The troubles with war and power plays

The Week in Review, by Dr Shane Oliver (AMP Capital)

Investor Signposts, by Craig James (CommSec)

Readings & Viewings

The share market waxes and wanes over the likelihood of war breaking out on the Korean Peninsula. But many are fleeing to US bonds, pushing up the prices and lowering rates and the US dollar.

For the share market, it’s as though markets can’t believe that global political leaders will go down the war track. And, indeed, that is the view in China where their leadership believes that war can be avoided.

As much as I hate the possibility of war I am becoming more convinced that it is highly likely, and that adds an extra dimension to the dangers in the market.

Let me share with you why I am so concerned. The US is pressing China to turn off its Korean oil tap, believing that will bring North Korea and its leader Kim Jong-un to their senses. The last time the oil tap was turned off to a serious military power in Asia was when the US stopped supplying oil to Japan in July 1941. It was supposed to bring Japan to its knees.

The US totally underestimated the military power and the technology of the Japanese, who responded in December 1941 by bombing Hawaii’s Pearl Harbour. That pre-emptive strike might have won them the war but for the fact that by chance two US aircraft carriers were not in Pearl Harbour on December 7, 1941 and the Japanese bombs missed two enormous oil storage tanks in Hawaii.

But the simple fact was that once the oil was cut off Japan responded vigorously. I think the same thing would happen if, at the behest of the US, China cut off North Korea’s oil.

Like Japan, Korea’s dictator would have no choice but to press the military option. And my casual reconnaissance of recent embargo sanctions indicates that they don’t work.

My second war fear comes because the North Koreans are now starting to make really serious threats to South Korea, Japan and the US including the launching of missiles with nuclear devices that would explode in the atmosphere in a way that would knock out the US internet and communication systems and bring the country to its knees. These are not the sorts of threats you should make to what is still the largest military power in the world.

And, finally, President Trump spent half an hour talking to our Prime Minister Malcolm Turnbull on the phone. I don’t think the two men are the greatest of friends but President Trump clearly had something he wanted to set out to the Australian Prime Minister, and that could only have been the likelihood of war. Under the ANZUS treaty we are committed to back the US. I don’t think we were committed in the Middle East because ANZUS doesn’t cover that area, but we chose to support the US. Also, if North Korea is not tackled now South Korea, Japan and Taiwan will want to become nuclear powers too, and that changes the whole balance in the region.

In conventional terms a war usually means a much lower stock market and a rise in commodity prices. From what we have seen during crisis periods in recent weeks, it would seem that if we moved to the brink of war there would be a sharp fall in the stock market.

It may be that the Americans will launch a massive and unprecedented bombing raid on North Korea, but if North Korea gets a missile off the ground and it lands on Japan, South Korea, Australia or US territory – then a full-scale horrific nuclear response might happen. The North Koreans have some 700,000 people under arms, so fighting a ground war looks extremely difficult. There would be an enormous flood of refugees into China, and that would disrupt our major trading partner.

My guess is that as the share market falls there would be an acceleration of the current US rush towards bonds as a safe haven. At the moment we are seeing the American dollar fall as traders clearly also believe a war would be bad for the US currency.

Australia does not have a strong set of listed companies who are deep into defence supplies that would rise in price in a war. And I fear our trade with China might be affected. I hope that in six to 12 months readers will say to me “you got that wrong. There was no war”.

Power prices and AGL

There is anger building in the Australian community about the rise in power prices. There is no doubt they are draining consumer spending ability and lifting corporate costs. I think it is likely we are going to see higher inflation as a result of higher power prices, and it might even trigger a higher interest rates environment.

The community requires investment in revamped grids and in power stations. Many of the facilities that we now require to be expanded or revamped are owned by private capital. I was on the radio this week and the operator was talking quite seriously of once again bringing these facilities under government ownership.

For most of its early life energy giant AGL had severe restrictions of what dividends it could pay – quasi-nationalisation. Leaving aside your views on coal, the elected Federal Government wants AGL to continue operating its Liddell power station for at least another five years after 2022. AGL is saying no.

The market thinks AGL may benefit from a government buy-out. I fear the reverse; nationalisation at a low price. What is required to make Liddell economic is a long-term contract to ensure that there is sufficient demand for its power to justify the necessary capital investment to continue operating efficiently beyond 2022.

But AGL is promoting itself as a company that will not produce power via coal. So we have a company in deep dispute with the government. Not only could the government nationalise the AGL Liddell operation and sell it, but AGL may be required to put cash aside for rehabilitation, which will be a big drain on its pocket.

