The Ticker: Modern business life

On today's blog:

- Aussie dollar will buy less than 80 US cents in 2015: Merrill Lynch

- Underestimate Virtual Reality and Oculus Rift at your peril

- Why the RBA thinks you won't be asking for pay rise any time soon

- Why business leaders may be overhyping Australia's productivity pitfalls

- A million Cattle worth a billion dollars'; Aust-China deal in pipeline

- Why international students are Australia's best tie to a globalised world

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

4.15pm - Aussie dollar will buy less than 80 US cents in 2015: Merrill Lynch

By Chris Kohler, BusinessNow

The Aussie dollar is going to be the weakest major currency in 2015, according to David Woo, head of global rates and currencies research at Bank of America Merrill Lynch.

Mr Woo says Australians should prepare themselves for the currency falling below 80 US cents next year as the investment that artificially boosted the unit disappear.

“Next year we're going to see a slowdown of capital inflows into Australia that is not going to be sufficiently offset by any improvement in the trade balance. So the Aussie dollar is going to struggle next year – regardless of what happens in China,” Mr Woo said.

The AUD will simply keep falling in the near future as investment is stripped away, according to the currency expert.

4.05pm - Underestimate Virtual Reality and Oculus Rift at your peril

By now, you've likely heard of Oculus Rift and if you're not interested in video games then you may have shrugged it off as an irrelevant piece of tech. This post is a quick attempt to change your mind.

Let's start with the obvious: the Facebook buyout.

Earlier this year, Facebook scooped up Oculus for a cool $2 billion and in announcing the buy founder Mark Zuckerberg went to some length to explain the opportunities for the platform outside of gaming.

“After games, we're going to make Oculus a platform for many other experiences,” he said.

“Imagine enjoying a court side seat at a game, studying in a classroom of students and teachers all over the world or consulting with a doctor face-to-face -- just by putting on goggles in your home.”

“These are just some of the potential uses… One day, we believe this kind of immersive, augmented reality will become a part of daily life for billions of people.”

Still not convinced? Well, in anticipation of this vision, some businesses have already started dabbling with the technology.

Here's a quick list of some of the more interesting examples we could find:

- Marketers in the tourism and auto industry are preparing for an era virtual-tour related campaigns to capitalise off the rise of virtual reality technology. (This is the most obvious one)

- Researchers are using the Rift to develop new treatments for post-traumatic stress disorder, anxieties and phobias.

- The Rift is also being used in the development of new architecture tools that allows architects to visualise and potentially alter building plans in real-time.

All this being said, the first hurdle for the Oculus and its mainstream uptake lies in the gaming sector.

Read more about this in our preview of the Rift.

2.55pm - Why the RBA thinks you won't be asking for pay rise any time soon

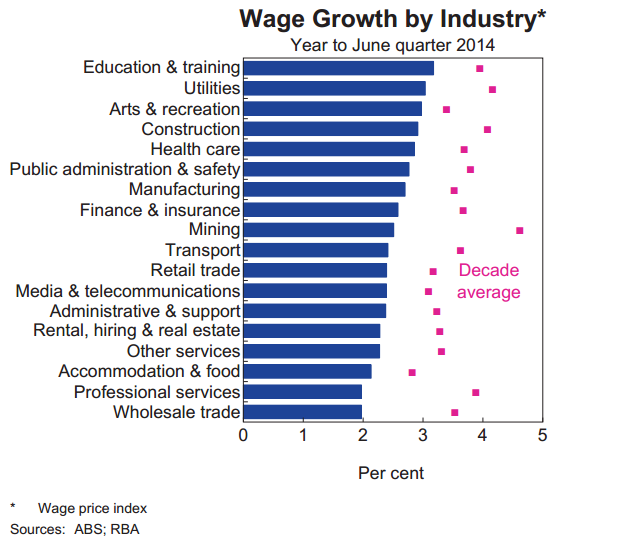

Palmer United Party senator Jacqui Lambie may be up in arms over defence's annual pay rise falling below inflation, but it seems most industries in Australia (both public and private) suffered the same fate over the past year. Average wage growth for the year ended June 2014 was 2.6 per cent, while inflation over the same period came in at around 3.0 per cent.

