The trends that will tame the Australian dollar

Could exchange rate relief be right around the corner? A capital flow analysis of the resource sector by Reserve Bank of Australia assistant governor Guy Debelle suggests that this could be the case.

The Australian dollar has proved fairly resilient over the past six months. Despite attempts by the RBA to talk the dollar down, its efforts have thus far proven unsuccessful.

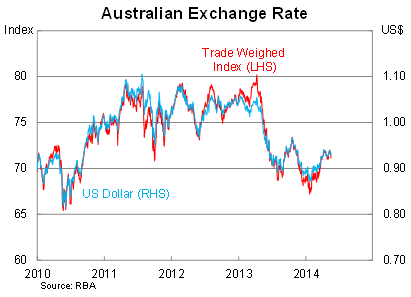

Nevertheless the dollar is well below where it was a year ago. The Australian dollar has depreciated by 10.4 per cent against the US dollar over the year to April and almost 9 per cent against the trade weighted index.

Unfortunately, some of the good work has been unwound as the dollar has made significant gains against Australia’s major trading partners since the beginning of the year.

The RBA has made it fairly clear in its public comments that it would prefer the dollar to push lower in order to facilitate the rebalancing of the Australian economy towards non-mining sources of growth.

The good news for the central bank and exchange-rate sensitive businesses is that there are compelling reasons to believe that the dollar should begin to depreciate further.

In an interesting though occasionally dense speech yesterday, Debelle discussed recent trends in capital flows and the implications for the Australian dollar. He suggested the dollar could depreciate further as foreign capital flows begin to slow following the end of the mining boom.

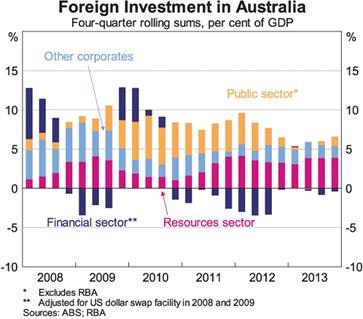

As a result of a persistent current account deficit, Australia has benefited from a high level of foreign investment. In recent years, most of this has been directed towards “expanding the capacity of Australia’s resources sector in order to meet growing demand for our bulk commodities”.

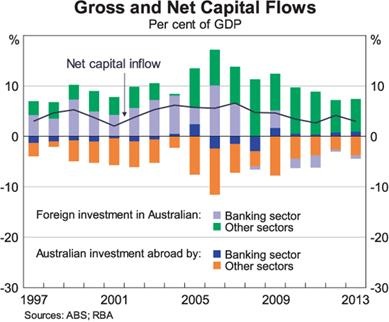

Despite the mining boom, Australia’s net capital inflows have slowed since the global financial crisis began. This mainly reflects a global decline in cross-border capital flows rather than an Australia-specific phenomenon.

The graph below highlights three interesting trends. First, since 2011 the resource sector has accounted for around 70 per cent of all foreign investment to Australia’s non-financial corporate sector. Second, Australian banks have shifted their funding base away from foreign wholesale debt towards deposits. Third, there has been a noticeable rise in foreign holdings of government debt.

Rather than borrowing from Australian banks, resource companies have accessed foreign debt markets directly. This partially explains why business credit – which is tied more to the performance of the non-mining sector – has remained so weak despite historically low lending rates.

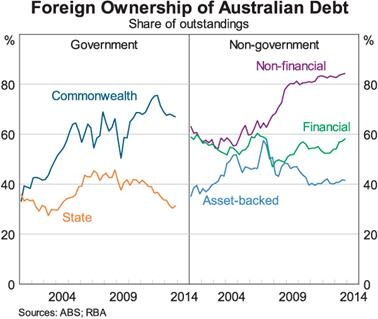

Another important factor has been the rise in capital inflows to the public sector, owing to the rise in government debt issuances. The share of foreign ownership of Australian government debt issuances has increased from 50 per cent in the early 2000s to around 70 per cent currently. This is particularly notable given the stock of issuance has increased five-fold over that time.

Given Australia’s AAA credit rating, Australian government debt has provided a relatively high return compared with other reserve currencies, while also offering some diversification benefits for asset managers. Despite the domestic view that we have a budget emergency, our government debt is viewed highly among international asset managers.

Debelle believes that “the bulk of sovereign asset managers now have Australian dollar assets as part of their portfolios, so there are not many new buyers left to emerge”. In other words, he expects the demand for Australian dollars originating from asset managers to ease.

Capital inflows are likely to fall further as the mining investment boom shifts towards the production phase since most of the financing has come from foreign investors. The sector should also experience higher export sales and profits, which should result in higher dividends that again would lead to a capital outflow to foreign investors.

The resource sector’s impact on capital flows is complicated by imports from abroad, but Debelle says that on net “we might expect to see reduced capital flows and reduced demand for Australian dollars as the resources sector moves into the production phase”.

Debelle also believes that foreign holdings of government debt could be quite sticky but noted that there could be greater demand coming from Japan. But there is limited evidence of this so far.

Readers should bear in mind that “the ability of economists to forecast exchange rate movements is notoriously poor”. But with capital inflows to the mining sector set to decline significantly in coming years, combined with the mounting evidence that China will slow and the recent decline in iron ore prices and our terms of trade, it seems reasonable to believe that exchange rate relief will arrive for Australian businesses sooner rather than later.