The Week in Stocks

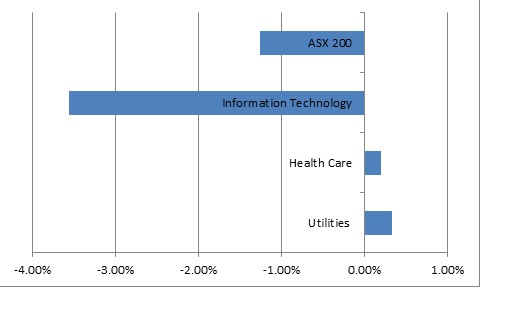

Defensives led by utilities and health care were in favour this week as talk once again swirled that the Federal Reserve may begin tapering in the months ahead. Positive economic data on Thursday from the US confirmed the economy is gathering steam, adding even more weight to taper talk.

Source: Bloomberg

Worley Parsons’ trading update forecast a decline in profit between 15 and 25 per cent from numbers initially forecast at the annual general meeting only in October. The second profit downgrade for this calendar year was not well received by patient Worley investors.

Source: Bloomberg

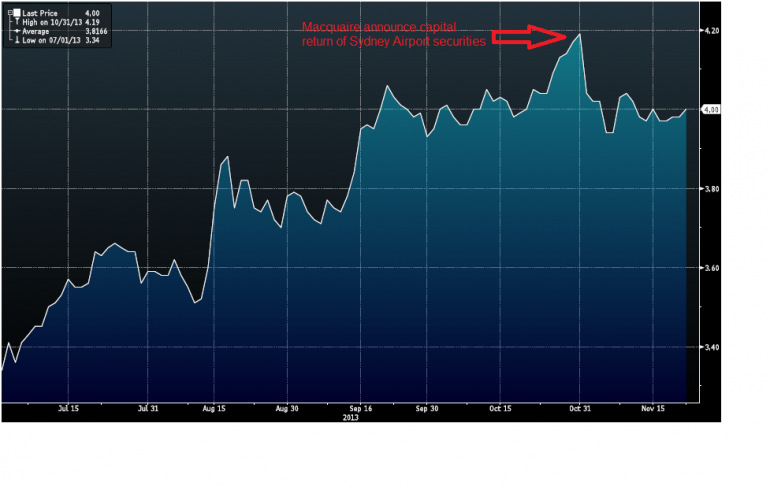

Catching our eye at Markets Spectator has been the continued share price decline of Sydney Airport. Since Macquarie Group’s announcement at the start of November that it would make a capital return comprised of Sydney Airport securities, the airport has lost 4.6 per cent.

This is surprising given the strategic positioning of Sydney Airport and the potential of Chinese air travel. Australia, along with Sydney, is well positioned to benefit from an increase in Chinese tourist numbers. At the moment, the fundamentals suggest Sydney Airport offers long term growth potential.