The RBA, however, is hopeful that the situation with wage growth won't get any worse.

“While this is the lowest it has been since the late 1990s, when the wage price index was first published, the pace of wage growth looks to have stabilised in recent quarter,” the central bank said.

Another interesting point from the statement:

“It is also possible that concerns about job security – which remain elevated as measured by unemployment expectations in the Melbourne Institute survey of consumers – have led workers to limit their wage demands. Liaison with firms supports this, with reports that employees appear to be willing to trade lower wage growth for greater job security. It is also consistent with the low level of industrial disputes.”

Here's how each industry performed in the year ended June 30. The discrepancy between the decade average increase and the actual increase is pretty breathtaking.

Now, if only the RBA published a graph on changes in executive pay.

12.40pm - Why business leaders may be overhyping Australia's productivity pitfalls

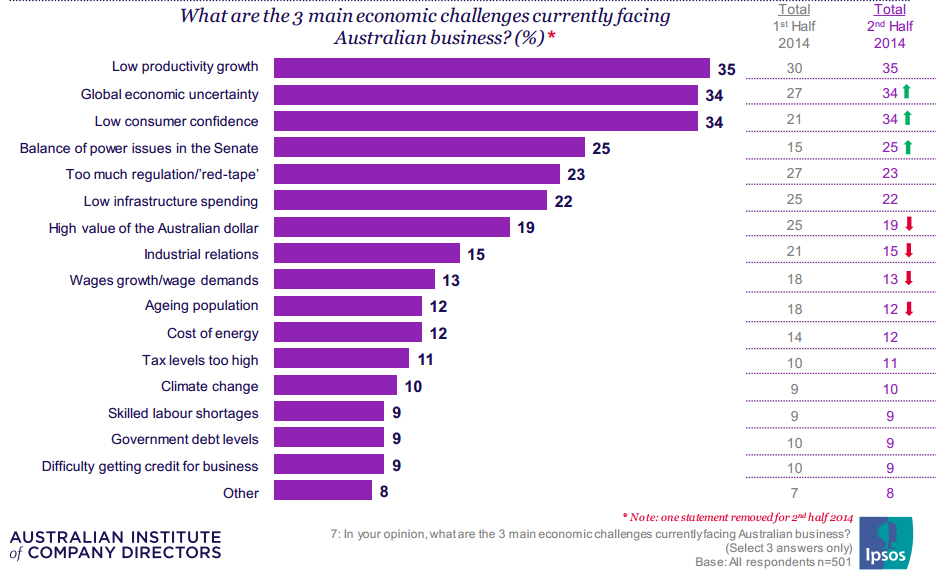

Lagging national productivity growth has been consistently pinned as one of the key issues plaguing business in Australia. Case in point: the latest Director Sentiment Index. We featured this chart on the Ticker earlier this week.

