Three wealth trends to watch

Summary: Modern families are about as common now as traditional families, and the financial planning industry is scrambling to keep up. Wealthy families expect to take holidays this summer, but costs are likely to be low as they move between their second or third homes throughout the world. More and more financial advisors are using robo-advisor platforms to perform menial tasks like rebalancing portfolios, freeing them up to handle more complicated issues. |

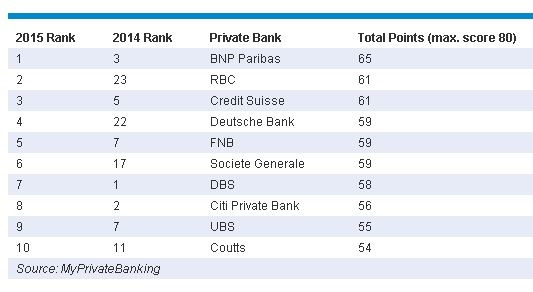

Key take-out: Not all private bankers know how robo-advisor platforms can be used to make them more efficient. A ranking of 30 wealth management firms' technology platforms featured only one US-based bank in the top 10. |

Key beneficiaries: General investors. Category: Economics and investment strategy. |

Penta's roundup of surveys on wealthy families provides insight on estate planning challenges facing “blended families,” vacation spending patterns of the super-rich and a ranking of the best private bank technology platforms.

Estate planning for blended families

A UBS survey of 1,787 investors with more than $US1 million finds that “modern families” are about as common now as “traditional families.” Modern families are defined as households with children from prior marriages, same-sex couples, and families living under the same roof with either aging parents or adult children. The exact breakdown was 35 per cent traditional, 34 per cent blended, and the remainder were households with no children.

UBS finds that modern households built out of disparate clans are often at odds. Two-thirds of blended-family parents are “frustrated” that they cannot raise a spouse's children the way they raised their own. The same percentage says that their spouse's children “don't accept them.”

Clearly, that tension is also setting up some inevitably awkward conversations around wealth transfer. UBS finds that modern families are more than twice as likely to report conflicts among potential heirs, 31 per cent versus 12 per cent for traditional families. The financial planning industry is scrambling to keep up. UBS notes that 71 per cent of the families surveyed thought that their private banker's guidance and solutions to their anxiety-ridden problems were “generally geared to traditional families.” More often, these families need a patient, psychologically-attuned arbiter to stave off the squabbling, not a geeky-number-crunching private banker.

Holidays of the super-rich

Hardworking wealthy families are taking the time to kick back and relax this summer. According to BMO Private Bank, millionaires expect to spend $US13,249 on vacations this year. The 493 folks surveyed, with at least $US1 million in assets, will spend a rather modest $US2,902 per trip, including airfare, accommodations and food, with two-thirds expected to take three or more trips.

How come they are taking low-cost package tours? They aren't. Wealthy globetrotters are able to keep actual travel costs low because more likely than not they are bouncing between their second or third homes spread throughout the world. Researcher Wealth-X estimates that there are 211,275 families in the world with at least $US30 million or more in assets. These folks, on average, own 2.7 properties worth, in aggregate, $US2.9 trillion.

BMO says about 90 per cent of the US clients surveyed travel within the United States, and half spend time in Europe. Hotspots include big cities like London, New York, and Paris along with second home destinations such as Monaco, Aspen or the Hamptons.

Robo-advice for the super wealthy

Technology is changing the nature of private banking. According to a survey from Jefferson National, 19 per cent of financial advisors use a robo advisor-like platform to automatically perform menial tasks like rebalancing portfolios. That then frees up advisors to handle more complicated estate planning issues, such as stockpiling for a gaggle of grandchildren to go to college.

That productivity innovation explains why more than half of advisors who were currently using robo-advisor platforms say they use it most often for clients with over $US1 million in investable assets; one-quarter of advisors take advantage of this technology for clients with more than $US10 million.

But not all private bankers know how the robo-advisor platforms can be used to make them more efficient. MyPrivateBanking ranks 30 wealth management firms from around the world, scoring their technology platforms on eight different issues like an app's core functions or ease of navigation. See our table below – the higher the score, the better the app. But the headline on the report says it all: “Wealth Managers' Mobile Apps Lack Focus and Innovation.” Only 63 per cent of private banks have a mobile application catering to high-net worth families, and many lacked basic features like portfolio analysis and acceptable security. The only US-based bank to crack the top 10 was Citi Private Bank.

This piece has been reproduced with permission from Barron's.