The Week in Review: May 18, 2018

Rising bond yields, geopolitical risks, and a tariff deadline looming large.

Investment markets and key developments over the past week

- Global share markets were mixed over the last week with Eurozone and Japanese shares up – helped by weakness in their currencies. US shares were down a bit on the back of rising bond yields and geopolitical worries. This weighed on Australian shares. Chinese shares also fell. Bond yields rose led by strong data out of the US, and the spread between Italian and German bonds widened as investors worried about a populist government in Italy. Oil and iron ore prices rose slightly but the gold price fell. A further rise in the US dollar weighed on the Australian dollar.

- We're approaching the May 21 tariff deadline. Progress towards resolution to the US-China trade dispute continues, but it will remain slow and uncertain. As an act of goodwill (after his phone conversation with President Xi) President Trump tweeted the removal of restrictions on US companies from trading with Chinese company ZTE. Chinese Vice Premier Liu travelled to the US to negotiate on trade, and China has offered to accept a US demand for a $200 billion reduction in its trade surplus with the US indicating that it is taking US demands very seriously. But against this, Trump expressed doubt that any resolution will be achieved, although this may be a bit of posturing to pressure China. We see a negotiated solution ultimately, but it's going to be a slow process which won't be over by the May 21 deadline (for the US to finalise its tariffs on China and for the US Treasury to table proposed restrictions on China investing in the US). With the May 21 deadline coming in the next few days, Trump could decide to delay commencement of the tariffs if the negotiations look promising. But the risk is high that the tariffs or at least some of them could start up for a short period until there is a trade deal, which would not go down well with markets in the weeks ahead.

- Investors are finally awakening to the risks around the populist Five Star Movement (FSM) and Northern League (NL) government in Italy. Assuming they agree on a prime minister, the indications are that they are proposing big tax cuts, a basic income and a roll-back of pension reforms. The resultant budget deficit blow-out will create tensions with the rest of the Eurozone and put upwards pressure on Italian bond yields with NL leader Matteo Salvini naively bragging that “the spread [between Italian and German bond yields] is going up – do you remember the spread?”. It seems investors do, and the spread between Italian and German bond yields rose by 0.16 per cent over the last week. This is starting to weigh on Italian shares. Market and economic realities may eventually force 5SM and NL to water down their policies in government – which may explain why the leader of neither wants to be prime minister! In some ways this has echoes of the experience of Syriza in Greece that started off promising extreme populist policies but ultimately just became another centrist European political party. An 'Itexit' is not an imminent threat and the risk of contagion to the rest of the Eurozone is far less than it was when 'Grexit' was talked about as other vulnerable countries like Spain are now in much better shape and popular support for the Euro is solid. But a 5SM/NL Government will be bad for Italian assets and poses some risks for the Euro.

- At least another spread is falling, and that's the US LIBOR-OIS rate spread (the interbank lending rate less the expected Federal Reserve funds rate). And the bank bill rate less expected cash rate spread in Australia has followed. Such spreads have fallen by 0.15 per cent or so over the last few weeks – this is taking pressure off bank funding costs thereby reducing the risk that Australian mortgage rates will rise in compensation. However, a threat to mortgage rates from rising global bond yields is building.

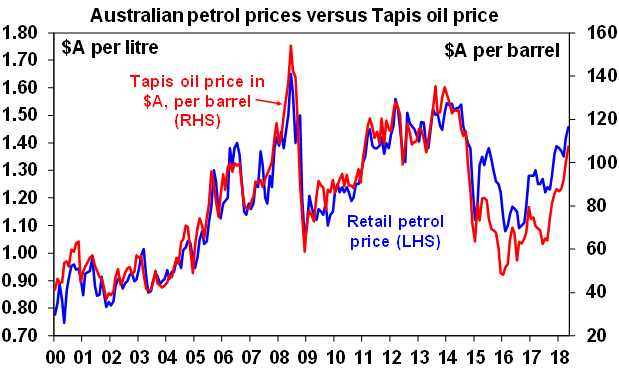

- Rising oil prices are flowing through to petrol prices and cutting into spending power. Reflecting strong global demand, falling inventory levels and the threat to the supply of Iranian oil, global oil prices have risen around 45 per cent over the last year and this has driven a sharp rise in Australian petrol prices from around $1.25/litre to around $1.45/litre. The lag from higher oil prices to higher petrol prices suggest Australian petrol prices may rise another 3-4 cents/litre in the next week or so.

Source: Bloomberg, AMP Capital

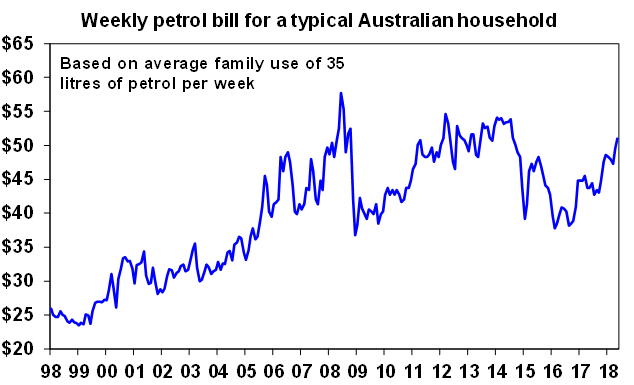

- Naturally, the rise in petrol prices feeds directly into inflation, but the indirect impact is likely to be muted in Australia's case as constrained consumer spending in the face of soft wages growth is making it hard for businesses to pass on cost increases. The weekly petrol bill for a typical Australian household is already up $8 over the last year and up $13 since its 2016 low so it will further constrain consumer spending power.

