The Ticker: Modern business life

On today's blog:

- Australian companies are convinced that flu shots and health checks will stop you from taking sickies

- Ten global market stats that sum up 2014

- The end of cheap overseas holidays? Four graphs on how the dollar affects our vacations

- Strong case for more RBA rate cuts: Credit Suisse

- Why Facebook's play for the workplace won't kill LinkedIn

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.05pm - Australian companies are convinced that flu shots and health checks will stop you from taking sickies

Has your company offered you a flu shot this year? Before you thank them for it, it's worth noting that a majority of firms around Australia believe a flu shot is the most effective means of stopping you from skipping work. Up to 42 per cent of companies think that health-focused initiatives are the most effective means of curbing workplace absences.

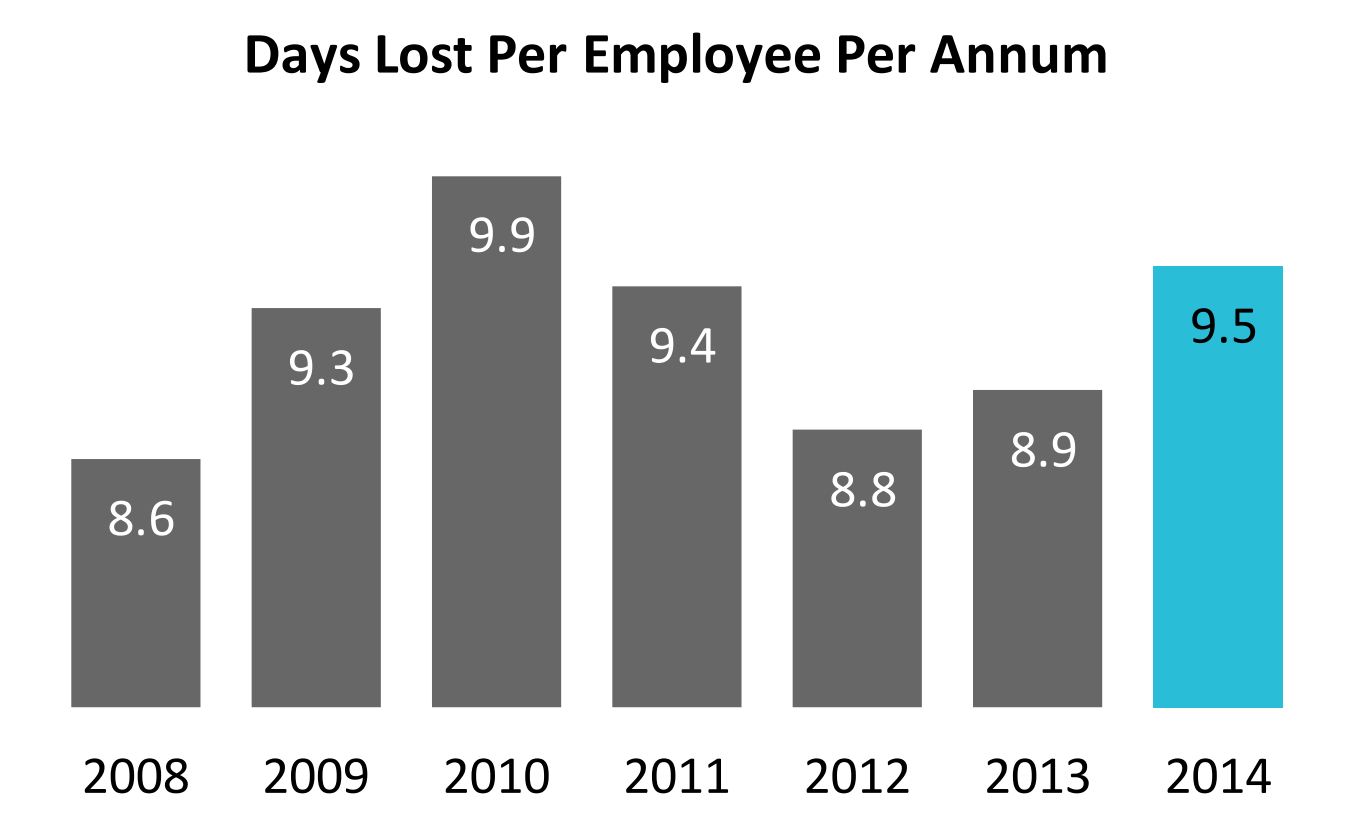

A new survey of over 100 companies from Direct Health Solutions found the average employee takes around 9.5 unscheduled days away from work per year. The figure has jumped in recent years, although it hasn't quite hit the peak reached in 2010.

The survey also found that sick days are the most common cause of absenteeism. Chucking a ‘sickie' came in as the third most common cause for ditching work.

It also found that there were fewer instances of absenteeism among smaller firms.

But back to the flu. The report makes an interesting point about employee entitlement: it suggests that more stringent sick day enforcement and monitoring systems are the most effective means of cracking down on ‘sickies'.