In this politically-driven environment where voters are suffering, similar situations could arise in other power network assets where major investment is required and returns are not being put on the table. This whole situation has a new degree of risk for that sector of the market.

Back to Top

The Week in Review

Investment markets and key developments over the past week

- Share markets mostly fell over the last week as worries around North Korea continue to impact, albeit most markets remain in the range they have been in for some time. Bond yields fell further helped by dovish comments from ECB President Draghi, a downwards revision to the ECB’s inflation forecasts and worries about the impact of hurricanes on the US economy. However, the Euro rose as President Draghi wasn’t seen as dovish enough resulting in a new down leg in the $US which also saw the $A push back above $US0.80. Oil and metal prices rose but iron ore dipped.

- Having broken key technical support levels the US dollar could fall further in the short term – which would be positive for US shares as it boosts US profits, global liquidity and the emerging world with $US debt – but it’s likely to reverse sometime in the next few months. The impact of hurricanes on US growth is likely to be temporary and the Fed will look through them – as we saw with Hurricane Katrina in 2005. And more fundamentally the falling $US is unwinding the Fed’s monetary tightening which is risking it becoming more aggressive at some point and the rising Euro is driving a monetary tightening in Europe at a time when Europe still needs easing and so will eventually force action by the ECB to counter it. This could involve a slower reduction than expected in its quantitative easing program. Likewise in Australia, the rising $A will constrain Australian growth and inflation further delaying any RBA tightening.

- We thought Hurricane Harvey made a US Government shutdown and debt ceiling crisis this month very unlikely and this has proved to be the case with President Trump and Congress agreeing to extend government funding and raise the debt ceiling out to mid-December. So no shutdown and no debt default for now. This continues the period of budget and spending stability that has been in place since the 2013 “crisis”. Uncertainty will rise again in December but a shutdown/debt default is also unlikely then. At the margin the move adds to confidence that tax reform will happen.

- Trump’s threatening tweets – eg, that he will stop all trade with countries trading with North Korea (read China) or pull out of the free trade deal with South Korea – create great media headlines but just remember that the trick with Trump is to take him seriously but not literally. His approach is all about setting up tough a negotiating stance, getting some movement in his direction and then settling. So yes he is trying to put more pressure on China regarding North Korea but don’t expect the US to cease trade with China.

- Uncertainty around the Fed ramped up a bit over the last week with Vice Chair Fischer resigning and reports that President Trump’s economic adviser Gary Cohn was no longer in the running for Fed Chair raising the possibility that Trump’s replacements may see the Fed take a more hawkish turn. This is not necessarily the case and in fact it’s in Trump’s interest to have stability at the Fed and he has indicated a leaning towards a “low interest rate” Fed all of which suggests he is unlikely to rock the boat with hawkish appointments. Yellen remains in with a chance if she wants it, but her supportive comments for post GFC financial regulation work against her to some degree.

- North Korean risks continued to escalate over the last week with a sixth nuclear test and an ongoing war of words. Our view remains that the risk of a skirmish or war has grown – particularly due to a miscalculation by either side in the conflict, but that a diplomatic solution remains most likely as North Korea is not quite so stupid to set off a war in which it will be annihilated and the US and its allies are aware of the potential huge loss of life in South Korea and potentially Japan that would flow from a pre-emptive military response. But we are a long way from a diplomatic solution yet. So the issue is likely to escalate further posing the risks of triggering further downside in share markets and demand for safe havens.

- The September 24 German election and October 1 Catalan election are of limited relevance for investors. Polling has Angela Merkel on track to easily “win” the German election with the issue being who she forms a coalition with: the Social Democrats again in which case the outcome is more pro-Europe or the Free Democratic Party which is less pro-Europe. It’s probably irrelevant as Merkel has migrated to a more pro-Europe stance anyway. The nationalist anti-Euro Alternative for Deutschland is a sideshow getting less than 10 per cent support. The Catalan independence referendum on October 1 may generate a bit of noise but it’s essentially a Spanish issue with not much relevance to the Eurozone. In any case the referendum is illegal, most Catalan’s prefer to stay in Spain but with more fiscal independence, independence is a long way off anyway even if there is support for it amongst a majority of Catalans and in any case Catalonia wants to stay in the Euro. The Italian election to be held before May 2018 is the one to watch but even here the populist Five Star Movement is wavering in its anti-Euro stance and it remains doubtful it will be able to form government (even if it gets more parliamentary seats than any other party). So a Euro break up continues to look unlikely and in the meantime its economy is getting stronger and its shares are cheap. The only fly in the ointment is the rising Euro.