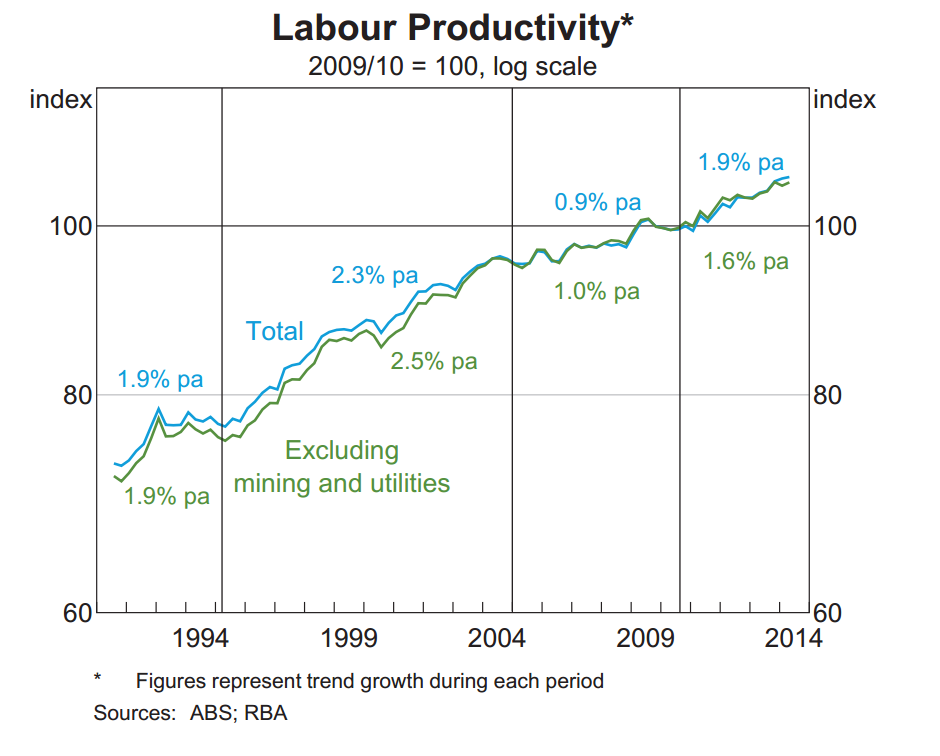

Given this, you can imagine our surprise when we saw this graph in the RBA's latest monetary policy update, which shows that productivity growth has significantly recovered since the mid-2000s.

“Labour productivity growth has increased over the past few years,” the central bank said.

“Recent improvements partly reflect the transition of the resource sector to a period of strong growth in output, which is much less labour intensive than the earlier period of significant accumulation of capital.”

“However, there are also signs that labour productivity growth has picked up across a wide range of industries over recent years.”

So, we dug a bit deeper and pulled some global data from the OECD on productivity growth. Here's how Australia compares to other major global economies -- and New Zealand for comparisons' sake.

There's no doubt that businesses are genuinely concerned about “productivity growth”. But perhaps the word is being thrown around as a catch-all for a number of issues, like the proliferation of red tape and digital disruption.

11.40am - ‘A million cattle worth a billion dollars'; Aust-China deal in pipeline

By Sue Neales, BusinessNow

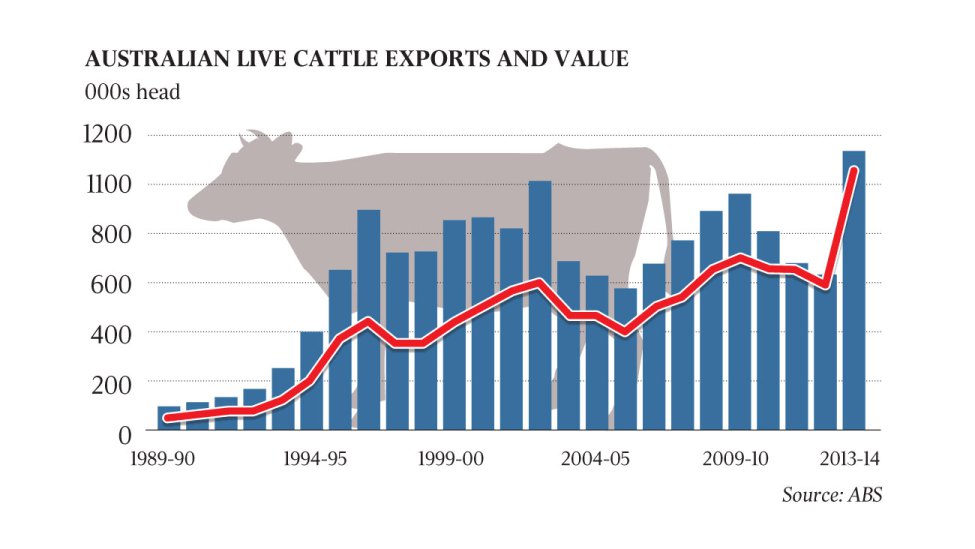

One million beef cattle valued at more than $1 billion are set to be shipped to China each year under a ground-breaking deal between the Australian and Chinese governments that will double Australia's live-export cattle trade.

