The trouble with trading on China's good fortune

Australian trade is expected to drive economic growth over the next few years, but that won’t occur without a few hiccups, such as in April when our trade balance slipped into deficit. The biggest concern for Australian trade remains its greatest strength -- China -- and our reliance on China leaves us particularly vulnerable if its economy slows.

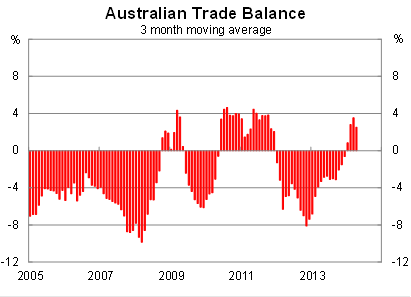

Australia ran a modest trade deficit during April -- the first since December -- providing a relatively poor start to the June quarter for trade. The result missed expectations for a $510 million trade surplus.

The result followed a strong start to the year, which was enhanced further by unseasonably warm weather. The graph below shows the trade balance over a three-month period.

The value of exports fell by 1.5 per cent in April, to be 11.4 per cent higher over the year. By comparison, imports rose by 2.2 per cent in the month, to be 6.6 per cent higher over the year.

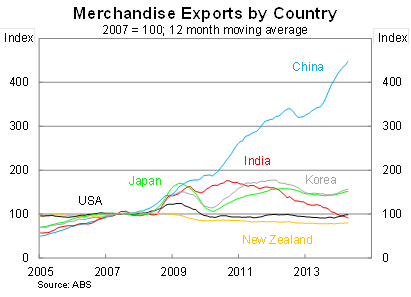

Exports to China rose by 25 per cent over the year to April and now account for almost 40 per cent of all merchandise exports. Exports to Japan and Korea were up by 8.3 per cent and 17.3 per cent respectively over the year. By comparison, our exports to India are down by a third since April last year.

The graph above provides a fair indication of our reliance on China to drive growth. In the national accounts, net exports contributed 1.4 percentage points to real GDP growth -- its largest contribution in five years (A focus on GDP misses the bigger picture, June 4).

By comparison, the domestic economy performed relatively poorly with gross national expenditure (which excludes trade), declining by 0.3 per cent in the March quarter. It’s fair to say that the beginning of 2014 has been a struggle for many Australians, consistent with a subdued job market and weak wage growth.

Our reliance on China hasn’t caused us any problems thus far, but recent speculation regarding Chinese property and the economy in general poses a risk that is hard to ignore. On a daily basis there are articles and analyses trying to understand the ‘black box’ that is China’s economy and the state of its financial sector.

China may be difficult to understand at the best of times. However, the rule -- where there is smoke there is usually fire -- applies to them just as easily as it does to other economies. Needless to say if the Chinese economy does sour, our trade balance will take a hit and the Australian economy will be left with few thriving sectors and limited monetary stimulus available.

Based on the current outlook for China, trade should remain upbeat over the remainder of 2014. However, the RBA noted on Tuesday in its board statement that it expected export growth to be weaker in the quarters ahead.

We shouldn’t be too concerned about the trade deficit in April. The monthly trade data is extremely volatile and we could bounce back with a solid surplus next month. Nevertheless, it reinforces how important it is that the economy continues to rebalance.

March quarter GDP provided a timely reminder that the economy remains too reliant on China and we desperately need a lower dollar to boost spending and investment throughout the non-mining economy. A strong contribution from trade is always welcome but it is not by itself sufficient for a thriving domestic economy.