There's only one cure for the eurozone's terminal disease

Last week I wrote that the euro crisis was not over -- far from it (The calm before the eurozone storm, 14 August 2014). However, having just read the latest article by Wolfgang Münchau, a fellow eurozone commentator and Financial Times columnist, I have to agree with his suggestion that we should no longer call it the euro 'crisis'.

Crisis, Münchau argues, suggests that there was at least the possibility of a turnaround. But the eurozone is different. There, we are no longer talking about something that could change for the better, but a state of affairs that resembles a chronic disease. “The eurozone as such is sick,” Münchau writes -- and he is right.

There are signs of sickness all over Europe, and the second quarter growth figures for large European economies released last week are just the latest reminder of how bad the continent’s economy is. For a change, France’s zero growth was not the worst offender; that mantle was shared by Italy and Germany, which saw their economies shrink by 0.2 per cent.

Of course, one could point out some good reasons why at least the German figures were better than they looked. The German winter had been mild, so some construction activity, which would have boosted second quarter figures, actually happened in the first quarter. Without these weather effects, growth might have been slightly positive in the second quarter. But would that have changed the bigger picture? Is anyone really expecting a rebound in the third quarter, when the full impact of the trade war with Russia will show up in economic statistics for the first time?

The truth is that the eurozone has become a disaster zone, unable to generate the kind of growth rates required to keep debt levels manageable. As Paul de Grauwe, an economist at the London School of Economics, recently explained in a research note, despite all efforts to reform their economies and cut government spending, even those eurozone economies often seen as the most committed reformers are unable to stop their public debt ratios from spiralling out of control.

The reason behind this sober assessment is simple mathematics. To reduce government debt levels as a percentage of GDP, the primary budget surplus needs to be bigger than the difference between the real interest rate on government debt and the real growth rate. Keeping the two sides of the equation the same would stabilise the debt-to-GDP ratio. This is the well-known formula of debt sustainability.

De Grauwe then assessed the Spanish data using this method. It wasn't a bad choice, since Spain implemented quite a few economic reforms. It cannot be accused of doing nothing -- an accusation one might well level against other economies such as France and Italy. However, even Spain’s efforts to pull itself out of its trouble were insufficient to escape its debt dynamics.

To quote de Grauwe: “In 2014 Spain needs to achieve a primary surplus of 1.8 per cent to stabilise its debt-to-GDP ratio, while its primary balance shows a deficit of 2.8 per cent -- a gap of 4.6 per cent. Thus if Spain wishes to stabilise its debt-to-GDP ratio in 2014, it would have to institute an additional austerity effort of 4.6 per cent of GDP -- a heroic effort.”

The problem for Spain and for other struggling eurozone economies is that even with falling yields on their government bonds, their economic growth rates are too low to allow them to reduce their debt ratios. The result is a steadily worsening debt profile of euro periphery countries.

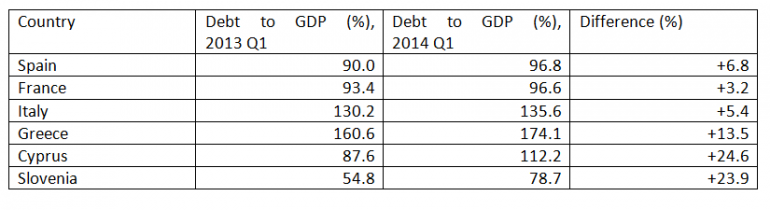

According to the latest Eurostat data, the debt situation has deteriorated markedly in those countries that are most in trouble:

It is easy to see that for these countries, there is no plausible way to get out of their debt dynamics. Shrinking or stagnating economies combined with deflationary tendencies make it virtually impossible for any of these nations to turn their public finances around.

There is a plausible resolution to this dilemma but it is one that is politically unfeasible. The logical steps would be for these countries to either leave the eurozone and take control of their own affairs, or to declare a default on some or all of their public debt -- or indeed do both. Unfortunately, none of these options are allowed to happen.

What we are seeing instead is an attempt by the European institutions to keep the eurozone together and European governments afloat by all sorts of financial trickery and political alchemy. This may even seem to work for a while, lulling markets and the public into a false sense of safety. But the only thing achieved by all these measures was time being bought. Sadly, the chronically ill patient that is the eurozone has not only failed to recover in the process, but its condition has actually deteriorated.

In this sense, Münchau’s rejection of the word 'crisis' for what are witnessing in the eurozone is spot on. There is no acute crisis but a more serious condition of economic decay. What Europe would really need is a proper crisis, which might at least trigger a resolution of a situation that is simply unsustainable.

In the absence of such a crisis, the eurozone will remain what it is today: an economic area characterised by low growth, high unemployment, and increasing debt levels. And for as long as the euro is not politically allowed to collapse, it will remain this way.

Euro periphery countries should have the courage to rid themselves off the shackles of an ill-designed currency union that they should have never joined in the first place. What do they have to lose?

Dr Oliver Marc Hartwich is the executive director of the New Zealand Initiative.