Time for a Copernican revolution in economics

The global financial crisis took the vast majority of the economics profession by surprise. Though there were individual mainstream economists -- such as Robert Shiller and Joseph Stiglitz -- who claim to have warned of the crisis, no mainstream economic model foresaw anything like what eventuated in 2007. In fact, mainstream model predictions led to politicians being advised to expect tranquil economic conditions ahead. The OECD’s advice in its June 2007 Economic Outlook was typical:

"Indeed, the current economic situation is in many ways better than what we have experienced in years. Against that background, we have stuck to the rebalancing scenario. Our central forecast remains indeed quite benign: a soft landing in the United States, a strong and sustained recovery in Europe, a solid trajectory in Japan and buoyant activity in China and India. In line with recent trends, sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment." (Emphasis added)

After being so disastrously wrong, one might expect that this modeling approach would now be subject to serious revision. But while New Keynesian DSGE model-builders are starting to add “financial frictions” to their repertoire of factors that prevent the economy from almost instantly attaining a competitive equilibrium (as in New Classical models), the core paradigm -- of an economy which, left to its own devices, will ultimately reach equilibrium, and in which money and financial institutions generally play non-essential roles -- has not been challenged.

Instead, the challenge that is occurring in academic institutions is the survival of the handful of proponents of an alternative paradigm -- one that sees capitalism as fundamentally both unstable and monetary. Before the crisis, economists who followed that broad tradition -- including myself -- were largely ignored by the mainstream. After the crisis, the mainstream could have accepted that this perspective has merit, and made more room for it in the academic curriculum. But instead, what little space was devoted to alternative approaches to economics has been reduced.

Recent events at the University of Manchester in the UK are indicative here. Having asked a contract lecturer Dr Sakir Devrim Yilmaz to “to prepare a module covering alternative approaches to the economic crisis, after a student group -- the Post-Crash Economics Society -- called for the curriculum to better reflect non-mainstream economic theory” (see Bubble bursts on economist’s ‘alternative’ course, May 15, 2014), the university decided not to run the course.

Dr Yilmaz then offered to run the course voluntarily after hours, and about 50 students participated. At the end of the year, his contract was not renewed and the “Bubbles, Panics and Crashes” module was discontinued, despite a petition signed by 246 Manchester University students calling for it to be offered.

I don’t know the intimate whys and wherefores of what happened at Manchester, but I was drawn into a discussion about what should have happened by a Twitter debate with Tony Yates, who had previously defended Manchester’s decision not to run the course. He instead supported Wendy Carlin’s approach, which he described as:

"to try to get the New Keynesian model used by central banks to be the focus of the undergraduate macro canon, rather than the older IS/LM model, harder to relate to contemporary debates (without the obduracy and genius of Paul Krugman). This is decidedly mainstream (and welcome)."

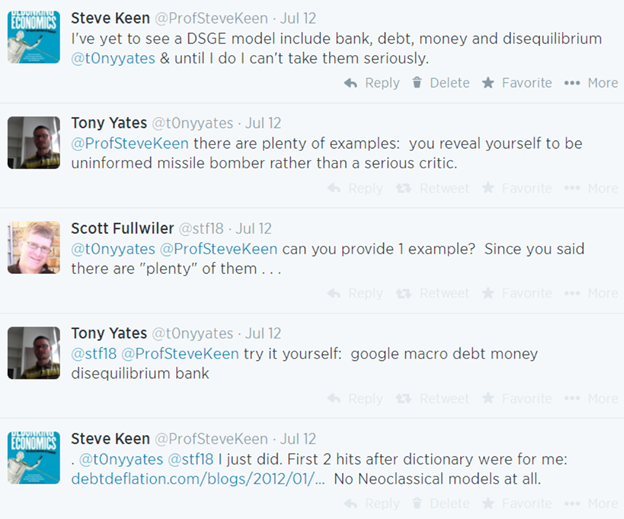

But these were the very models that had failed to anticipate the crisis in the first place: why should they be taught after it, I challenged -- especially since even Yates had conceded that “the state of the art in macro can't generate financial crises yet”. In particular, I commented that until I saw a Neoclassical model that included banks, debt, money and disequilbrium, I couldn’t take them seriously. Yates replied that “there are plenty of examples”, and invited me to Google “macro debt money disequilibrium bank” to locate them (see Figure 1). I was skeptical -- I knew of only one such model, by Eggertsson and Krugman -- so I took his challenge.

When I did, rather than finding “plenty” of Neoclassical models, the first two non-dictionary entries returned were to my work, and the only models that were returned were non-Neoclassical models by complex-systems economists like Carl Chiarella and Peter Flashel.

Figure 1: The Twitter debate with Tony Yates

This failure for the mainstream to treat the financial crisis as an existential crisis for its approach to economics is not surprising. It’s what almost always happens when reality throws up a challenge to a dominant intellectual paradigm -- especially when the alternative involves a diametrically opposed view of the world.

This, after all, was the substance of Copernicus’s challenge to the Ptolemaic orthodoxy in the astronomy of his day. Their vision had the Earth at the centre of the universe, with the Moon, planets and Sun orbiting around it, and the stars fixed in the firmament a short distance from Earth. Copernicus instead proposed a universe with the Sun at its centre, with the Earth and all other planets orbiting it, while the Moon orbited the Earth, and the mysterious Stars were unthinkably distant.

