Time the East Coast laggards got to work

Australia’s economic growth in 2012-13 continued to be driven by the resource rich states, and highlights the task required to rebalance the domestic economy as the mining investment boom slows.

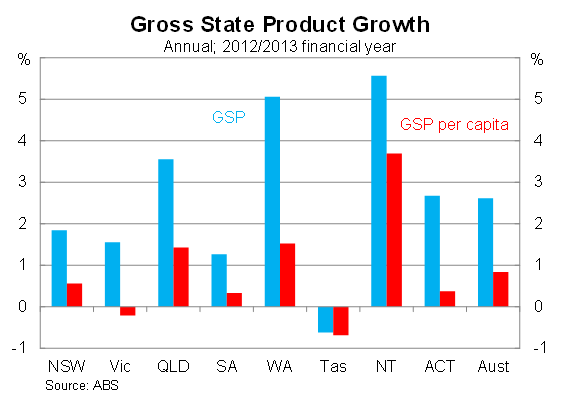

Gross State Product rose by 5.1 per cent in Western Australia and 3.6 per cent in Queensland during the 2012-13 financial year. Output in New South Wales and Victoria rose at a far more modest pace. The Tasmanian economy contracted during the 2012-13 financial year.

In Victoria, the entire rise in GSP was driven by population growth, with GSP per capita declining by 0.2 per cent. Despite strong population growth in recent years, the Victorian economy has failed to utilise it effectively with GSP per capita basically flat since 2008. Effectively the standard of living in Victoria has been unchanged since the global financial crisis began – an envious position perhaps if you were in Europe or Tasmania but incredibly weak nonetheless.

By comparison, output per capita in Western Australia has increased by 10 per cent since 2008 on the back of strong resource investment. You wouldn’t realise it looking at the graph but the standard of living in Queensland declined between the 2008-09 and 2011-12 financial years before picking up this year.

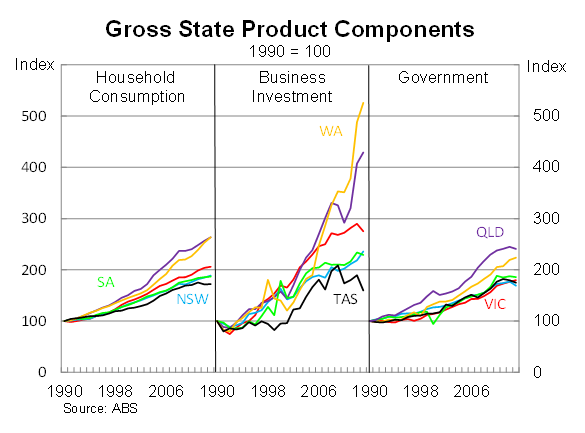

At the component level we can really see how strong investment has been in WA and Queensland and the extent to which other sectors of the economy have benefited. By comparison, the other states have generally performed at a similar level with regards to household consumption and government expenditure. Tasmania tends to be a bit more volatile, particularly with regard to investment. This largely reflects that Tasmania is a smaller state and investment can be quite lumpy, so big investment items can more easily drive trends.

The data by itself does not tell us anything we don’t already know. We all know that WA has been growing strongly; we might’ve heard about the boom in the Northern Territory, and we have been aware that the non-resource states have struggled a bit.

But it does highlight the task required to rebalance the economy as we progress from a mining investment boom to whatever comes next. Depending on whom you ask you’ll hear that the Australian economy will be relying on everything from housing, to exports, to manufacturing, to a retail revival to lead growth back towards trend (Australia's 2023 growth boom has begun, November 18). I see exports leading the charge but with only a limited contribution from the non-mining states.

The fact is that growth will have to pick up significantly in NSW and Victoria to offset the eventual decline in mining investment. Luckily it appears that we have a bit of a reprieve, after the better than expected investment intentions that suggest that the mining investment cliff will be less severe in 2014 than many expected (A capital surprise gives the RBA room to move, November 28).

The declining Australian dollar will also provide some relief for the non-resource states, with the dollar down 4 per cent against the US dollar and 2.6 per cent on a trade-weighted basis since Reserve Bank governor Glenn Stevens began jawboning the dollar a month ago. But the dollar still remains ‘uncomfortably high’ – to borrow the RBA’s vernacular – and for growth in Victoria and NSW to pick up the dollar will have to decline by at least another 5 per cent, perhaps more.

As a bit of a thought experiment we should look at what needs to happen if growth in the resource-rich states begins to slow to more normal levels. If growth in WA slows to 3 per cent and Queensland to 2 per cent over the next few years (from 5 per cent and 3.6 per cent respectively in 2012-13), Australian GDP growth will slow to 2 per cent; assuming growth in the other states does not change.

Based on that number, it is not insurmountable for the economy to reach the Reserve Bank’s expected level of growth of around 2.5 per cent to 2.6 per cent next year. But the task to return back to trend growth of around 3 per cent is more daunting and it is not readily clear how that will occur. Resource exports will certainly help to some extent but there is only so much that can be done while NSW – and particularly Victoria – weigh the national economy down.