The Ticker: Modern business life

On today's blog:

- Why the Australian government's latest report on automation ignored the rise of self-driving cars

- Abbott's ‘budget emergency' narrative has finally sunk in

- Out of luck? This graph shows why we've had it so good for so long

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

1.30pm - Why the Australian government's latest report on automation ignored the rise of self-driving cars

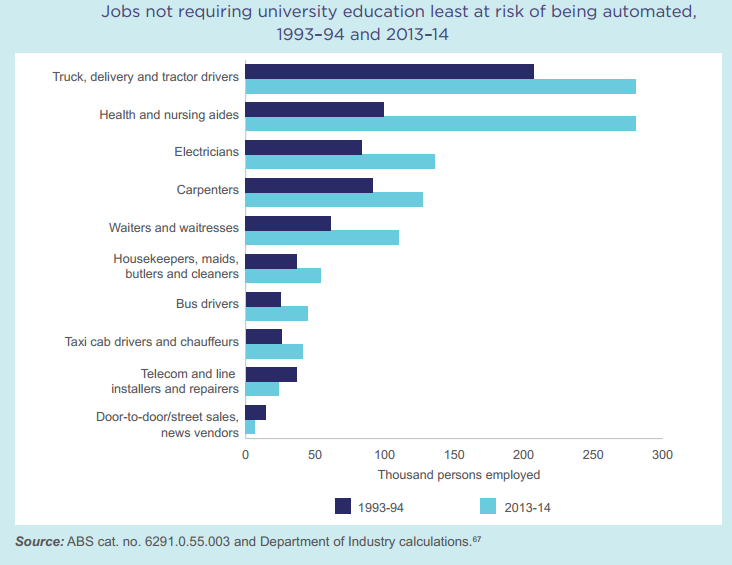

Can you spot what's wrong with this graph?

It's perhaps the biggest and most notable tech trend of 2014, yet it's missing from the government's latest research on the future of Australian industry.

According to the government's latest report, truckies, bus drivers and taxi drivers are among the least likely to have their job replaced by automation within the near future. But anyone tied to the technology sector would know that all three of these jobs are in the firing line for disruption by self-driving cars.

The wheels of disruption are already in motion. Regulation is changing ahead of the self-driving car revolution. For example, the UK passed laws earlier this year to allow self-driving cars on the road, well before their anticipated mainstream release. The state of California followed suit just a couple of months ago.

Closer to home, Business Spectator has already documented how BHP Billiton is using automated trucks to cut costs and drive productivity.

Mainstream adoption of the technology could occur sooner than we think. According to Accenture's Australia and New Zealand digital lead David Maunsell, so far analyst reports and estimates have consistently overshot the pace of the trend. He believes the forecast made by former General Motors corporate vice-president Larry Burns -- that self-driving cars will be mainstream by 2018 -- is too conservative.

This all begs the question: why wasn't this mentioned or accounted for in the report? The answer is rational, albeit convoluted.

According to Mark Cully, the report's main author and chief economist at the Department of Industry, the report attempted to replicate and localise a prior MIT study into job automation. It suggested that role automation depended on the nature of the role: routine tasks could be automated, whereas manual and abstract tasks could not.

Here's the problem: for control, this study negated any influence of current or future technology. It simply considered the nature of the roles in isolation.

