The view from Wall Street: Australian bank stocks

Summary: Macquarie says Australian bank stocks are trading at earnings multiples not seen “in years” and predicts stock-pickers will be drawn to the banks over the next few weeks for the dividends. UBS also remains upbeat, with the caveat that Australia doesn't slip into a deep recession. But Morgan Stanley warns of the prospect of rising loan losses, higher funding costs and dividend cuts. |

Key take-out: Through Australia's good times the country's banks were market darlings. They now need to show they've got what it takes to muscle through the bad times. |

Key beneficiaries: General investors. Category: Bank shares. |

Australia's banks have a well-earned reputation as some of the highest yielding stocks in Asia, with the nation's big four lenders offering an average yield of roughly 6 per cent.

The allure of fat dividend payments has over the years proved a magnet for income focused investors hungry for yield in a low interest rate environment. The strong growth in dividends helped propel bank stocks higher, with the S&P/ASX200 Banks Index more than doubling from September 2011 to March this year.

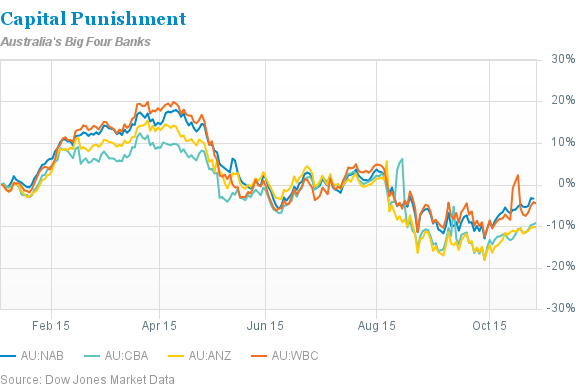

But the gloom that has cast a pall over investors' outlook for the Lucky Country as prices for key commodities like iron ore and coal have tumbled to multi-year lows has weighed heavily on bank stocks. A jobless rate entrenched above 6 per cent has raised concerns about a rise in bad loans, while a regulator prodding banks to raise more capital has prompted the big four to tap equity markets for large licks of additional capital, diluting existing shareholders in the process. Shares in the big four banks – Commonwealth Bank (CBA.AU), Westpac (WBC.AU), Australia & New Zealand Banking Group (ANZ.AU) and National Australia Bank (NAB.AU) – have fallen around 25 per cent since April.

But the fall in share prices may offer a buying opportunity for what are some of Asia's top defensive stocks. Three of the banks will go ex-dividend in the next month, meaning investors still have time to buy and pocket hefty upcoming dividend payouts from NAB, Westpac and ANZ. The annual yields from Australia's banks are some of the biggest in the business, while current trading multiples are the cheapest in years. The million dollar question though is how long can the era of fat dividends go on given the headwinds buffeting the industry?

Macquarie makes a case for beaten-down banking stocks. The bank's analysts point out that in the weeks leading up to their ex-dividend dates, Australia's big four lenders generally outperform the broader Australian benchmark by up to 4 per cent as investors rush to buy the stock and the dividend. CBA is the only one of the four that won't go ex-dividend in November as its financial year ends on June 30.

Aussie stocks are some of the highest yielding in Asia, with the average dividend for companies listed on the S&P/ASX200 more than 4.5 per cent. Stocks on average pay out about three-quarters of their earnings back to shareholders. ANZ, Westpac and NAB go even further – they all yield a chunky annual dividend of between 6 per cent and 7 per cent.

Macquarie analysts say these banks are trading at earnings multiples not seen “in years,” with valuations depressed given macro concerns around the commodities-dominated Australian economy. However, Macquarie reckons stock-pickers will be drawn back to the banks over the next few weeks on their reputation for paying out beefy dividends to shareholders. “We view the upcoming dividends as a catalyst to drive outperformance as the dividends focus the market on the attractive valuations,” says Macquarie's Werner Fortmann.

Given the weakness in earnings growth and the Australian economy, analysts have naturally focused on the sustainability of the banks' ability to maintain generous dividend policies. However, UBS remains pretty upbeat on banks continuing to paying dividends at current rates at least for the next couple of years, although with one caveat: Australia doesn't slip into a deep recession.

Add into the mix attractive-looking multiples and UBS sniffs an excuse to buy. “The banks now appear cheap from a dividend yield perspective,” says analyst Jonathan Mott, who thinks payouts can come through Australia's current economic travails and even a mild recession unscathed.

Mott points to a few reasons why bank share prices have been weak this year, but also why he thinks the banks can tough it out.

He says the market's attention earlier in the year was on capital reserves. Australia's financial regulator had been on the banks' case to raise their levels of Tier 1 capital, but UBS reckons concerns have been soothed as fresh capital was raised through rights issues, which have depressed share prices. However, the issue could rear its head in the future as the tighter capital requirements of Basel IV global banking regulations move closer to implementation.

Mott says sceptics have recently zoomed in on the quality of the banks' loan books. He points out loan-loss provisioning among Australia's top banks are at all-time lows, leading investors to conclude they can only go higher given the slower pace of economic growth. Re-pricing across the banks' loan books is already taking place, notably in investment property lending. Mott pencils in further rises of about 30 basis points across the banking sector for investment property mortgages over the coming year. This could help bolster net interest margins – the spread between what banks pay depositors and receive from borrowers – and offset some of the pain from rising arrears as the economy slows.

It's worth noting interest rates in Australia are at a record low of 2 per cent, but this gives the central bank room to cut. In this case, Mott isn't convinced banks will be generous enough to pass on the full discount to borrowers. It's worth noting that the big four have raised their standard variable rates for homes loans in recent weeks. Mott also reckons that any rate cuts will prompt the banks to cut rates for depositors, helping plump net interest margins.

Earnings could also be supported by cutting costs. Mott argues Australian banks “have not been prepared to make tough decisions on costs” during the commodity boom years. As balance sheets and revenues grew, the banks took an “if it ain't broke, don't fix it” approach. Operating costs among Australian banks are now $A37 billion – which he says is “an astronomical amount” – and are ripe for trimming by closing branches and relying more on technology.

Of Australia's big four lenders, ANZ looks appealing on a couple of different measures. It trades at roughly 10 times last 12-month's earnings, down from its five-year average PE of 13 times earnings. That's as cheaply valued as the stock has been for more than two-and-a-half years, Macquarie points out. Earnings per share should grow 3 per cent or so in fiscal 2015, analysts estimate, while the stock price could rise 15 per cent in the next year. ANZ's “super-regional” strategy means it has a higher overseas exposure than Australia's other banking majors, but also a smaller mortgage book.

Westpac and NAB are slightly pricier options – both trade at about 13 times trailing earnings. NAB looks the better choice out of the two with the stronger earnings per share growth predicted for the current financial year. At 12 per cent it's also got the sturdiest Tier 1 capital position out of the three going ex-dividend next month. NAB has also taken steps to jettison foreign operations in the US and the UK to double down on its more profitable Australia and New Zealand businesses.

Still, it's undeniable some investors are bearish and their reasoning isn't difficult to understand. “We think investors now need to focus on the prospect of rising loan losses, higher funding costs and dividend cuts,” says Richard Wiles, a Morgan Stanley analyst.

Through Australia's good times the country's banks were market darlings. They now need to show they've got what it takes to muscle through the bad times.

This piece has been reproduced with permission from Barron's.