The Week in Review: April 27, 2018

Investment markets and key developments over the past week

-

Shares were mixed over the last week – up in Europe, Japan and Australia but down slightly in the US and China. Bond yields generally rose, but commodity prices fell slightly. The US dollar continued its recovery, and this weighed on the Australian dollar.

-

More good news on the geopolitical front with: US Treasury Secretary Mnuchin going to China to negotiate on trade in what will likely be a long process but one that will ultimately head of a full on China –US trade war. French President Macron, is proposing a renegotiation of the Iran nuclear deal, buying a bit of time to head off the US threat to walk away from the deal by May 12. There's been ongoing signs of progress regarding North Korea. It's also likely that President Trump will extend the EU's exemption from aluminium and steel tariffs beyond May 1 when it currently expires.

-

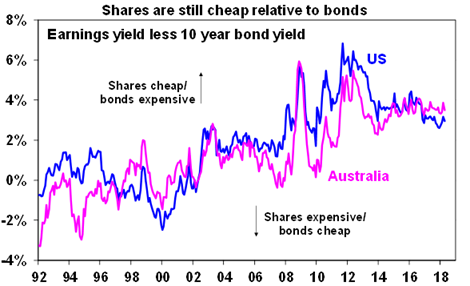

So it's back to focusing on economic fundamentals, notably the risk of a more aggressive Federal Reserve (Fed). A few weeks ago, the big concern was the flattening US yield curve, partly as investors fretted that a trade war would slow global growth with PMIs softening a bit. As always, we need to be cautious of the crowd as it has now swung back to focusing on strong growth and the risk of higher inflation in the US, with the US 10-year bond yield briefly closing above 3 per cent for the first time since 2013 on the back of strong data, rising inflation and rising fears around the Fed. Our view remains that the market has been too complacent on the Fed (factoring in just two more hikes this year and one next) and we continue to see three more hikes this year and another three next year. This will cause ongoing volatility. However, bond yields are only rising because of stronger growth, while US profit growth may be close to peaking (at around 20 per cent year on year in the March quarter) it's likely to continue growing solidly, US monetary policy is a long way from being tight and Europe and Japan are a long way from any monetary tightening. And don't forget that a 3 per cent US bond yield implies a real yield of just 1 per cent, which is very low historically. With the forward PE on US shares having fallen to 16.8x it means that the gap between the earnings yield of 5.95 per cent and the 3 per cent 10-year bond yield is still relatively wide at around 3 per cent. In Europe the earnings yield bond yield gap is much higher at around 6 per cent and in Japan it's around 7 per cent. So bond yields can rise a fair bit further before they become a major threat for shares.

Source: Bloomberg, AMP Capital

-

In Australia, APRA has formalised a further tightening in lending standards, at the same time as removing the now redundant 10 per cent investor lending speed limit. Removing the speed limit makes sense given that investor credit growth was just 2.8 per cent over the year to February, the property market in Sydney and Melbourne has cooled and the speed limit is being replaced by a more fundamental tightening in lending standards including around interest only lending (last year). Now much tougher requirements around borrower's income/expenses and bank attitudes towards borrower's total debt to income. Given this and more realistic investor expectations regarding future capital growth it's hard to see a resurgence in investor lending, particularly in relation to Sydney and Melbourne. To the contrary, I expect that the tighter lending policies and practices will mean a further net tightening in lending conditions leading to a further slowing in credit growth which in turn will maintain downwards pressure on home prices in Sydney and Melbourne, where I continue to expect prices to fall another 5 per cent or so this year, another 5 per cent or so next year and prices to still be falling slightly in 2020.

-

No RBA rate hike until sometime in 2020. We had been expecting the RBA to start raising rates in early 2019 but with the further tightening in bank lending standards effectively doing the RBA's work for it and growth likely to remain below 3 per cent and inflation around 2 per cent for longer we now don't see an RBA tightening until sometime in 2020. With the Fed likely to continue hiking this only adds to confidence in our view that the $A will fall towards $US0.70. And on this front its noteworthy that it appears to be breaking below the rising trend line that's been in place since 2015.