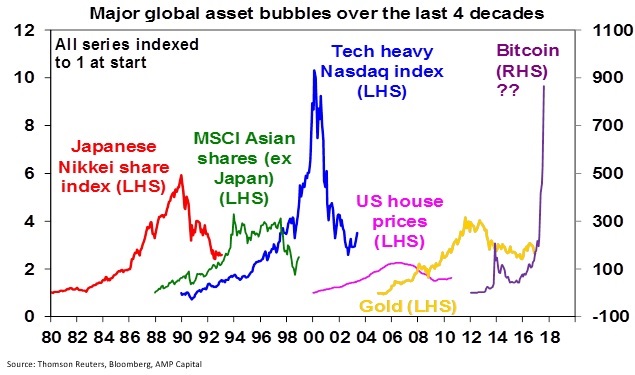

- What about Bitcoin? Crypto currencies led by Bitcoin are generating much interest. They and the block chain technology underpinning them seem to hold much promise but there is reason to be cautious. Lots of them are popping up, the ascent of Bitcoin’s share price looks very bubbly (although its potential ramifications if it bursts are nowhere near as significant as the other bubbles shown on the chart) and regulators are starting to take a closer look. I also still struggle to fully understand how it works and one big lesson from the GFC is that if you don’t fully understand something you shouldn’t invest (who really understood CDOs? – obviously not many!)

Australian economic events and implications

Australian data was the usual mixed bag. GDP growth bounced back nicely in the June quarter driven by consumer spending, investment and trade and ANZ job ads continue to grow strongly pointing to ongoing labour market strength. With the drag from mining investment slowing, non-mining private investment picking up, strong public capital spending and an ongoing contribution to growth from trade volumes growth is likely to improve further. However, July retail sales and trade were off to a soft start for the current quarter, and with continuing low wages growth (with average wages -0.1% in the June quarter and up just 0.1% over the last year) constraining consumer spending and dwelling construction topping out the rebound in growth will remain constrained relative to the RBA’s expectations for 3% plus growth. Which in turn means that the risks to underlying inflation remain on the downside.

So despite RBA Governor Lowe sounding upbeat, we remain of the view that the RBA will leave rates on hold out to late 2018 at least before starting to gradually raise rates. If the $A continues to rise – with it back above $US0.80 over the last week – then any hike could be pushed further out.

Source: AMP Capital

Dr Shane Oliver is Chief Economist at AMP Capital

Back to Top

Investor Signposts

Business conditions and jobs to dominate

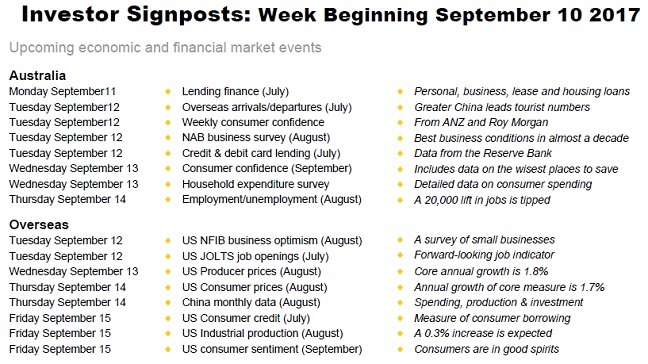

- There are fewer ‘top shelf’ economic indicators in Australia in the coming week but it is still a busy schedule. Main interest is in the NAB business conditions survey and the latest jobs report.

- The week kicks off on Monday with the Australian Bureau of Statistics (ABS) releasing the July data on lending finance commitments. As well as containing figures on new home loans, the data covers personal, commercial and lease loans.

- A busy agenda is set down for Tuesday. The ABS releases the publication “Overseas Arrivals and Departures”. And not only is data on tourism flows included in the publication but also longer-term migration figures.

- Also on Tuesday, NAB issues its August business survey. This is one of the best indicators to be released each month as it is a summary of how businesses across the nation are actually doing and feeling. Business conditions are near decade highs.

- Other data out on Tuesday includes the July data on credit and debit card lending issued by the Reserve Bank as well as weekly consumer confidence data.

- Aussie consumers had been a touch downbeat but there is a growing realisation that overall economic conditions are still pretty good. Interest rates remain near generational lows but the Aussie dollar is firmer – encouraging travelling and spending.

- On Wednesday, the monthly survey of consumer confidence is released from the Melbourne Institute and Westpac. This data is now more a check on the timelier weekly survey data. But of interest in the September survey are the responses to the question “where are the wisest places to put new saving”.

