The Ticker: Modern business life

On today's blog:

- Friday funny: The real boss of the Xi household

- G20 country debt in one handy infographic

- The G20 has turned parts of Brisbane into a ghost town

- Four graphs on how Australia is tracking in CEO gender equality

- Three tips for investing in emerging tech start-ups

- Backing themselves: The ASX executives with the largest holdings in their own company's stock

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3pm – Friday funny: The real boss of the Xi household

From the APEC summit earlier this week:

It's all in the look. We originally found this graphic on Shanghaiiist.

Have a great weekend.

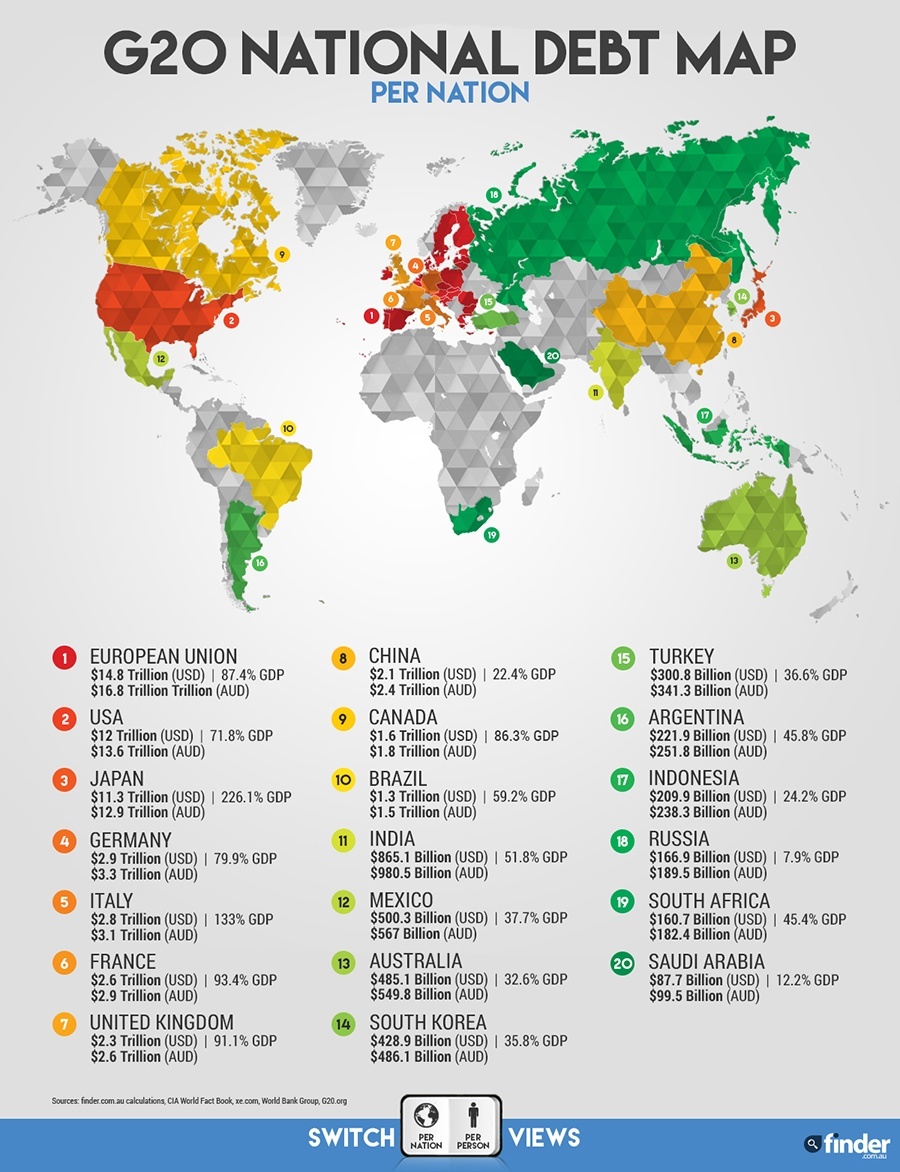

2.30pm - G20 country debt in one handy infographic

1.05pm - The G20 has turned parts of Brisbane into a ghost town

The peak hour view up Anne St this morning from Fortitude Valley. #G20 @612brisbane pic.twitter.com/Pb5hczNAVU

— Michael James (@MichaelJames_TV) November 13, 2014This is to be expected, given the size of the area being cordoned off to ensure the safe arrival and meeting of the leaders. But the pictures on Twitter are still pretty amazing.

