Three lessons from a power investment binge

The Australian Energy Market Operator has just released its latest assessment of future supply and demand in the National Electricity Market. For electricity generators the news won’t come as much of a surprise, but we essentially have way more power generating capacity then we need.

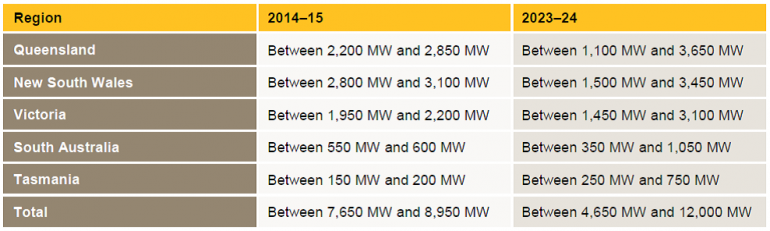

AEMO observe that even in 10 years’ time (2023-24) between 1100 and 3100 megawatts of power capacity (depending on levels of economic growth) would have to close from each of NSW, Queensland and Victoria before we’d have to worry about power supply reliability.

The table below sets out how much supply is in excess of peak demand requirements by each state for this year and what’s expected in 10 years’ time.

Figure 1: Surplus capacity by region under low, medium and high demand growth scenarios

This represents a huge oversupply for the Australian context. If we take the medium demand growth forecast, then in 2023-24 Victoria, NSW and Queensland are each anticipated to have around 2000 MW of capacity excess to reliability requirements. This represents 16 per cent of Victoria’s installed generating capacity, 15 per cent of Queensland’s and 12 per cent of NSW’s.

This state of the power generation market carries three key lessons:

1) The wisdom of government getting out of the power generation business

The seeds of our current large oversupply of generation were laid by expansionist state government electricity authorities and a misguided aluminium smelting industry development strategy based on subsidised power contracts. Victoria, NSW and Queensland all have far more coal-fired baseload power stations than they need, even though much of this was built a decade or more ago. We don’t need this capacity now and we certainly didn’t need it back when it was built.

Thanks to Jeff Kennett, Victorian power consumers and taxpayers don’t have to wear the cost of dumb investments in coal power stations that aren’t needed. The same unfortunately can’t be said for Queensland and NSW.

Still, even though the private sector has now bought into NSW coal generators at a huge discount to their replacement cost, it won’t stop them, and the private owners of Victorian and South Australian generators, from trying to shovel the financial consequences of the depressed demand and the need to contain carbon emissions onto the rest of society.

As detailed in the article, The $30 billion government bail-out for power companies, almost all the entire generating capacity owned by the private sector in Australia was purchased after 2007 (when existing energy efficiency and renewable energy policies were already enunciated). If it turns out a lot of this capacity isn’t needed, then buyers should have anticipated this (and many no doubt did through paying a discounted price!).

2) Time to abandon the obsession for ‘baseload’ power

For almost a decade the Australian energy policy debate has been caught in a simplistic obsession about the need for baseload power generation (baseload means power stations that are economically optimal when operated close to 24 hours a day, seven days a week close to their maximum capacity, such as coal and nuclear). Yet it has been clear for some time that we simply haven’t needed new baseload capacity, and in fact a better mix would involve less coal and a greater amount of more flexible gas plant. This was apparent in 2005 as much as it is apparent now.

Looking back now you have to laugh at the NSW Government’s decision to commission the Owen Inquiry in 2007 to investigate how best to handle an apparent urgent need to invest in new baseload power supply. And in light of what we now know, it puts shivers down the spine to hear of calls by politicians for the construction of a new baseload power station in Northern Queensland to support “industry development”.

What we need looking forward is in fact a more flexible power system, not one built around an assumption Australia’s prosperity lies in smelting metals.

3) There is no threat of the 'lights going out' as a result of the RET

This report makes a complete mockery of chicken-little claims that power supply reliability is at imminent threat due to the Renewable Energy Target. In particular, it makes the Victorian Government’s Department of State Development submission to the RET Review looks particularly alarmist when it claims that there was a need for the RET to support new gas-fired generation when Victoria has 2000 MW more generating capacity than it needs to meet peak demand requirements.

Anyone that thinks our power supply is at risk needs to take deep breath and read AEMO’s submission to the government’s RET Review panel.