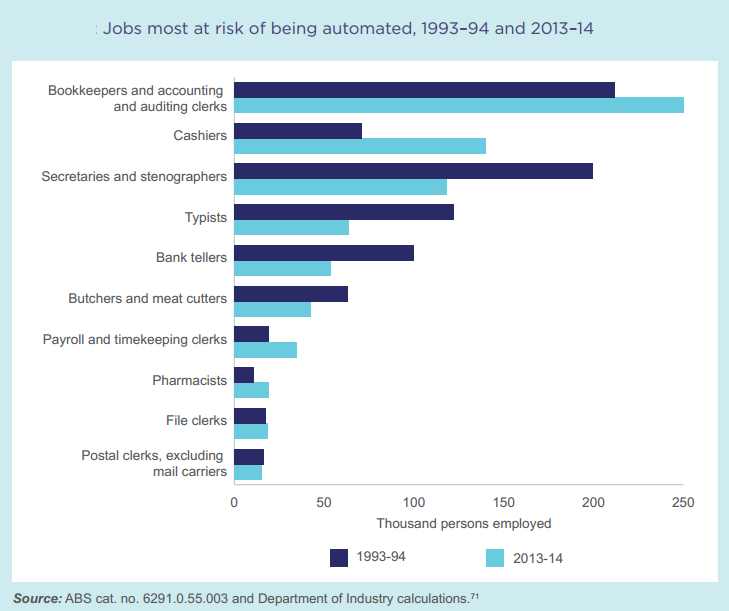

It basically said that routine jobs, like the ones below, could be automated.

The report also suggested that roles which include manual labour or abstract work would be more difficult to replace with machines. But this isn't exactly the case. In fact, another study from Oxford University considers taxi and truck drivers roles to be significantly more endangered by automation.

Regardless of the report, Cully believes automation will, in fact, disrupt the transport sector.

“As well as trucking, it [automation] may also affect mining, insurance, and public and private transport, including taxi services,” he told The Ticker.

“Equally, as the report makes clear, new technologies create all sorts of new job opportunities, as well as the benefits they offer consumers in lower prices and higher incomes,” Cully added.

This situation is an important lesson in interpreting research on automation and even wider technological disruption. Regardless of the figures or the credibility of the research, sometimes the most logical answer is indeed the most accurate one.

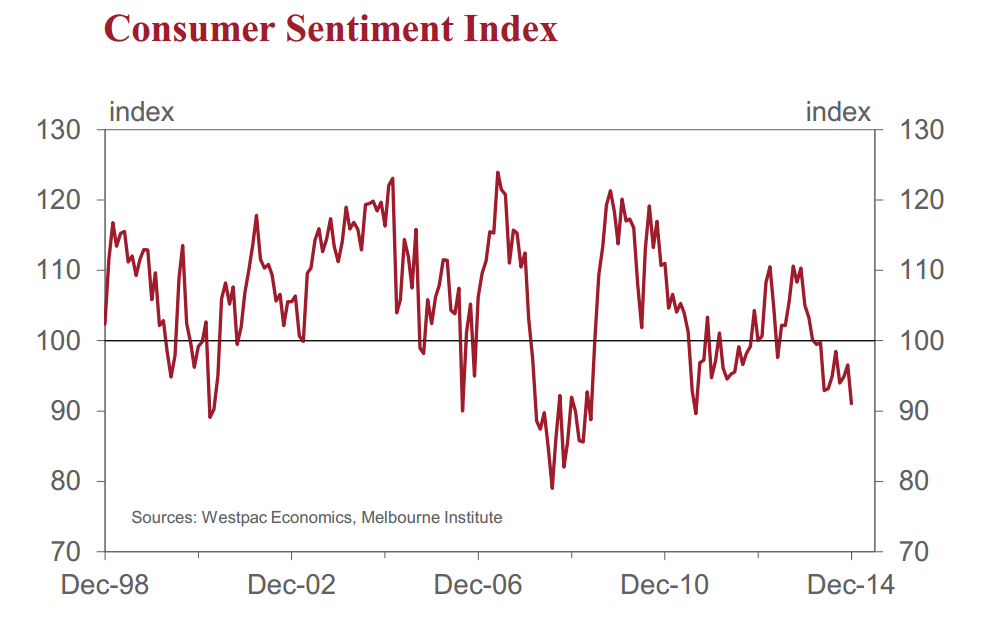

11.40am - Abbott's ‘budget emergency' narrative has finally sunk in

In some shocking news for Christmas retail, consumer confidence was today reported to have hit a three-year low.

But there's another interesting revelation buried in the report: We're hitting new records in terms of our downbeat interpretation of economic news. As Westpac's chief economist Bill Evans notes below:

“The survey provides us with a specific measure of those news categories which most affected respondents and whether they were assessed as favourable or unfavourable. The most recalled news topics were: ‘economic conditions' (59.2 per cent of respondents); ‘budget and taxation' (52.7 per cent); ‘international conditions' (26.3 per cent) and ‘employment' (19.5 per cent).

