Three things you must know about ETFs

The Australian ETF market has recorded a compound annual growth rate of 35 per cent

Exchange-traded funds are booming. ETFs are the hottest part of the investment market by any measure. Yet many investors don’t get the basics right, and that is costing them dearly over time in terms of lower compound returns.

Alex Zaika is a director of BlackRock, the giant investment house behind the iShares series of ETFs listed on the ASX. BlackRock manages around $8 billion in funds on the Australian Securities Exchange through iShares along with managing more than $US1.5 trillion in assets globally.

Zaika is at the heart of the ETF industry and says there are three things investors should know.

“Are you tracking equities or bonds?” he asks. “That will have a material impact on your portfolio. Within equities, are you tracking Aussie shares or global shares? That will have a material impact. Then, within global shares, are they currency-hedged or currency-unhedged?

“Are you looking at a particular region, a particular size — small caps, mid-caps or large-caps. All of these separate issues have a far more material impact on a portfolio than the actual cost or fees of the ETF.”

Zaika points out that’s not just the headline management expense ratio, but the underlying costs such as the brokerage, the buy-sell spread (the difference between the prices that you can buy and sell ETF units at) and the ongoing costs. The ongoing cost is made up of the headline expense fee, but it’s also how well the manager can track the benchmark. If a benchmark delivered a 10 per cent return, yet an ETF only delivered 9 per cent, that 1 per cent difference is an indirect cost to the investor.

Zaika says change is accelerating across the sector.

“What we are seeing is a shift outside of those traditional funds, which I call the fat belly of the asset management industry, into one of two areas. One popular area is high conviction, unconstrained type funds.

“These are long-shorts, benchmark-unaware, very concentrated portfolios. So high fees, but the promise of very large returns potentially. But the biggest move has been into exchange-traded funds and passive, and generally the way investors use these ETFs is that they will build a core portfolio out of ETFs to reduce the overall cost. That frees up their fee budget to go and spend money on very high conviction outcome-based fund managers.”

A core ETF is essentially one, or several, that sit at the very heart of a portfolio, providing broad exposure to a whole market or multiple markets.

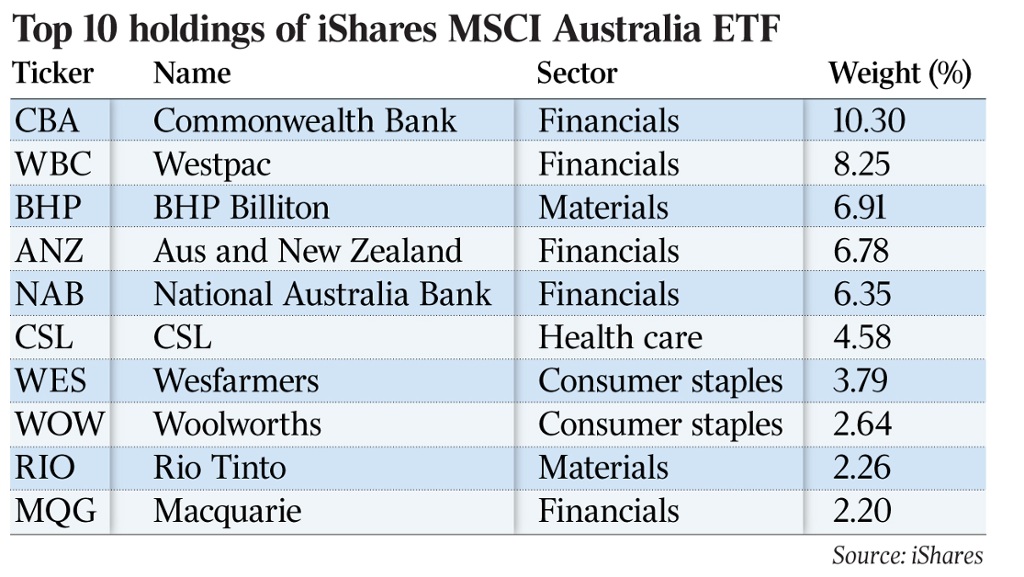

For Australian investors ETFs can offer a way to tackle the issue of concentration risk, which is relatively severe in our local market thanks to major banks. To put the bank-heavy nature of the ASX in perspective, it is estimated that so-called ‘‘financials’’ in Australia make up about 37 per cent of the ASX 200. But if you map that same figure on the global equity market it is about 17 per cent.

In Australia, a core ETF could be considered one that tracks the ASX 200 index, which accounts for more than 80 per cent of the market’s total capitalisation. ETFs in this category might include Betashares Aus 200, IShares ASX/S & P 200, or Vanguard’s MSCI Au Large Companies fund.

In a similar vein for global shares any ETF from any manager that covers the MSCI World Investable Market Index is a core holding. With holdings in more than 6000 stocks, it covers 99 per cent of the world’s market cap and costs just 16 basis points. It is the nearest thing to a simple product which literally has stockmarkets of the world ‘inside”.

Whether you favour ETFs or not it certainly makes sense to understand the scale of success in the industry in recent times: this year $380bn has entered the ETF sector, which exceeds the record set back in 2015.

Moreover, inside Australia the domestic ETF market is now worth close to $30bn, and the enthusiasm for these products expands continually, along with the menu of choices for the retail investor.

New ETF products are being added to the ASX boards about every month. Since July we have seen new listings including the VanEck Vectors Australian Floating Rate ETF and the Evans and Partners Global Disruption Fund.

The Australian ETF market has recorded a compound annual growth rate of 35 per cent, and there is no sign of it stopping.

Frequently Asked Questions about this Article…

The Australian ETF market has recorded a compound annual growth rate of 35 percent, indicating a strong and ongoing expansion in this investment sector.

ETFs are booming because they offer a cost-effective way to build a diversified portfolio, and they have become the hottest part of the investment market with significant inflows and new product offerings.

When investing in ETFs, consider whether you are tracking equities or bonds, the specific region or market size, and whether the ETF is currency-hedged. These factors can have a more material impact on your portfolio than the cost or fees of the ETF.

ETFs help tackle concentration risk in the Australian market by providing exposure to a broader range of sectors beyond the heavily bank-weighted ASX, thus diversifying your investment.

A core ETF is one that forms the foundation of a portfolio, offering broad exposure to a whole market or multiple markets. It is important because it helps reduce overall investment costs and provides a stable base for building a diversified portfolio.

Examples of core ETFs for Australian investors include those tracking the ASX 200 index, such as Betashares Aus 200, iShares ASX/S&P 200, or Vanguard’s MSCI Au Large Companies fund.

The ETF sector has seen a shift from traditional funds to high conviction, unconstrained funds and passive ETFs, with investors using ETFs to build core portfolios and reduce costs.

The MSCI World Investable Market Index is significant for global ETFs as it covers 99 percent of the world's market cap with holdings in over 6000 stocks, making it a comprehensive and cost-effective option for global exposure.