The Week in Review: February 2, 2018

Volatility spikes and global share markets correct, for the first time in a long time.

Investment markets and key developments over the past week

- After a strong start to the year global shares came under pressure over the last week as bond yields rose further in part driven by rising expectations for more aggressive Fed monetary tightening. US, Eurozone, Japanese and Chinese shares all fell but Australian shares managed to rise having significantly underperformed since the start of the year. While the $US fell further against the Euro, it rose against the Yen and the $A with weaker than expected inflation helping to hold the $A down. Commodity prices were mixed with metals and gold up but oil and iron ore down.

- Correction time for shares? After a strong start to the year and very low volatility last year US and global shares had become overbought and overdue a decent correction, which in turn will impact Australian shares. The back up in bond yields is likely providing the trigger and it could have further to go with more volatility likely expected this year as inflation risks shift to the upside and the Fed gets more aggressive. But providing the rise in bond yields is not too abrupt, shares will likely still see reasonable gains this year thanks to rising earnings.

- In the US, the Fed left interest rates on hold at its first meeting for the year, but was more upbeat on the economy and inflation signalling more rate hikes ahead with the next move almost certain to be in March. With the US economy so strong and inflation risks shifting to the upside we see the Fed raising rates four (or possibly even five) times this year which is still more than the three the market is now allowing for. Reflecting this we see more upside for bond yields ahead.

- Meanwhile, other central banks remain a long way from a hawkish shift. Bank of Japan communications and a pick up in its shorter dated bond purchases look aimed at convincing markets its not about to raise its zero 10 year bond target, the ECB looks like remaining patient (despite some ECB officials) with core inflation of just 1 per cent in January and softer than expected December quarter inflation in Australia is consistent with the RBA remaining on hold out to later this year. A more hawkish Fed at a time when other central banks remain dovish should ultimately support the US dollar.

- President Trump becoming more conciliatory. A worry for this mid-term election year in the US is that President Trump will become more populist to appeal to his base. His decision to impose tariffs on imports of washing machines and solar panels was a move in this direction but his recent speech in Davos and his State of the Union address actually moved in the other direction with a more conciliatory presidential tone, no big threats on trade and positive statements about progress on NAFTA. And its worth noting that the tax cuts and news of companies making cash payments to workers as a result is helping to boost popular support for the GOP.

- As goes January, so goes the year – or does it? The so-called January barometer that takes January as a guide to how the year will go has long been looked at around this time of year. With global shares up 3.8 per cent and US shares up 5.6 per cent in January its positive for this year, but for Australian shares its negative with shares down 0.5 per cent in January. However, the January barometer tends to be far more reliable for positive Januarys than negative Januarys. Since 1980 a positive January in the US has had an 86 per cent hit rate of going on to a positive year, but a negative January has had only a 40 per cent hit rate of going on to a negative year. In Australia, a negative January has had just a 29 per cent hit rate of going on to a negative year, so I wouldn't read too much into January's fall as a guide to the year as a whole for Australian shares. Of course, even for positive January's its not full proof and in 1987 US shares saw a whopping 13 per cent gain in January - they still had a positive year in 1987 but it was only 2 per cent!

- So why did Australian shares underperform so badly in January? Basically, the further rise in the Australian dollar weighed on earnings expectations, the rise in bond yields weighed on interest sensitive parts of the market like REITs and utilities to which the Australian share market remains more highly exposed and earnings expectations at around 7 per cent in Australia remain well below the rest of the world where earnings growth is running around 10-15 per cent.

Major global economic events and implications

- US economic data remains solid with consumer confidence and the ISM manufacturing conditions index remaining very high in January, continuing strength in personal spending, a solid rise in construction spending, strong labour market indicators, a modest acceleration in wages growth and a pick-up in inflation. Consistent with this, the December quarter US earnings reporting season has also continued to impress. Of the 231 S&P 500 companies to have reported so far 83 per cent have beaten earnings expectations and 81 per cent have beaten on sales. Earnings growth for the quarter is tracking up 14.5 per cent year on year and revenue is up 8 per cent yoy for its strongest in six years.

- Eurozone economic data also remains strong with GDP growth of 2.7 per cent through 2017 (up from 1.9 per cent in 2016) and continuing high readings for business and consumer sentiment. Core inflation in January edged up but only to 1 per cent year on year.

- Japanese data was a bit mixed with a soft reading for household spending but continuing strength in industrial production, business conditions and the labour market.

- Chinese business conditions PMIs were on average little changed in January suggesting that growth remains solid.

Australian economic events and implications

- It was a bit of a mixed bag in Australia over the last week. Business conditions and confidence remain strong according to the NAB survey and the AIG and CBA PMIs and the terms of trade rose slightly in the December quarter providing support for national income. Against this though, building approvals fell sharply led by volatile units which re-established a downtrend in overall approvals, private sector credit growth continues to slow, home prices fell further in January led by Sydney and inflation came in slightly weaker than expected and below target for the December quarter. This is all consistent with the RBA remaining on hold - with no rate rise likely until later this year.

- Government related prices helping drive falling real wages. Much has been made of record low wages growth and falling real living standards. But its interesting to note that while wages growth has fallen to a record low, price rises for most Australian businesses only averaged 1.1 per cent last year (according to the ABS's Market sector goods and services ex volatile items price index). If price rises for government influenced areas like health, education, utilities and tobacco were similar there would be far less angst about low wages growth!

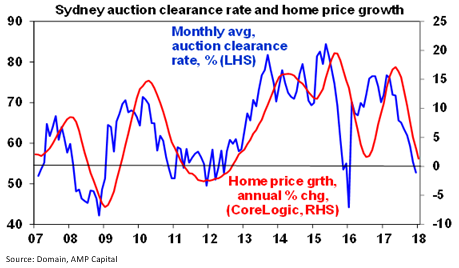

- While it's dangerous to read too much into December and January property price data given low sales volumes, property prices are likely to soften further in Sydney and Melbourne as APRA tightening measures and rising unit supply continue to impact. Auction clearance rates in Sydney running in the 50s are consistent with prices falling on an annual basis.

Dr Shane Oliver is the Chief Economist at AMP Capital

Share this article and show your support