-

The 2018 Federal Budget to be handed down on Tuesday May 8, is likely to look like a pre-election budget aimed at improving the Government's standing ahead of the next Federal election. A big improvement in in the underlying budget on the back of increased corporate tax revenue, strong employment growth and lower spending is expected see the deficit for this year fall to $19 billion from the $29 billion projected in last year's Budget. This would allow the projected return to surplus to be brought forward a year to 2019-20 but the Government is likely to “spend” much of the revenue windfall and leave the return to surplus in place for 2020-21, with a projected deficit of around $18 billion for 2018-19. The key elements of this pre-election budget handout are likely to be personal tax cuts for low and middle-income earners possibly starting as early as July this year, the dropping of the 0.5 per cent increase in the Medicare levy, more infrastructure projects and maybe some increase in health spending. Financial sector regulation may also get a boost in view of the Royal Commission. Key Budget numbers for 2018-19 are expected to be: a Budget deficit of $18 billion, real GDP growth of 3 per cent, inflation of 2.25 per cent, wages growth of 2.5 per cent and unemployment of 5.25 per cent.

-

The upside of the Australian Government's Budget strategy is that consumers will be given a shot in the arm at a time of soft wages growth, falling home prices in Sydney and Melbourne and tightening bank lending standards. And the fiscal stimulus will be nowhere near the 2 per cent of GDP seen recently in the US. The downside is that we will still be seeing a record 12-years of budget deficits with nothing put aside for the next rainy day and there is a risk that the revenue surprise seen lately will prove ephemeral if global growth is threatened and/or employment slows.

Major global economic events and implications

-

US data over the last week was mostly strong. Underlying durable goods were softer than expected but April business conditions PMIs, home sales, home prices and consumer confidence all rose, jobless claims fell, and the goods trade deficit narrowed. The US earnings reporting season is now 50 per cent done and so far, so good. 80 per cent of results to date have beaten on earnings and 71 per cent have beaten on sales with earnings on track to rise around 20 per cent or more helped by solid growth and a 5-10 per cent boost from tax cuts.

-

As expected the ECB left monetary policy on hold, remaining on track towards a tapering in QE in the final quarter but with no rate hike likely until mid-2019 at the earliest. If anything, ECB President Draghi sounded a bit dovish. There is no quick exit from easy money here. Business conditions PMIs stabilised in April, in contrast to German and French business confidence readings that slipped a bit further. The ECB's latest bank survey showed easier lending conditions and rising loan demand. Overall Europe looks good and the now falling again euro will take a bit of pressure of, but it's not enough to speed up the ECB.

-

The Bank of Japan also made no changes to monetary policy as expected and lowered its expectations around inflation. While March labour market and industrial production data were strong and the April manufacturing conditions PMI improved slightly, core national inflation at just 0.5 per cent year on year (and now just 0.3 per cent in Tokyo) indicates that there will be no quick exit from easy money in Japan.

-

China moving to stimulate? China's latest Politburo meeting was interesting with talk of stimulating domestic demand with no reference to deleveraging. It's premature to expect a significant stimulus – growth is not weak enough (6.8 per cent in the March quarter) and the Government is still aware of issues around debt – but it reinforces the view that a significant slowing will not be tolerated. Taken together with either stronger or stable PMIs in the US, Europe and Japan in April it adds to confidence global growth will remain strong.

Australian economic events and implications

-

Australian inflation remains in the slow lane consistent with the RBA remaining on hold. While the March quarter saw large rises in prices for health, education and utilities weak pricing power is continuing to keep inflation at or just below the bottom of the 2-3 per cent inflation target. Signs of weak underlying inflation remain evident in falling prices for clothing, furnishing, household goods, communication and recreation with private sector inflation excluding volatile items running at just 1.1 per cent year on year. There is no case for RBA tightening here.

