There's more iron ore carnage to come

By the end of the year, the iron ore price will likely sit in the low-to-mid $US70s. And by the end of the shakeout, it looks like only BHP Billiton, Rio Tinto and possibly Fortescue (and maybe a couple of minor producers) will be able to operate in Australia.

The carnage across markets yesterday may have been eye-opening for some people, but it was an inevitable result when Chinese consolidation met unwise and excessive investment.

The iron ore spot price tumbled below $US80 a tonne overnight to be 40 per cent lower since the beginning of the year and at its lowest level since September 2009.

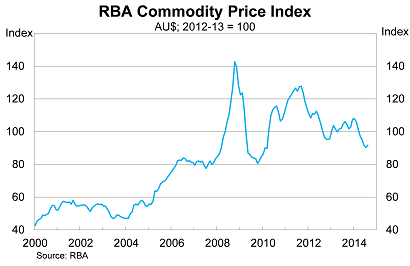

The RBA’s commodity price index, which has already declined by 15 per cent since the beginning of the year, should fall by another 4 to 5 per cent in September. The terms of trade and the Australian dollar won’t be far behind.

Despite falling prices, BHP and Rio plan to ramp up production further, which will almost certainly drive the iron ore price lower. It’s a battle for market share and a thinly veiled attempt to kill off their competition. They’ll be successful, too.

The situation is not lost on the RBA, which in August offered a damning assessment of conditions within the resource sector. “At current prices, there is a sizable amount of coal and iron ore production that is unprofitable”. Furthermore, it said, “the outlook for prices will depend on what proportion of these mines is shut down” (Prepare for more Australian miners to crumble, August 11).

But we shouldn’t overstate how much control the Australian majors have. They might dictate the eventual composition of the Australian market, but the Chinese steel mills enjoy the real market power.

Unfortunately for Australian miners, the Chinese property market is facing serious headwinds. It is too soon to declare a housing bust since modest downturns are not uncommon within China, but the writing is on the wall.

Floor space per capita in China has surpassed 30 square metres, rocketing past the level in Japan in 1988 prior to its market collapse. Housing construction has been rapid, largely due to urbanisation, but annual population growth has slowed to just 0.5 per cent and China’s population should peak in the next 10 to 15 years.

First-home buyers in Sydney baulk at the house price-to-income ratios they face, yet some cities in China have housing multiples of between 15 and 40 times. It’s the kind of exuberance that exists only in an economy that has been doubling in size every handful of years for decades on end.

Whether a property bust is in the process of occurring or is delayed to next year or the year after is immaterial. The bottom line is that the Australian economy is poorly positioned to absorb such a bust.

The best case scenario for China is that Chinese authorities manage to rebalance their growth model towards consumption and exports, but even in that scenario the Australian economy takes a hit. Besides iron ore and coal, we really don’t export anything that they need.

Australian miners are paying the price for their misplaced belief that Chinese demand would simply grow indefinitely, absorbing any new production that came online. The result was chronic over-investment during the boom, including a number of mines that were only profitable as long as the iron ore price remained above $US100 a tonne.

In the near term, miners will be hoping that Chinese steel mills restock as inventories run low and that the Chinese authorities will once again come to the rescue. But for now, Chinese authorities appear content to continuing consolidating steel production and easing excess capacity.

High-cost Australian iron ore producers will either go bankrupt or be bought out by their bigger competitors. The market will become increasingly dominated by BHP and Rio Tinto, the only producers who will be able to withstand a prolonged period of low prices.

But the most important near-term effect will be felt in jobs and on government balance sheets.

Earlier this year, ANZ and NAB estimated that job losses in the mining sector could run between 50,000 to 100,000 over the next couple of years. Those estimates remain in play but the iron ore has deteriorated faster than either bank expected.

The federal budget assumed that iron ore prices would remain above US$80 a tonne through to June 2014. The shift in the terms of trade will weigh on nominal income growth (through which taxes are levied) and the federal government will downgrade their revenue projections significantly in December.

Back of the envelope calculations indicate the lower iron ore price and terms-of-trade could cut as much as $12 billion from government tax revenues. That would blow the underlying cash deficit out by a further 0.8 percentage points for the 2014-15 financial year, though that doesn’t include the higher spending from the failure to get key budget measures through the senate.

The impact on the Western Australian budget will be much greater again and stems from the fact that they assumed an iron ore price of US$122 a tonne -- a number which at the time was considered comical.

Obviously, there is a lot of speculation whenever you deal with the Chinese economy. But based on recent developments and comments by Chinese authorities, there is little reason to be upbeat about the Australian iron ore market. The income shock is already flowing through to the Australian economy and the terms of trade has fallen sharply. We may not experience a recession, but it’s certainly going to feel that way for a lot of Australians.