The finalised live-cattle deal, to be formally announced after this weekend's sensitive talks in Beijing on the long-awaited bilateral free-trade agreement, comes after 10 years of negotiations.

Agriculture Minister Barnaby Joyce said last night that, while the deal had not yet been signed by the two governments, “we are confident we are very close to finalising the protocols and certification requirements for this important market”.

It is expected that as many as 50,000 head of cattle valued at more than $50 million will be shipped in the next 12 months to China, where they will be slaughtered and eaten as beef, as soon as the deal is signed.

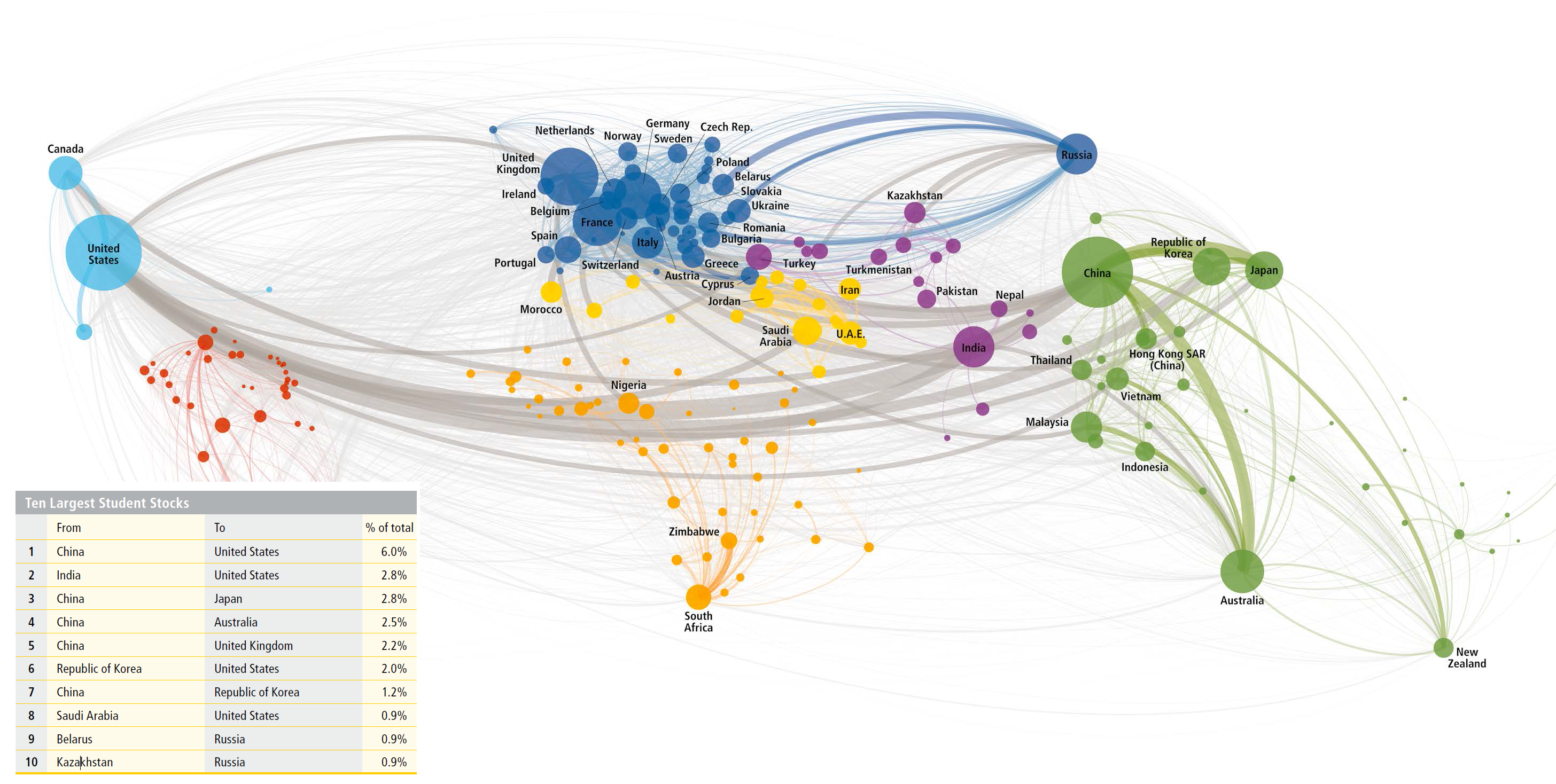

11.20am - Why international students are Australia's best tie to a globalised world

Australia has a rather narrow focus when it comes to talking about globalisation. The talk around our ties to an increasingly globalised world often revolves around Australia's trade record, free-trade agreements and the need for foreign investment.