Empty Brisbane for #G20 @SBSNews pic.twitter.com/zjytC55DQ0

— Stefan Armbruster (@StefArmbruster) November 14, 2014So empty! #g20 @ABCNewsBrisbane pic.twitter.com/Ob0vhCzdlU

— Stephanie Smail (@sjsmail) November 13, 2014You can see more tweets on News.com.au

12pm - Four graphs on how Australia is tracking in CEO gender equality

Gail Kelly's resignation sees female CEO representation in ASX Top 50 drop by a third. Now there will be two. Shame #ausbiz @LizBroderick

— Elysse Morgan (@ElysseMorgan) November 12, 2014The pursuit of gender equality in the upper stratosphere of Australia's corporate world took a tumble yesterday after Westpac's CEO Gail Kelly announced her retirement.

So, on the back of this, how are we faring in CEO gender equality? Here's the data.

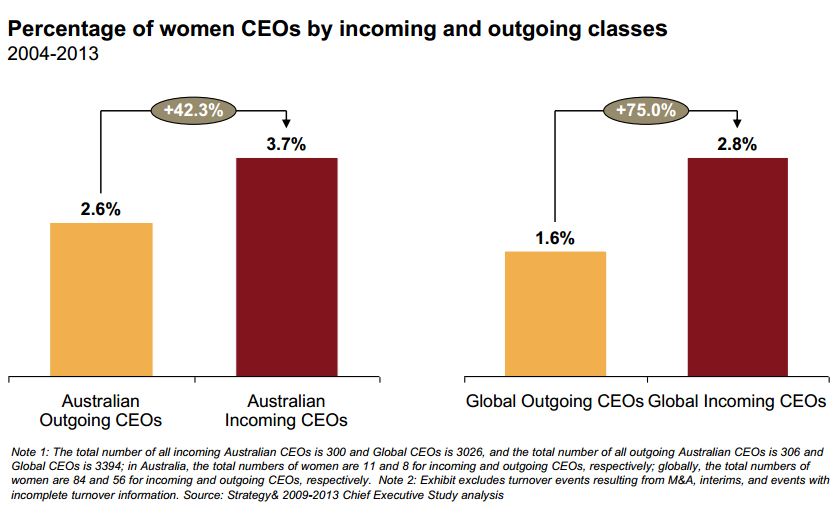

Over the past decade the net number of female CEOs in Australia has grown, but not as much as it has globally.