Yet companies are heading in the opposite direction, focusing on enhanced health and wellbeing programs instead of basic HR. Most (around 40 per cent) said they had reviewed their absence policy, but only 26 per cent said they had put in place a basic check that would monitor and review staff members with a record of absenteeism.

There's nothing to say that more onsite perks are a bad thing; more office massages wouldn't go astray. But if the goal of all of these incentives is to avoid employee absences, then companies need to realise that sometimes the simplest measures are often the best.

1.20pm - Ten global market stats that sum up 2014

By Chris Kohler, BusinessNow

As 2014 slowly begins to wind down we can start to tally up the score, or survey the damage (depending on where you're sitting).

Here are a few favourite facts and stats of 2014 from Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch – and they're pretty damning.

What's a key takeaway? According to the year ends with asset markets and the bull case for risk assets “embarrassingly dependent” on central bank intervention.

Global central bank assets (including FX reserves) now stand at $US22.6 trillion (a sum larger than the combined GDP of US and Japan).

- 83 per cent of world equity market cap is currently supported by zero interest rate policies; and 50 per cent of all government bonds in the world currently yield 1 per cent or less.

- Government bond yields fell to all-time lows in 2014 in Japan, Germany, France, Spain, Italy, Ireland, Portugal, Sweden, Korea, Czech Republic, Hungary, Poland (to name a few).

- And yet the total return from global government bond markets in 2013 and 2014 combined is on course to fall 4 per cent, the worse 2-year return since the early-80s.

- This year's best performing asset was the US Dollar (11 per cent annualised). It bested global equities (6 per cent), fixed income (2 per cent) and commodities (-17 per cent).

- Copper is down 11 per cent (annualised), silver -22 per cent, the price of Brent crude oil on course for a 31 per cent slump – deflation the theme of 2014.

- US equities (14 per cent annualised) stunningly outperformed European equities (-6 per cent) by the widest margin in 40 years (1976).

- The best performing global equity market is reforming India (36 per cent annualised); worst are non-reforming Greece (-39 per cent), Portugal (-35 per cent). Russia (-28 per cent).

- Only double-digit yields left: Venezuela (22.6 per cent), Ukraine (15.6 per cent) in $-denominated debt; Egypt (14.1 per cent), Nigeria (12.6 per cent), Brazil (12.3 per cent) & Russia (10.0 per cent) in local currency debt.

- Finally, Apple's market cap ($US662bn) is now $US170bn bigger than market cap of all the eurozone banks combined; and just shy of MSCI market cap of both Latin America ($695bn) and EMEA ($704bn)

12.15pm - The end of cheap overseas holidays? Four graphs on how the dollar affects our vacations

Say goodbye to sunsets on Kuta beach, and hello to the Gold Coast.