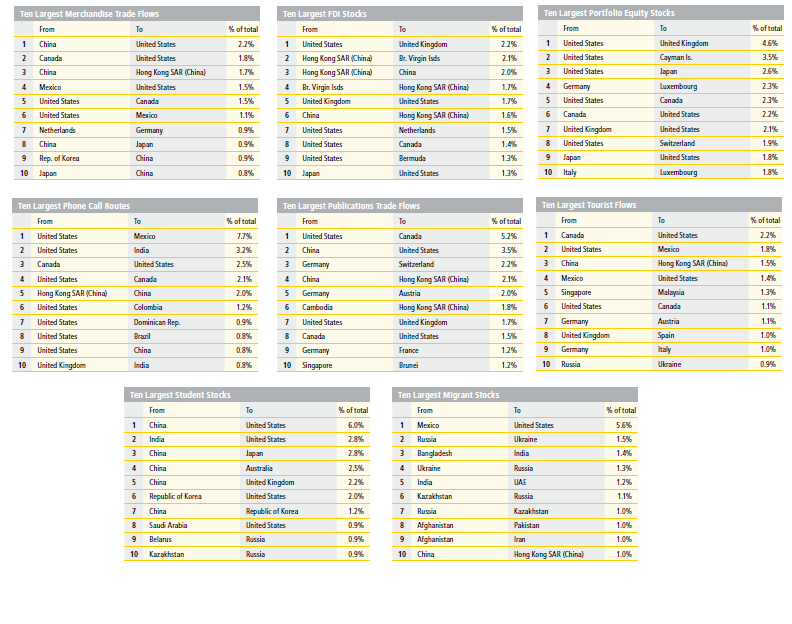

But a series of maps from this year's DHL Global Connectedness report reveals that our best asset in a globalised economy is in fact our roaring international student trade. It's the only category in which Australia ranks within the top 10 in terms of trade flow.

Here's how the rest of the world ranked in the other categories:

9am - Interesting reads from around the web

India is the new China. Watch US economist Nouriel Roubini (AKA: Dr Doom) explain why China's growth could slump to 5 per cent by 2016.

The economics of quitting your job. Studies show that jumping between jobs can lead to a higher wage in the long term.

Content is thriving, but “journalism” is dying. Some solid suggestions on how journalism and reporting can survive in the digital age.

Forever young. How Google and a raft of major drug companies are attempting to increase the human lifespan.

The ultimate experiment in crowdsourcing. A primer on the 36 anonymous volunteer co-ordinators who drive Wikipedia.