The Week Ahead

Prices, prices, prices

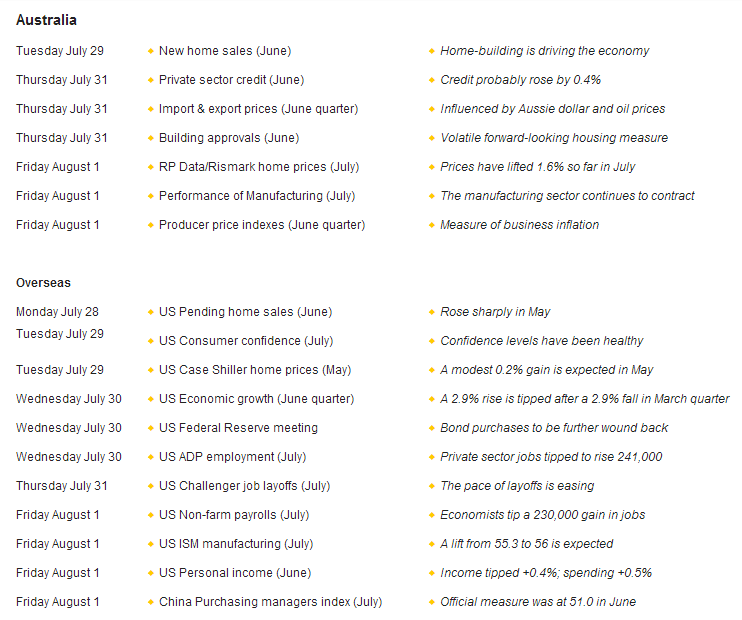

In the coming week, various price indexes will take centre stage. On Thursday the Australian Bureau of Statistics will issue data on import and export prices for the June quarter.

On Friday, the ABS issues the producer price indexes (measures of business inflation) while RP Data/Rismark issues the home value index for July.

In the past, the data on trade and producer prices were important, as they provided a guide to the more important estimates of consumer prices. But with the quarterly trade and producer price figures now issued after the release of the consumer price index, they are more of interest to economists divining future price pressures. And unfortunately there is no exact science that relates the trade and producer price data to broader economy-wide inflation.

But the data on home prices is important, especially given that there are indications that growth has accelerated over the past month. In June, the five-city average of home prices lifted by 1.4 per cent, and so far in July prices have lifted by 1.6 per cent to stand 10.8 per cent higher than a year ago.

The Reserve Bank has been trying to 'jawbone' the housing market, warning potential buyers that prices can fall as well as rise, as they have done in the past. If home prices continue to rise solidly, then the Reserve Bank may have to start revisiting the measures implemented by central banks in New Zealand and Canada that have been implemented to quell excessive speculation in property markets.

Apart from the price measures to be released, there are a number of other indicators to be released in the coming week.

On Tuesday the Housing Industry Association issues data on new home sales for June. In May, new home sales fell by 4.3 per cent. While this was only the first fall in sales in 2014, it was the biggest decline in 10 months.

On Wednesday the ABS issues some different living cost indexes for the June quarter, providing inflation perspectives for groups like pensioners and self-funded retirees. On the same day the ABS releases the motor vehicle census as at January 2014.

On Thursday, a forward-looking measure of home building is released: building approvals. Unfortunately the data can prove volatile, as evidenced by the 9.9 per cent lift in dwellings approved for construction in May.

Also on Thursday, the Reserve Bank releases private sector credit (or data on loans outstanding) for June. In May, credit rose by 0.4 per cent to stand 4.7 per cent higher than a year ago.

And on Friday the Australian Industry Group releases a key gauge that tracks the growth of the manufacturing sector – the Performance of Manufacturing index. The PMI has been below 50 (suggesting contraction of the manufacturing sector) for eight months.

Big week in the US

There is a bevy of ‘top shelf’ economic indicators for release in the US with a meeting of Federal Reserve policymakers thrown in for good measure. In China the focus is on the purchasing managers’ index to be released on Friday.

The week kicks off in the US with the pending home sales index to be released on Monday.

On Tuesday, the consumer confidence index is issued together with the S&P/Case Shiller measure of home prices and weekly chain store sales figures. Home prices may have edged up just 0.2 per cent in May.

In the US on Wednesday, the first reading of economic growth in the June quarter is published. Harsh winter weather caused the US economy to contract at a 2.9 per cent annual rate in the March quarter. Economists expected that growth rebounded by 2.9 per cent in the June quarter. The ADP national employment report is also released on Wednesday.

Also on Wednesday Federal Reserve policymakers meet and bond purchases will be further wound back from current levels of US$35 billion a month.

On Thursday the Challenger job layoffs series is issued together with the employment cost index and the usual weekly figures on jobless claims -- new claims for unemployment insurance.

On Friday, the monthly US jobs report (non-farm payrolls data) is issued. Economists tip a 230,000 increase in jobs with the jobless rate holding around 6.0-6.1 per cent. The ISM manufacturing index is also released on Friday.

In China, both the “official” and HSBC purchasing manager indexes are released on Friday.

Australian shares at record highs

An investor looking to buy a rental property is interested in likely capital gains over the holding period as well as the rental return. Clearly it is more than just what you can buy and sell the property for -- you want a tenant in there as well! With shares, the equivalent when looking at the broader market is the All Ordinaries Accumulation index (AOAI) -- that is, total return on shares. On Monday the AOAI index hit record highs, up 15.7 per cent over the year.

Australian profit-reporting season

The Australian profit-reporting season has begun. But it will be a slow climb in terms of the number of companies issuing results with the key days being August 13, 19 and 20.

Leighton Holdings is expected to release its half-year results on Monday with ERA to report on Thursday and Resmed to issue its quarterly accounts on Friday. Woolworths is scheduled to release sales figures on Wednesday.