Source: Bloomberg, AMP Capital

Major global economic events and implications

- US data remains strong. Housing starts fell in April, but strength in the National Association of Home Builders' (NAHB) index points to a continuing rising trend. Meanwhile, April retail sales, industrial production, May manufacturing conditions in the New York and Philadelphia regions, and the Conference Board's leading index were all strong. Jobless claims are running below early 1970s levels and point to an eventual pick up in wages growth, and the prices received component of the Philadelphia survey is at its highest since 1989. That points to higher inflation. Our view remains the US Federal Reserve will hike three more times this year and the money market is gradually coming around to this view… all of which means more upside for US 10-year bond yields. They broke decisively above 3 per cent over the last week for the first time since 2011 and, while negative sentiment towards them suggests the risk of short-term decline in yields, they look to be heading to 3.5 per cent by the end of the year.

- No early exit from easy money in Japan. The Japanese economy went backwards in the March quarter for the first time since 2015, and core inflation slowed to just 0.4 per cent year-on-year. While business conditions surveys point to a rebound in growth, falling and way below target inflation confirms that the Bank of Japan won't be rushing to the exits from easy money any time soon.

- Chinese activity data was a mixed bag in April. There was stronger growth in industrial production, and a fall in unemployment, but slower growth in retail sales and investment. Overall it suggests continuing solid growth, but there may have been some slowing in domestic demand.

Australian economic events and implications

- Slowing jobs growth and still weak wages growth. While April saw a solid gain in employment, with full time jobs leading the charge as they have over the last year, it was not enough to absorb new entrants to the workforce and so unemployment edged up to 5.6 per cent. Continuing high levels of unemployment and underemployment suggest that wages growth will remain subdued for some time yet. It remained just 2.1 per cent year-on-year in the March quarter. Yeah, I know that wages including bonuses and hours worked look stronger on an annual basis, but both are very noisy and look affected by base effects. Meanwhile, it's a bit unclear whether the Budget provided a boost to consumer confidence with the ANZ-Roy Morgan survey showing a small rise but the Westpac/MI survey showing a small fall. Whatever the impact was, it looks pretty small, which is understandable given the boost to low and middle-income earners averages at around $10 a week and won't be received until after June next year. This is all consistent with the Reserve Bank of Australia remaining on hold for a lot longer. We don't see a rate hike until 2020 at the earliest and still can't rule out a rate cut.

What to watch over the next week?

- In the US, the focus will be back on trade, and the Fed. Monday is the deadline for finalising the list of Chinese products to be subject to tariffs, and it's also the deadline for the US Treasury to propose restrictions on Chinese investment in the US. Meanwhile the minutes from the last Fed meeting (Wednesday) and a speech by Fed Chair, Jerome Powell (Friday), are likely to confirm an upbeat view on the US economy and inflation, and that it remains on track for more interest rate hikes with the next move in June. They are also likely to push the financial market closer to factoring in another three hikes this year (from expecting just two). On the data front, expect May business conditions PMIs (Wednesday) to remain solid at around 55, home sales (due Wednesday and Thursday) to fall back after solid gains in March, home prices (Thursday) to show further gains, and durable goods orders (Friday) to rise.

- Eurozone business conditions PMIs (Wednesday) for May will be watched for a stabilisation around a still solid 55 after seeing falls from highs earlier this year.

- In Australia, expect a 0.5 per cent rise in March quarter construction activity (Wednesday) after a very weak December quarter. Skilled vacancy data will also be released and a speech by RBA Governor Lowe (Wednesday) are likely to affirm that the RBA remains comfortably on hold.

Outlook for markets

- Volatility in share markets is likely to remain high as US inflation and interest rates move up, and as issues around President Trump (trade, Mueller inquiry, etc.) continue to impact ahead of the US mid-term elections in November. However, the medium-term trend in share markets is likely to remain up. A global recession is unlikely, and earnings growth remains strong globally, while solid in Australia. We continue to expect the ASX 200 to reach 6300 points by end-2018, and with the ASX 200 currently at 6120 points, it now looks a lot more believable.

- Low yields and capital losses from rising bond yields are likely to drive low returns from bonds. Australian bonds are likely to outperform global bonds helped by the relatively dovish RBA.

- Unlisted commercial property and infrastructure are still likely to benefit from the search for yield by investors, but it is warning, and listed variants are vulnerable to rising bond yields.

- National capital city residential property prices are expected to slow further as the air continues to come out of the Sydney and Melbourne property boom and prices fall by another 5 per cent this year. While Perth and Darwin bottom out, Adelaide and Brisbane see moderate gains and Hobart booms.

- Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2 per cent.

- The Australian dollar likely has more downside to around US70c as the gap between the RBA's cash rate and the US Fed Funds rate pushes further into negative territory. Solid commodity prices should provide a floor for the Australian dollar though.

Shane Oliver is the Chief Economist at AMP Capital.

Share this article and show your support