“Respondents assessed the news to be extremely unfavourable for all of these categories. Of those giving an opinion, 87 per cent viewed news on ‘economic conditions' as unfavourable; 83 per cent viewed news on ‘budget and taxation' as unfavourable and 96 per cent viewed ‘employment' news as unfavourable.

“These are the most negative responses on ‘economic conditions' news recall since March 2001; on ‘budget and taxation' since September, 1986; and this is the worst set of figures for ‘employment' since the beginning of the survey in December, 1975.”

It's hard to tell whether this is a win or a loss for the government. Its poor timing given Christmas retail, but, after a year of talking up a ‘budget emergency', Prime Minister Tony Abbott's narrative has finally sunk in.

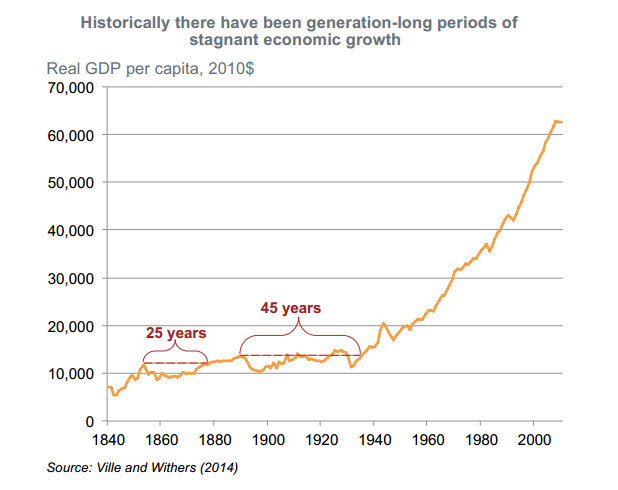

10.40am - Out of luck? This graph shows why we've had it so good for so long

For as long as this reporter can remember, Australia's always been described as the lucky country. Perhaps it's because of our stunning beaches or our laid back culture. But many often use it to refer to our nation's prosperity.

It wasn't always this way. Take a longer term view of Australia's economic growth, and it becomes apparent that this comprehensive rise in wealth and living standards is really a just a product of the past 70 years. It's a point that's buried in the Grattan Institute's latest report on generational wealth.

The Grattan Institute notes:

“While the growth of the last 70 years has set expectations, it may have been an anomaly when seen as part of a longer history.”

“Many decades of strongly growing prosperity do not guarantee more of the same into the future. The economic stagnation across much of Europe and the United States shows how economic growth can remain low for a decade or more.”

So, has Australia had it good for too long? Has our luck finally run out?

It all boils down to two factors: terms of trade and productivity. The first is being dragged down by weaker prices for our mineral exports, and the second hinges on whether emerging technologies can compensate for an ageing population in terms of allowing us to produce more goods and services per person. The last point is a debate in itself; economists are split as to whether the digital revolution will have the same growth impact as the industrial revolution.

The report plainly states that this outcome could be avoided with significant political reform, namely tax reform, increasing female workforce participation and elderly workforce participation.

But the report's pessimism on the likelihood of change is palatable:

“Major reform is always hard, both to formulate and to implement. The current political climate – particularly the 24-hour news cycle, the lack of crisis to motivate change, and the lack of funds to buy reform – increases the difficulty.”

9am - Interesting reads from around the web

Think the name is bad? It gets worse: BHP Billiton failed to secure the domain name 'South32.com' for its new spin-off and now cybersquatters are holding it for ransom.

Olympics 2.0: The International Olympics Committee just introduced a raft of reforms that could radically reshape the global event.

Shopping like its 1899: How the internet is reviving the ancient art of haggling.

Hold that thought: Why your brain loves procrastination.

Could this end Australia's Game of Thrones piracy spree? HBO just revealed the inner workings of its plan to broadcast the popular series over the web, rather than through a cable or streaming service.