Three reasons why Qantas and Virgin may not be doomed after all

It reads like a contradiction. Qantas yesterday posted a statutory loss after tax of $2.8 billion, and yet its share price closed 6.8 per cent higher on Thursday.

But if you dig below the headline figures, there’s actually substantial cause for investors to be bullish on the aviation industry. The worst is apparently over; competition in areas other than capacity is heating up, and on this basis both Virgin and Qantas will return to profit over the next couple of years.

So why is this case? Here’s a quick explanation:

1. Qantas said it would cut costs, and it is cutting costs.

Cost has always been a major sticking point in the rivalry between Qantas and Virgin. As a legacy airline, Qantas has had to slash overheads in order to compete with its nimbler, newer counterpart.

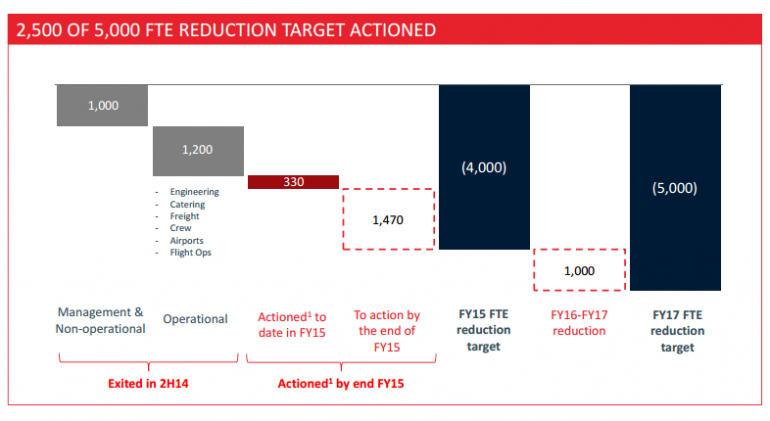

That’s really the core message behind the massive restructuring and job cuts at Qantas. And to the dismay of many, it’s not wavering from its resolve. The airline has already shed 2500 jobs -- half of the 5000 job target it set earlier this year.

Source: Qantas

Qantas’ cost cutting program extends beyond job cuts; it has also worked to cancel out another costly expense to its business, jet fuel. Now up to 97 per cent of Qantas’ fuel costs are “hedged” against -- or in laymen’s terms, able to offset -- any future increases in jet fuel prices in 2015 financial year. This puts the airline in a win-win situation with fuel prices. If they rise, they are covered for next year thanks to their hedging. But if they fall, Qantas will be able to fully participate in the savings.

2. The domestic capacity war may be coming to a close.

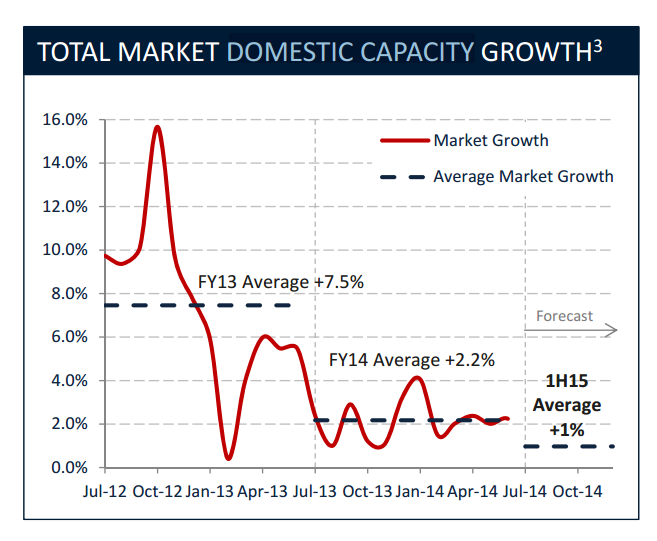

Qantas predicts that capacity growth will slow in FY15, which is good news because keeping up with Virgin’s aggressive capacity war has pushed Jetstar and Qantas Domestic into the red. Simply put: the capacity war has seen Qantas and Virgin compete for market share based on how many services they offer to consumers. You can read a more detailed primer on how it’s impacted the aviation market here.