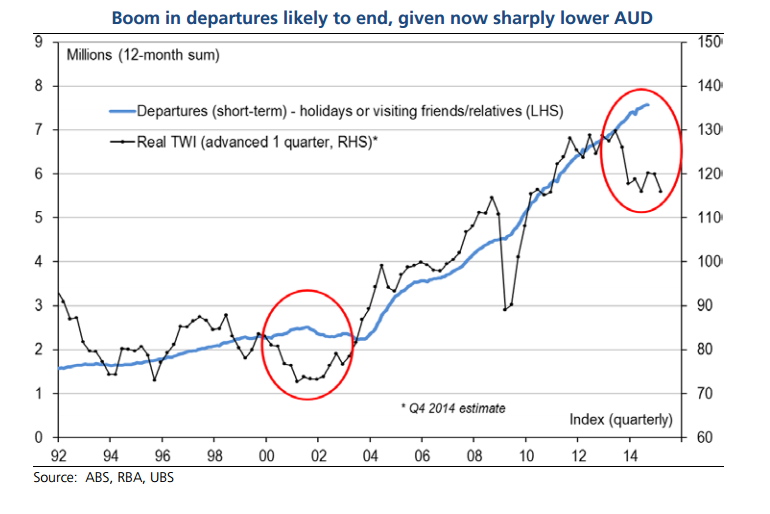

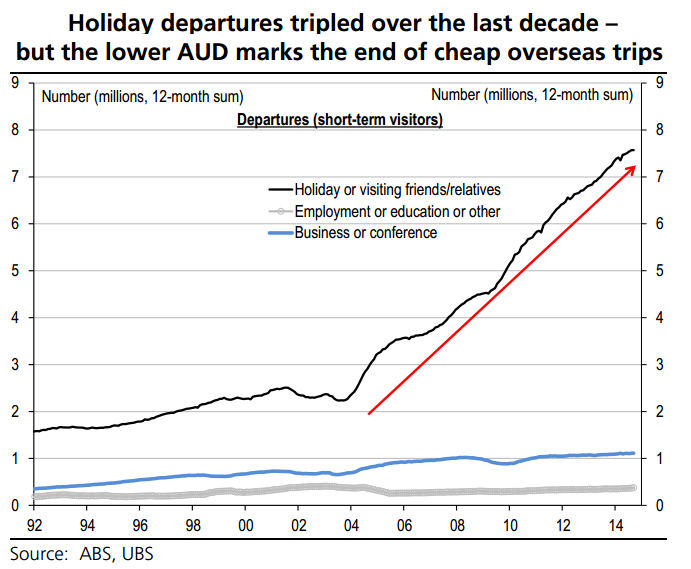

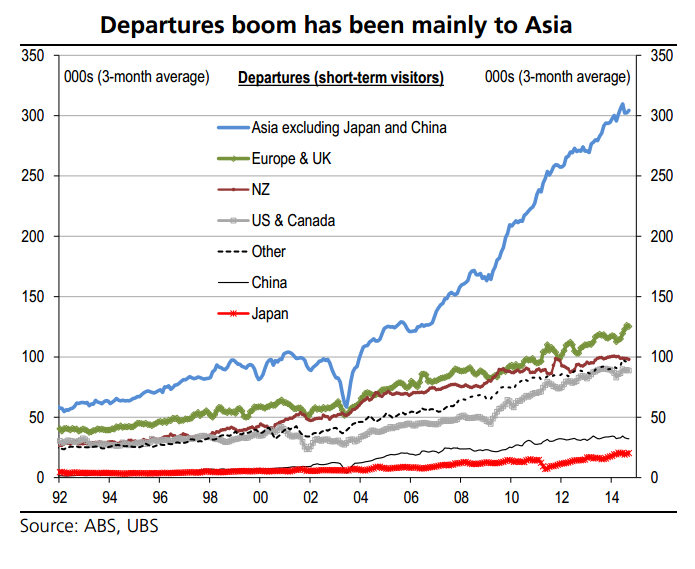

We've long known that the Australian dollar impacts both domestic and global tourism in Australia. In its latest analyst note, UBS analysts spelled out this correlation, arguing that a sustained decline in the Australian dollar may also lead to a boost in internal tourism by making overseas trips financially less attractive than domestic holidays.

Here's what they found:

1. In recent years, departures have climbed in line with the rise of the Australian dollar, as indicated below by the trade weighted index -- a measure that takes into account the value of the dollar against all currencies. With the dollar falling, the boom in departures is set to come to an end.

2. And no, there hasn't been a boom in corporate travel. The majority of this movement has been for holidays.

3. No surprise, we're largely vacationing in South East Asia.

4. Lastly, as a result of the high dollar, we're spending more while abroad.

10.40am - Strong case for more RBA rate cuts: Credit Suisse

By David Rogers, BusinessNow

There's a strong case for more interest rate cuts in Australia, according to Credit Suisse.

Its predictive model of the cash rate, which includes business and consumer confidence, inflation expectations and unemployment, suggests interest rates could fall to 1.5 per cent (implying three more rate cuts) in the year ahead.

“Confidence is low and consistent with weak growth,” Credit Suisse strategists Damien Boey and Hasan Tevfik say. “Inflation expectations are falling and the unemployment rate is rising. Also, mortgage principal repayments are rising, as interest-only loans reset. All factors point to lower rates.”

10.25am - Why Facebook's play for the workplace won't kill LinkedIn

Facebook is currently working on a new workplace-focused product aimed merging social media with corporate communications, the FT reports.

At face value this seems like a direct attack at LinkedIn's turf and perhaps Google's data storage dominance, given the service will reportedly contain a document storage feature. But this snippet actually hints at the service's true purpose: competing with enterprise social media services like Yammer and Slack.

Enterprise social networks are products designed around improving productivity, office knowledge sharing and efficiency in the workplace. They contain services that most regular office workers already use -- calendars, event planners and chatrooms -- but they meld them under one umbrella and improve their usability.

Yammer drew attention to this area of social media last year when it was purchased by Microsoft for $1.2 billion. More recently, Slack has been drawing headlines for its staggering level of growth in the past 12 months.

Here's a chart of its user base from earlier this year.

Slide from @SlackHQ update deck. I have never seen viral enterprise app takeoff like this before--all word of mouth. pic.twitter.com/oTkUDAQbXX

— Marc Andreessen (@pmarca) February 10, 2014And here's a more recent chart from Quartz.

Facebook declined to comment to FT. We reached out for comment from the company's local arm, and will update this post as soon as we hear back.

Facebook won't kill LinkedIn, but if the report holds true, you could be using it in your workplace sooner than you think.

9am - Interesting reads from around the web

The next population challenge. Are we so focused on planning for population growth that we're ignoring pockets of future population decline?

The data divide. While wealthy nations are drowning in information, developing countries are suffering a data drought.

All out of hype. It's yet to be launched, but now testers and developers are losing interest in Google Glass.

The pursuit of status: even without deregulation Australia's universities are obsessed with rankings and research at the expense of student outcomes.

Wasting time on the internet? There's a course for that.

And a bonus: Here's a link to the G20's Brisbane action plan (pdf).