There was no “Minsky Moment” for astronomy, but the anomalies that were most vexing for the Ptolemaic vision of the Universe -- apart from the idiosyncrasies of the model itself, and the drift in the accuracy of Ptolemaic tables -- were the comets. According to the Aristotelean vision on which Ptolemy’s system was based, comets were atmospheric phenomena -- because the Heavens were perfect, the appearance of a comet had to be an Earthly, and unpredictable, event. According to Copernicus’ model, they were astronomical objects -- but even Galileo clung to the Aristotelean vision. The ultimate proof that the Copernican vision was correct and the Ptolemaic vision false came with the ability of mathematicians, armed with Newton’s mathematics as well as Copernicus’s model, to accurately predict the date of the return of Halley’s Comet.

Why such a digression on Renaissance astronomy? Because I believe there are enormous parallels between the Ptolemaic-Copernican transformation of astronomy and the current state of economics.

The alternative vision of capitalism -- as fundamentally unstable and monetary -- is as discordant with the Neoclassical vision of equilibrium in a barter economy as Copernicus’s Heliocentric vision was to Ptolemy’s Earth-centric model. It simply isn’t possible for one vision to incorporate the other -- which is why Neoclassical attempts to assimilate Hyman Minsky’s “Financial Instability Hypothesis” have been so lame. Minsky himself observed that:

"The abstract model of the neoclassical synthesis cannot generate instability. When the neoclassical synthesis is constructed, capital assets, financing arrangements that center around banks and money creation, constraints imposed by liabilities, and the problems associated with knowledge about uncertain futures are all assumed away. For economists and policy-makers to do better we have to abandon the neoclassical synthesis."

That statement is even more true of modern DSGE models than it was of the input-output “computable general equilibrium” models that were the state of the art when Minsky wrote those words. The actual nature of Neoclassical models has changed profoundly, but the core concepts -- of equilibrium ‘dynamics’ and ‘microfoundations’ (despite the modern concept of emergent properties from complex systems that make it impossible to derive an aggregate phenomenon from its micro constituents), the absence of any fundamental role for banks, debt and money, and the existence of agents with a prophetic capacity to anticipate the future -- have continued on.

Claims that these aspects of modern economics are precisely the elements that need to be replaced is met by incomprehension by modern-day Neoclassicals. To them, economics simply cannot be done without these concepts -- just as Ptolemaic astronomers couldn’t imagine modelling the Earth and the Heavens without the Earth as the central frame of reference. Progress to Neoclassicals involves adding more “frictions” to the core equilibrium, non-monetary paradigm -- just as progress for Ptolemaic astronomers involved adding more epicycles.

Ironically, this is part of the appeal of the Neoclassical approach to its adherents. Just like the Ptolemaic model of the Universe, it is so complicated -- and being so complicated, it’s little wonder its adherent feel that ‘it must be correct’. Certainly when one looks at Ptolemaic models, though it is possible to describe them as ‘mad, but clever’, one simply has to applaud how hard these ancient astronomers worked to fit their ‘mad, but clever’ model to the observed Universe.

I feel similarly when I read a Neoclassical DSGE model: one simply has to marvel at how this fundamentally inaccurate vision of capitalism is nonetheless fitted with passable accuracy to the real world by the addition of ‘frictions’, ‘shocks’, and bizarre assumptions about the capacity of mortals to predict the future (otherwise known as ‘rational expectations’, but which I prefer to describe as ‘prophetic expectations’). ‘Passable accuracy’, with of course, ‘notably rare exceptions’, such as the crisis of 2007 and the Great Depression.

Here Neoclassical economics shares another commonality with Ptolemaic astronomy. Just as it couldn’t explain comets, nor will Neoclassical theory be able to explain if another major financial crisis occurs in the relatively near future -- say the next three to seven years (bear in mind that the gap between the crisis of 2007/8 and the previous serious recession was about 18 years). On the other hand, the alternative private-debt-focused perspective that I share with Michael Hudson, Dirk Bezemer, Richard Werner, Richard Koo, Richard Vague, and many others, will have an explanation.

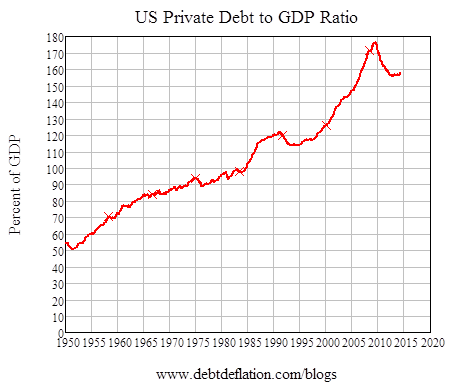

Figure 2: This recovery is startng from an unprecedented level of private debt

This recovery is starting from an unprecedented level of private debt: whereas the last post-recession recovery in America began from a debt level of 115 per cent of GDP, this one is commencing from 155 per cent (see Figure 2). If it only reaches the level of the previous peak (177 per cent) in the next five years, it will have fulfilled Richard Vague’s empirical rule of thumb for the cause of an economic crisis (a private debt to GDP ratio above 150 per cent, and an 18 per cent increase in that ratio over 5 or less years). That probable future occurrence will be the economic equivalent of the reappearance of Halley’s Comet.

Of course, by the time Halley’s Comet reappeared, Ptolemaic astronomy was largely dead: despite the Catholic Church’s persecution of Galileo, younger astronomers took to the new Copernican-Keplerian model because it was simpler and more elegant.

A similar observation applies to the monetary, far-from-equilibrium approach that I and others are developing—though this elegance and modelling simplicity invokes the complex systems concepts of emergent properties and complex behaviour from (relatively) simple systems. I expect and hope that young economists will gravitate towards this approach after the existential challenge that the financial crisis posed to Neoclassical equilibrium thinking.

However I have zero expectation of current adherents to the Neoclassical vision conceding their hold on the profession -- at least not until that unexpected Comet of another financial crisis arrives in the next three to seven years.