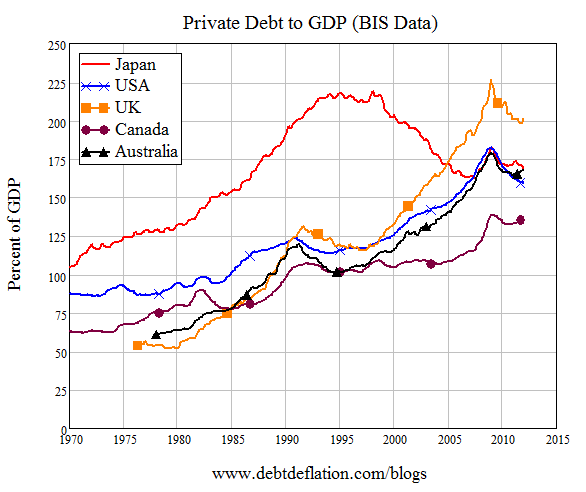

On the empirical front, not only did the “Loanable Funds” vision of lending mean that proponents of this view were sanguine about the dramatic growth in bank debt prior to the crisis (see Figure 3) while endogenous money proponents were raising the alarm about it, it also means that they can’t fully understand why ‘business as usual’ hasn’t resumed after it.

Figure 3: Pride before the Fall? Rising debt the prelude to crisis

Well, they do have the zero lower bound argument, but I reckon that endogenous money provides a stronger one.

Here I’m going to push the envelope a bit and put forward a minority position within endogenous money: the implication that I, Michael Hudson, Dirk Bezemer, Matheus Grasselli and (with a slightly different approach) Richard Werner derive, that effective demand in a credit-driven world is income plus the change in debt.

I stress that this is a minority position: it is disputed by many who identify with endogenous money, and regarded as an error of ‘double-counting’ – and it’s one reason that I’m currently working with mathematicians at the Fields Institute is to answer this objection. Such disputes are a healthy part of the development of economic thought over time. Sometimes we find this way that we’ve made a mistake, or underestimated the importance of some issue – as I clearly did when I used not to use double-entry book-keeping in my monetary modelling. That’s healthy, and it’s important not to have so much ‘ego in the game’ that you’re unwilling to change your mind over time – as Tobin clearly did, and as I hope Krugman will too on this topic.

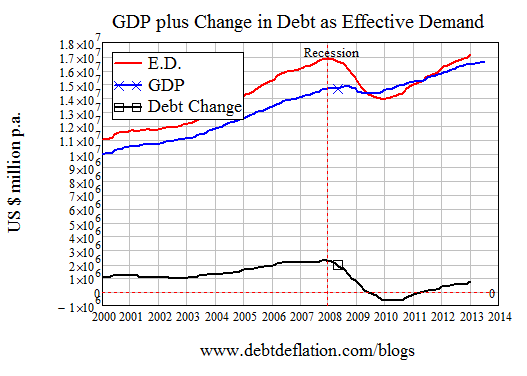

That said, I use this still-contested argument to pinpoint when the crisis began and why, because of a dramatic fall in the growth of private debt from $2 trillion-plus per annum to minus $0.5 trillion (excluding finance sector debt, for reasons I explain here), and to identify when an apparent but tepid recovery began – in mid-2010, as the change in demand started to rise again (see Figure 2).

Figure 4: Collapse of debt-financed demand in 2008, recovery from 2010 in the USA

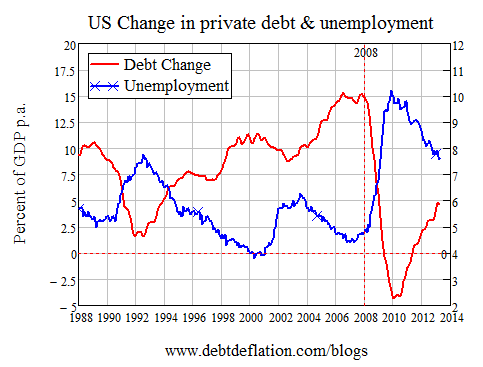

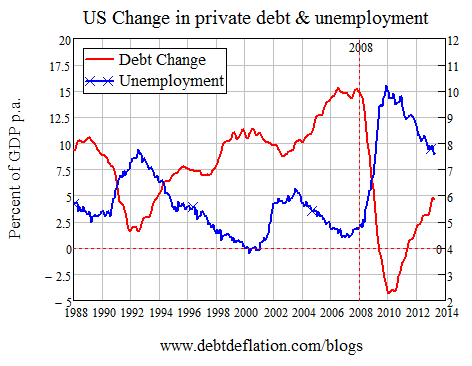

The correlation of the change in private debt with vital macroeconomic indicators such as the unemployment rate long proceed the period of the ‘zero lower bound’, which as noted is the New Keynesian explanation for why private debt can have a macroeconomic impact. The correlation coefficient since 1998 is -0.905 (and since 2000 it is -0.95 – the correlation rises as the ratio of debt to GDP increases).

From my reading of New Keynesian literature, it should be not quite zero, but a lot lower than that. The one prominent New Keynesian model that allows some impact for credit is Ben Bernanke’s ‘Financial Accelerator’ argument, which relies on asymmetric information and a price and credit rationing transmission mechanism rather than a direct volume effect as I use here.

Figure 5: Change in private debt and unemployment (Correlation -0.9)

This still-heretical argument (even in endogenous money circles) extends to the asset markets, since debt finances not just much of investment and some consumption but also speculation on housing and shares, and implies a causal (but somewhat diffused, because it’s not the only causal factor, and it can affect the volume and turnover of assets as well as their prices) relationship between the acceleration of debt and the change in asset prices. The correlation of change in real house prices and acceleration of mortgage debt since 1988 is 0.79.

Neither of these correlations would happen – or be anywhere near as high – if debt were simply ‘patient lending to impatient’, since one party’s increase capacity to spend (and speculate) would be offset by the other party’s diminished capacity.

Figure 6: Acceleration of mortgage debt and change in the US real house price index

So I’m afraid it’s not championship point to Krugman, either from the Talmud, logic, or empirical data – far from it. If economics were a fair contest like a tennis match, the trophy would long ago have been lifted by the endogenous money camp. But instead the view that ‘banks don’t matter’ dominates teaching, research and policy in economics. Tennis has more in common with world championship wrestling than it has with Flushing Meadows – or it has had in the past. Speaking presumptuously on behalf of the endogenous money camp, we’d be pleased if Krugman continued the trend of considering the arguments behind endogenous money thinking, and in the process helped make economics less like a mix of a rigged sport and a set of rival religions, and more like an intellectual discipline.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.