Source: Qantas

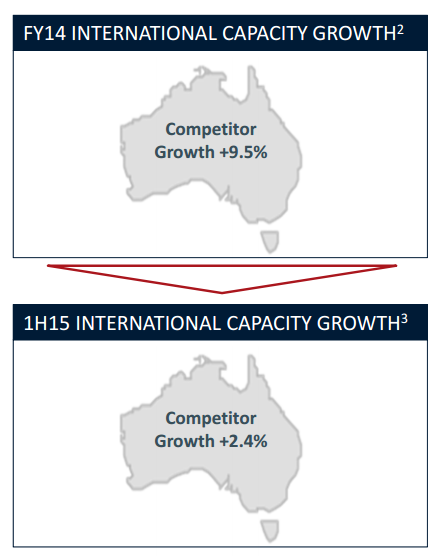

Qantas is also expecting capacity for its international division to decline, which will also lead to more cost savings.

Source: Qantas

Despite the sharp spike in the number of seats being offered by the airlines, the number of passengers usually increases at a much slower rate of about 3 per cent per annum. Significantly lower rates of capacity growth will overtime result in less empty seats and fuller planes mean more revenue and less waste for both Qantas and Virgin.

Virgin has stated that it will not be commenting on capacity from now on, suggesting that it too may be considering a slowdown on growth.

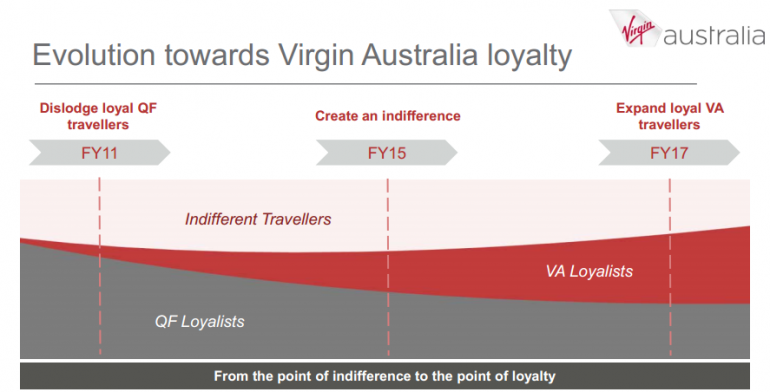

3. And in lieu of the capacity war, the next focus for the airlines appears to be loyalty.

When airlines talk about loyalty, they’re really talking about two things: their consumer rewards program, and their ability to poach high yielding business travellers from their competitors.

On the first front, the reward programs of both airlines will become increasingly valuable to their core business over the next couple of years. Today, Virgin announced that it reaped in $336 million through selling 30 per cent stake of its Velocity program to Asian equity firm Affinity.

It’s questionable whether this will force Qantas to act on selling or floating its Frequent Flyer program. Speculation on this has been floating around since January this year. But it’s worth asking given that Qantas’ program has more than six million more members than Virgin’s. Qantas is yet to rule out this idea, but it considers its Frequent Flyer program to be a key growth asset and looks more likely to hold on to it.

Meanwhile, on the business travel front, Virgin today revealed that it making headway in stealing away parts of Qantas’ loyal customer base.

Source: Virgin

We’re yet to see how Qantas may retaliate. Or how further reductions in its headcount may impact customer satisfaction. It’s interesting to note that while Qantas is set to sack another 2500 staff, Virgin is looking to hire another 4000.

It seems the capacity battle that devastated our local aviation market may be over, but the war between Qantas and Virgin is only just heating up.

Got a question? Let us know in the comments below or contact the reporter @HarrisonPolites on Twitter.