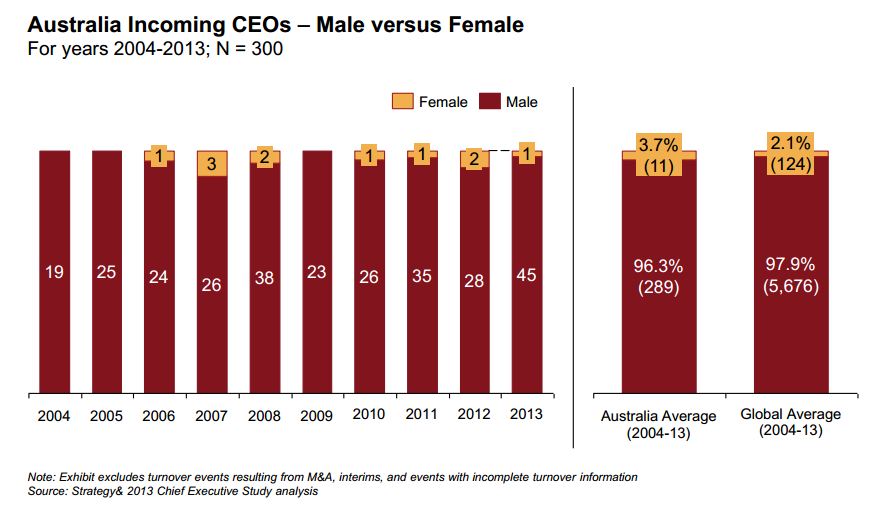

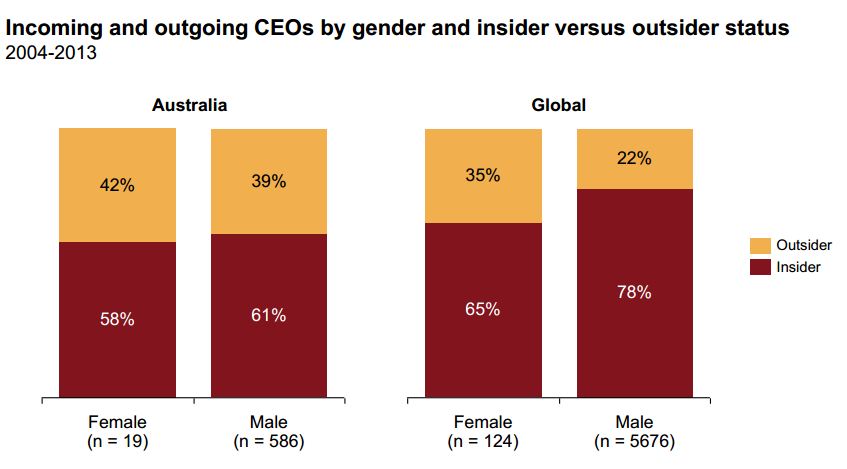

Here's a breakdown of that last graph.

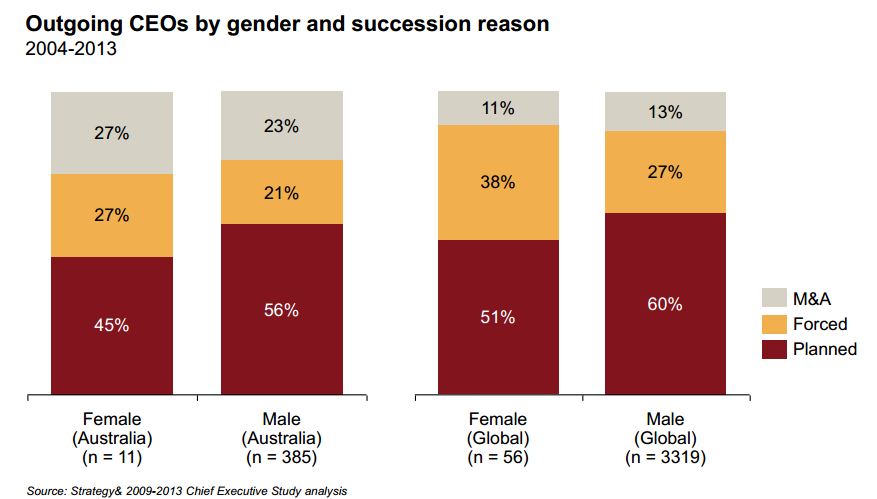

More bad news: Women CEOs – in Australia and globally -- are more likely to be forced out of office than men.

As for their replacement? Australian companies tend to favour outsiders more than the rest of the globe.

11.25am - Three tips for investing in emerging tech start-ups

There's no denying that Australian investors have an appetite for our emerging tech start-up sector, and the returns they can deliver.

With the government poised to eventually change the laws around start-up crowdfunding and investment, now is a good time for investors of all flavours to get clued up on what to look for in a potentially successful young technology business.

On that, Rui Rodrigues of Australian venture capital firm Tankstream Ventures, published this new video with LiveWire outlining what he looks for in a tech start-up. Here's the top three tips will pulled from it.

1. Make sure you truly understand the technology, where it fits into the current tech ecosystem and the evolutionary course of the industry it affects before you invest.

2. Look for strong adoption and subscription numbers. Any figures that indicate engagement are also important – possibly more important than raw user figures.

3. Track record matters. Take note of the past experience of the founders and their past ability to execute. Use this to evaluate the likelihood that they will deliver on their business model.

You can watch the full video below.

10.45pm - Backing themselves: The ASX executives with the largest holdings in their own company's stock

So, we now know that around one in 10 company CEOs, directors and chairmen did not hold shares in their own company in 2013. But, what about the remaining 90 per cent that did?

In addition to yielding this interesting factoid, the Australian Council of Superannuation Investors also listed Australia's largest corporate shareholders. We've charted them below.

It's worth noting that mining firm Fortescue's major executives appear to back themselves more than senior figures at any other company.

9am - Interesting reads from around the web

Get ready for a weekend of talk about growth: What to expect from the G20 and why we should expect more.

The subliminal secrets of junk mail, and what we can all learn from their tricks.

Three cannonballs, four ships. How Cooktown in far north Queensland has been preparing for a Soviet invasion – even before the Russians were called ‘the Soviets'.

After several key mistakes and flat revenue growth, investors want Yahoo CEO Marissa Mayer out. But here's why they should keep her.

The beginning of the end for clickbait? How publishers can improve revenue without having to strive to drive masses of traffic.

Back-peddling before the G20? Former prime minister of Luxembourg Jean-Claude Juncker says he's not the architect of the country's tax mitigation regime and is calling the EU to take action on tax evasion.