What to watch over the next week?

-

In the US, the Fed (Wednesday) is expected leave interest rates on hold but indicate that it remains on track to continue raising interest rates gradually on the back of strong growth and rising inflation. Market expectations for just two more rate hikes this year remain too complacent and we continue to see three more this year with the next move in June. Data showing a rise in March core private consumption deflator inflation (Monday) to 2 per cent year on year, continued strength in employment (Friday) with April payrolls likely to rise by 190,000 and wages growth edging up to 2.8 per cent year on year are expected to provide support for continued Fed tightening. In other data expect solid gains in household income and spending (Monday), a rise in pending home sales (Tuesday) and continuing strength in the ISM manufacturing conditions index (Tuesday) and non-manufacturing conditions index (Thursday). Meanwhile, the March quarter earnings reporting season will continue.

-

In the Eurozone, March quarter GDP (Wednesday) is expected to have increased by 0.4 per cent quarter on quarter seeing annual growth slip slightly to 2.6 per cent year on year and March unemployment (also Wednesday) is expected to fall further to 8.4 per cent. However, April core inflation (Thursday) is likely to have remained unchanged at 1 per cent year on year.

-

Chinese business conditions PMIs (due Monday and Wednesday) are expected to edge down a bit but remain around 51 for manufacturing consistent with growth running around 6.5-6.8 per cent year on year.

-

In Australia, the Reserve Bank is expected to leave interest rates on hold for a record 20th month in a row when it meets on Tuesday. Strong business confidence, improving non-mining investment, solid global growth and the RBA's own growth and inflation forecasts argue against a rate cut, but risks around consumer spending, tightening bank lending standards, weak wages growth and inflation, the slowing Sydney and Melbourne property markets and the still too high $A, all argue against a rate hike. We now don't see the RBA commencing a tightening cycle until sometime in 2020, and another rate cut cannot be ruled out. The RBA is expected to make only minor changes to its 2018 forecasts in its Statement of Monetary Policy (Friday) with a slight rise in its underlying inflation forecast to 2 per cent and a downgrade in its growth forecast to 3 per cent, but these are unlikely to affect the outlook for interest rates.

-

Meanwhile on the data front in Australia, expect credit growth (Monday) to remain moderate. CoreLogic data for March to show continuing weakness in home prices (Tuesday) led by Sydney. A 2 per cent or so bounce in building approvals for March (Thursday) and a March trade surplus of around $1 billion (also Thursday). Business conditions PMIs for April are likely to remain solid.

Outlook for markets

-

Volatility in share markets is likely to remain high as US inflation and interest rates move up and as issues around President Trump, trade, Mueller inquiry, etc, continue to impact ahead of the US mid-term elections in November, but the medium-term trend in share markets is likely to remain up as global recession is unlikely and earnings growth remains strong globally and solid in Australia. We continue to expect the ASX 200 to reach 6300 by end 2018 – it might take a bit longer to get back on the path up to there though.

-

Low yields and capital losses from rising bond yields are likely to drive low returns from bonds. Australian bonds are likely to outperform global bonds helped by the relatively dovish RBA in contrast to the Fed.

-

Unlisted commercial property and infrastructure are still likely to benefit from the search for yield by investors, but it is waning, and listed variants remain vulnerable to rising bond yields.

-

National capital city residential property price gains are expected to slow further as the air continues to come out of the Sydney and Melbourne property boom and prices fall by another 5 per cent this year, but Perth and Darwin bottom out, Adelaide and Brisbane see moderate gains and Hobart booms.

-

Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2 per cent.

-

The $A is likely to fall towards $US0.70 as the gap between the RBA's cash rate and the US Fed Funds rate pushes further into negative territory. Solid commodity prices should provide a floor for the $A though – in contrast to early last decade when the interest rate gap was negative and the $A fell below $US0.50.

Shane Oliver is the Chief Economist at AMP Capital