- Also on Wednesday, the ABS are hoping to provide two publications: “Household Expenditure Survey” and “Household Income and Wealth”. These publications had been due for release in late August. But the data is keenly awaited by a raft of businesses.

- On Thursday the ABS releases the August labour market indicators (employment and unemployment). Based on a raft of positive indicators, employment should have lifted by another 20,000 people in the month with the jobless rate steady at 5.6 per cent.

- Also on Thursday, the ABS releases the Modellers Database – data which provides some additional insights into the economy’s performance.

Overseas: Pivotal US and Chinese indicators

- In the coming week investors will get the latest information on how the two biggest global economies – the US and China – are travelling. Both countries issue estimates on retail spending and industrial production.

- In the US, the week kicks off on Tuesday with the release of the Business Optimism index for August from the National Federation of Independent Business, a leading small business association. The Business Optimism index is near 12-year highs.

- Also on Tuesday is the JOLTS survey – job openings and labour turnover survey – a forward-looking gauge on the job market. Job openings stand at record high – the question is whether there are enough possible applicants to fill all the positions.

- The usual weekly data on chain store sales is also issued on Tuesday.

- On Wednesday in the US the August data on business inflation – the producer price index – is released with the monthly budget figures and weekly data on housing finance. The core PPI measure (excludes food and energy) is tipped to rise 0.1 per cent in August after July’s surprise 0.1 per cent fall.

- On Thursday in the US the consumer variant on inflation – the consumer price index – is released together with the usual weekly data on jobless claims (new claims for unemployment insurance). While not the Federal Reserve’s preferred measure of inflation, trends in the CPI are still closely watched. The core CPI measure is tipped to rise 0.2 per cent in August to stand up just 1.6 per cent on a year ago.

- And on Friday in the US, data on retail sales and industrial production are set for release together with the first consumer sentiment survey for September. Both production and retail sales may have lifted 0.4 per cent in August. While solid readings, if they not accompanied by signs of higher inflation, then the Federal Reserve has no compelling need to lift rates. In turn, this keeps the US dollar down and Aussie dollar close to US80 cents.

- In China, the monthly download of economic indicators is set down for Thursday – retail sales, production and investment. Much interest is in retail spending – up by a lofty 10.4 per cent in the year to July.

Financial markets

- If there is one trend that highlights the improving health of the global economy it is the rise and rise of base metal prices. Zinc is at decade highs, up 33 per cent on the year. Copper is up 49 per cent, aluminium is up 32 per cent and lead and nickel are up around 20 per cent.

- Metals are being supported by fundamentally firmer demand and lower supplies together with special influences like the fear of tighter environmental regulations in China.

Craig James is Chief Economist at CommSec

Back to Top

Readings and viewings

Readings and viewings

Remember back in the early 1990s when Coles Myer launched World 4 Kids to tackle the arrival of US retail giant Toys R Us? World 4 Kids didn’t last long, and now the protagonist – which still has outlets across Australia – appears to be in financial trouble.

And just as Toys R Us could fall off the shelves, Amazon is planning to open its second HQ in another US city. Meanwhile, there’s widespread talk that retail behemoth Amazon could launch in Australia this side of Christmas. Look out Coles and Woolies!

It’s tough in retail everywhere, as we’ve been saying for a long time. Over in New Zealand, after collapsing in Australia a few months back, the New Zealand leg of the fast fashion business Topshop has now cracked.

Fast fashion is furious. Handbag sales for designer brands are soaring, with one brand touting a 600 per cent rise for the first half of 2017.

Here’s a think piece on why these billionaires need to stop looking up to the same old economists.

This WSJ writer is confident because we survived spreadsheets, we can survive artificial intelligence.

Investor Charlie Munger gives weight to “anti-goals” over goals for achieving happiness and success in life.

Harvard also reckons if you want to come up with a good idea, start by imagining the worst possible idea.

Why Yale owns a forest.

Did Trump solve the debt ceiling crisis this week? No, he just delayed it.

Hurricane Irma has brewed up something fierce across the Atlantic — and if it seems off the charts, that’s because they’re claiming it is.

144 million Americans are feeling nervous today — on top of those already suffering from geopolitical and hurricane jitters. This is among the worst data breaches ever.

Someone put it well this week about Brexit: “If you leave the world’s largest free trade area because you believe in free trade, you're bound to confuse people”. Several industries have expressed their concerns, with science now having their say.

If you’re feeling like your social media feeds are clogged with negativity, you’re not the only one.

A major UK PR firm is erring on collapse after accusations of inciting racial hatred. It’s not the first time they’ve been caught up in controversy.

Have a good weekend.

Back to Top