Three lessons from three sovereigns

Summary: Sovereign wealth funds are a handy benchmark for investors, but some do things differently than others.

Key take-out: Adapt to the new world, counterbalance high risk bets with a safety net, and step outside your home turf, even if you've got green grass on your side of the fence. All sage lessons from some of the world's biggest, and most mysterious, investors.

Sovereign wealth funds rank among the world's biggest investors, with more than $US7.4 trillion in assets under management.

Among them is Australia's own Future Fund, which has just reported an 8.8 per cent return from the year to December 31 and now holds $139 billion in investments around the world.

Indeed, sovereign wealth funds (SWFs) are now throwing a lot more weight around the global economy, with over 40 funds created since 2005. They're usually seeded from budgetary surpluses, but four out of five of the world's biggest SWFs trace their wealth directly to oil.

These funds invest across all asset classes with a long-term view – much like many retail investors. But the IMF thinks SWFs deal higher up the risk curve than traditional investors, often holding higher stakes in emerging markets.

Some are opaque, most operate behind a veil. They're the investors that helped rescue banks during the GFC, and they're still far less understood than other investment vehicles.

Few reveal their full portfolios, but exploring the changing natures of these billion-dollar funds is worthwhile.

Government Pension Fund Global (Norway)

The largest of the bunch, Norway's GPFG recently broke the trillion dollar-mark. It invests mainly in equities – 9000 companies (around 290 Australian) across 77 countries – and is totally transparent with its stock picking.

Oslo's Stock Exchange, by comparison, has only 220 listings – another lesson that investors can't depend on their local market alone.

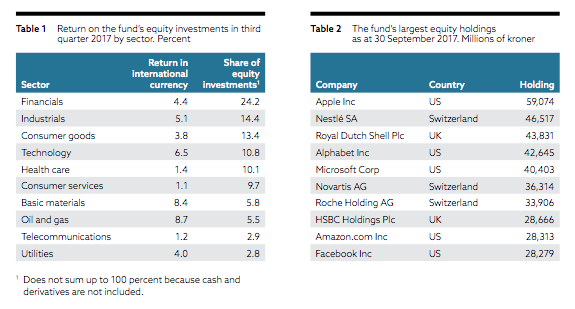

Source: NBIM GPFC Q3 2017 report

GPFG is quite the conservative investor, generating an annual net real return of just 4.06 per cent since inception in 1996. Net real returns in the past five years come in at 7.86 per cent though, and it has put on a significant 10.3 per cent in the past year.

Norway's takes a relatively green approach. Our comparative Future Fund had only 27 companies blacklisted at December 2017.

GPFG refuses to invest in tobacco, coal, nuclear weapons, and companies that have caused serious environmental damage, which includes Rio Tinto in their books (other miners make the grade). Among just a handful of others, Wal-Mart has been boycotted for severe violations of human rights.

Around 90 per cent of GPFG's investments are in developed economies, and almost two-thirds goes into equities. A lack of diversification partly explains its underperformance; infrastructure and other illiquid assets have been vetoed by the Ministry.

This SWF also operates like an endowment fund, typically placing 50-100 year bets on stocks and bonds, a passive approach which could curb returns.

Sony Kapoor, a former strategic advisor to the Norwegian Government on GPFG, said he “waged a 10-year war” to convince the SWF to invest in illiquid assets and divest from oil, gas and coal. He drew on 2014 survey data where eight out of 10 Norwegians thought it was important GPFG didn't make investments that would cause environmental harm.

Coal is officially out, and in December last year it was announced GPFG was moving to divest its vast holdings in oil and gas (around 6 per cent of the fund), even if it impacts short-term returns.

Alaska Permanent Fund Corporation (US)

Only an investor clearly comfortable with risk could do 20 per cent in a year across almost all its asset classes, and by bucking the global trend.

APFC did just that last financial year across its US equities (20.1 per cent), international equities (22.6 per cent), and private equity portfolios (21 per cent).

Every high-flying investor needs an anchor though, and for APFC, it's a heavy anchor in bonds.

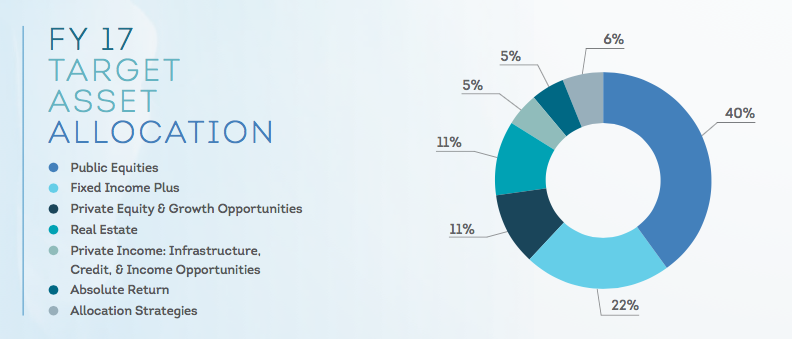

Source: Alaska Permanent Fund Corporation annual report 2017

Unlike GPFG, this SWF claims to place fixed income trades daily. Fixed income was its worst performing portfolio last financial year, dragging down overall performance to 12.57 per cent, but the APFC says bonds are its safe haven for crisis and volatility.

That portfolio still outperformed. In its annual report, the fund claims that was because of good selection and being overweight corporate bonds as spreads tightened by 47 basis points. Around one-quarter of APFC's $US8 billion corporate bond investment is outside the US.

