The trade war shadow hanging over solar

Over the past few years, the solar photovoltaic panel industry has overcome many challenges, including reduced incentive levels in major European markets, an oversupply of PV components stemming from rapid investment by Chinese suppliers, and continuous downward pressure on pricing and margins for manufacturers.

However, in the past few quarters, the solar PV environment has improved as uncompetitive capacity has been removed from the supply-side and declines in installed system prices have opened up previously unavailable markets to downstream project developers.

Top tier suppliers are now reporting stabilised pricing and operating profits, and some are starting to consider increased investments in production facilities, a significant development after the industry saw an eight-year low in new capacity investments in 2013.

However, a hangover of sorts continues to impact the industry in the form of global trade disputes.

These disputes arose during the downturn, as domestic manufacturers in several global markets claimed unfair competition on the part of foreign (primarily Chinese) suppliers. This led to trade investigations being launched in most major solar markets, including the European Union, the United States, India, and China.

Each trade dispute has its own set of factors that influence the timing, scope, and potential impact. Until now however, the most damaging aspect of these disputes has been uncertainty introduced within each market.

Just recently, more announcements have been made based both on previously launched cases and new trade investigations. Within the EU, Chinese glass manufacturers will have duties imposed for five years; India has announced that it found evidence of dumping by foreign manufacturers; and Australia launched an anti-dumping investigation concerning Chinese PV modules.

In terms of the most recent announcements, the overall impact of the global PV industry is likely to be limited, especially compared to other trade disputes such as the US and EU investigations. While both Australia and India are considered top 10 global markets, their combined global demand share in 2013 was less than 5 per cent.

Furthermore, manufacturing capacity – while it does exist in both markets – makes up a minimal percentage of global production capacity, is often restricted to local consumption, and is currently unable to fully serve domestic demand without significant investment in new capacity.

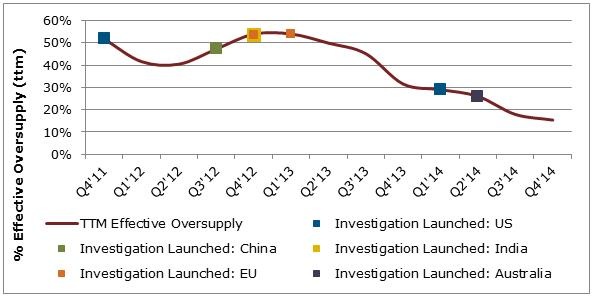

The figure below shows the global effective oversupply of PV modules on a trailing-12 month basis, with each point representing the start of a new trade investigation. It is clear that the industry balance has changed significantly since many of these investigations were launched. Given that proceedings can often take months (if not years) to reach a conclusion, any outcomes are likely to be valid within a different industry environment than the one in which they were initiated.

Global PV industry: Effective oversupply and trade dispute timeline

Source: Adapted from NPD Solarbuzz Quarterly, March 2014

With project development now accounting for the majority of solar industry revenues, it begs the question: why would countries continue to pursue trade investigations that have the potential to damage downstream developers?

The reality however, is that trade investigations are being initiated, not by the countries themselves on behalf of the local PV industry, but by upstream PV suppliers, and often as a last resort.

Downstream developers and installers have kept well clear of jumping on the trade war bandwagon, and in most cases, have been strongly opposed to actions taken out by their respective governments. Ultimately, downstream channels simply want to install as much solar capacity as possible, and have the widest range of supply available from a purchasing perspective.

And as such, any uncertainty introduced to affect the supply of PV components or the financing of PV projects is seen as having a stronger negative impact on the industry than any potential market-share gains that would result in a positive trade ruling for local PV manufacturers.

Originally published by NDP Solarbuzz. Reproduced with permission.