Time for panic stations on wind power?

Wind power and other large-scale renewables confront a serious challenge – time is running out on the Renewable Energy Target.

If it looks highly likely supply of renewable energy will fall short of future years’ targets forcing retailers to pay a penalty, governments will be sorely tempted to reduce the target.

But it’s not time for panic stations, at least not just yet.

According to Miles George, CEO of wind farm developer Infigen Energy, once you’ve managed to sign-up a long-term power purchase agreement, it still takes around two years before that wind farm is pumping full output into the grid.

So how does that flow through to supply meeting the target right now?

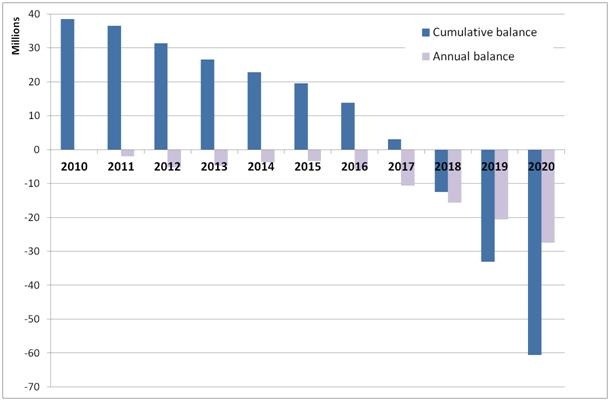

The chart below illustrates the net balance of renewable energy certificates or LGCs in the Renewable Energy Target market, according to Green Energy Markets. This is based on projects already in place and under construction. The dark blue bar indicates that right now the market is swimming in a sea of accumulated surplus LGCs left over from a surge in solar receiving bonus certificates. However the light purple bar shows that, since 2011, the amount of LGCs produced in a given year has been less than that year’s demand. So our surplus is being eaten away. By 2017 supply is looking extremely thin and it becomes a major shortfall in 2018.

Net balance of Large-scale renewable energy certificates (millions of LGCs)

Source: Green Energy Markets

Given the two year lag to get a wind farm operational and the large number of wind farm projects with planning approval already in place, we still have some time up our sleeve, given a shortfall isn’t due until 2018. It was thought we’d run out earlier, but hydro generators have been furiously pumping out power in order to take advantage of the fixed carbon price before it disappears, which also helps them generate LGCs.

So it’s not time for panic stations just yet.

However the surplus in 2017 is very thin. Some companies that have a moderate surplus of LGCs for that year may be reluctant to trade them to others who don’t have enough. So to be confident that liable companies can readily avoid the shortfall penalty, you’d ideally want a bigger surplus of LGCs for 2017.

Given the two year lead-time for wind projects, the second half of 2014 and first half of 2015 is the crunch period where we really need to see projects committed to construction.

There’s a view amongst some market participants that the Coalition’s intention to review the RET in 2014 will mean there is too much uncertainty to commit to investments until it’s complete. This might not happen until early 2015, cutting time very short.

Yet whatever conclusion the Coalition might reach, it matters little if it can’t get its changes through the Senate. Current polling suggests Labor and Greens senators combined will hold a majority.

Why would they roll over to a Coalition push to water down the level of the RET?

This isn’t something the Coalition has campaigned on, so they have no mandate. Nor would it be an electorally popular proposal.

If the election result delivers control of the Senate to Labor and the Greens, the level of legislative uncertainty surrounding the RET is very low. This allows a sufficient time window for projects to be built in time to avoid a renewable energy shortfall.