Interestingly, APFC had more than $US147 million invested in a popular high-yield corporate bonds ETF, accessible to retail investors, at June 30 last year. As well, APFC hired State Street to invest more than half of its $US1.2 billion REITs portfolio.

It's increasingly turning to ETFs.

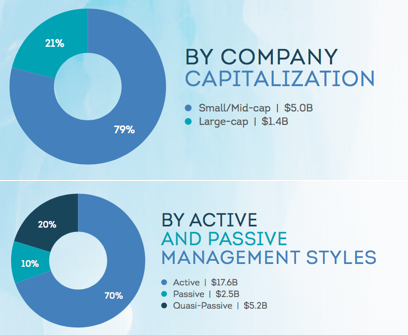

Source: Alaska Permanent Fund Corporation annual report 2017

US markets might be coming off a bumper year, but AFPC still managed to beat the market (its benchmark, the MSCI ACWI IMI) as it turned more prominently to stocks outside the US and small/mid-cap companies.

It all adds up then that APFC was the cornerstone investor in three smart beta ETFs launched by State Street in 2015 focused on Russell 1000 companies.

The biggest SWF in the US, in one of the greatest bull years ever, had only 42 per cent invested in its home region, followed by Europe ex-UK at 18 per cent:

“Over the past one year the primary contribution to returns came from emphasizing international equity markets over domestic equities and the excess return generated by the Fund's active and quasi-passive managers,” said Fawad Razzaque, APFC's director of public equity investments.

Mubadala Investment Company (Abu Dhabi)

The old world meets the new world here, potentially a lesson in rebalancing for investors with traditional portfolios.

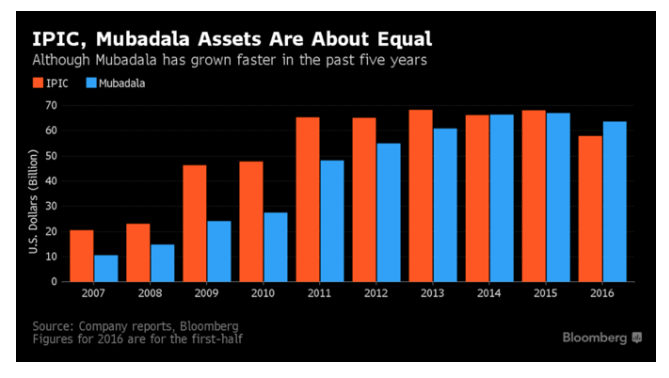

Among the top 15 biggest SWFs by total assets, this $US125 billion fund is also one of the newest, launched out of a merger last year.

Mubadala isn't turning away from oil anytime soon, but is now said to be equally focused on three other pots – renewables, aerospace and ICT; technology, manufacturing and mining; and alternatives like real estate. It even has a stake in EMI Music.

Probably smart moves considering the erosion in crude oil prices.

The original Mubadala emerged the dominant force in the deal, complete with control of the C-suite. That was the business focused on the cleaner investments, doing better in the past half-decade.

Consultancy Knight Frank points out the increasing allocations towards global real estate by all Arabian Gulf SWFs. Mubadala has a 5-10 per cent mandate for global real estate that's been in place since 2009.

Taking steps to diversify, Mubadala also committed $US15 billion to a SoftBank fund to develop majority interests in startups in the last half-year, and opened an office in Silicon Valley.

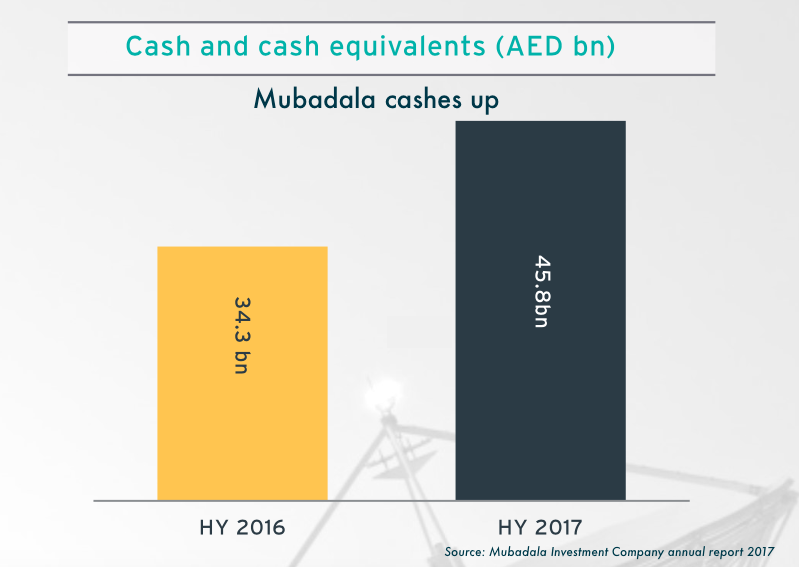

Mubadala is cashing up too, mirroring institutional portfolios the world over, giving it more cushion for future deals.

The fund won't be pulling out of dirty businesses anytime soon though. The single-largest money-maker for Mubadala in the last reporting year was a $AED7.7 billion bond raised by Nova Chemicals. That helped the fund make a profit of $AED4.2 billion overall for the year, from a loss of $AED4.7 billion the year before.