The Ticker: Modern business life

Welcome back, here are today's stories:

- The Republicans have gained control of the US senate

- Australian medics heading for Sierra Leone

- One graph on why business isn't happy with the Abbott government

- The state of the Australian economy in one RBA infographic

- Three graphs on the depth of change in Australia's commodity sector

- More spending for a stable turnout: The crux of the US elections in two graphs

- Why rising health insurance complaints won't drag down Medibank

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

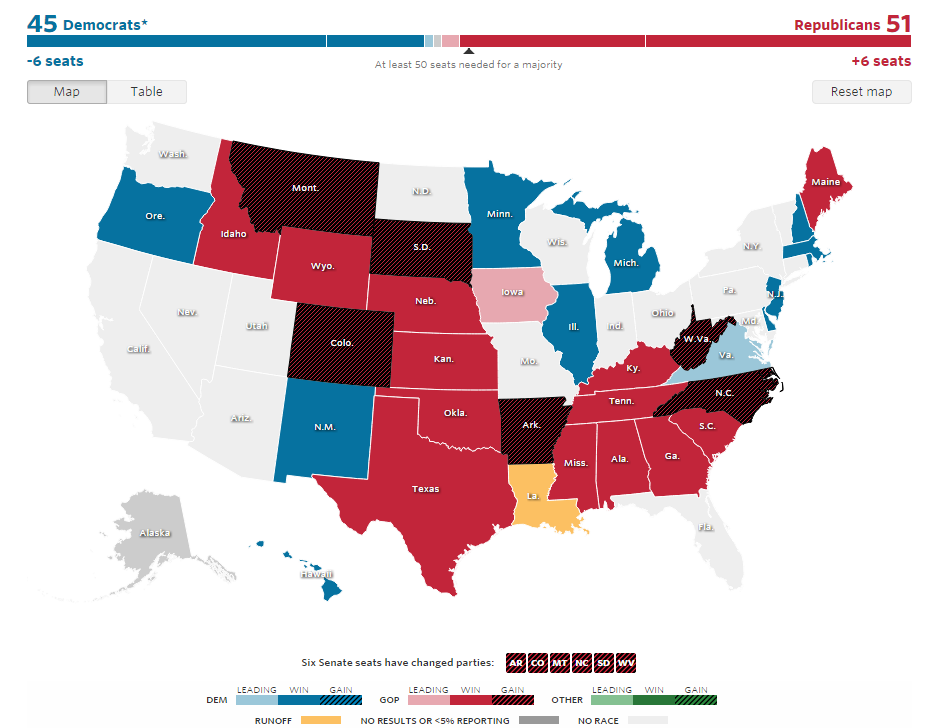

3.50pm - The Republicans have gained control of the US senate

A quick graphic from The Wall Street Journal:

You can view this graphic in its full, interactive glory on The Wall Street Journal.

3.30pm - Australian medics heading for Sierra Leone

By BusinessNow, Rosie Lewis

Australian medics will be sent to Sierra Leone as part of the nation's “ramped up” response to help control Ebola in West Africa.

Tony Abbott today announced the government would send paid Australian volunteers to the African country as part of an agreement with the United Kingdom to manage a 100-bed field hospital, and to care for Australian staff if they get sick.

The British-controlled centre will be staffed by Australian-owned medical provider Aspen, but the majority of staff will be locals.

Mr Abbott also announced an additional $24 million to help combat the epidemic.

“I stress, this is a health emergency,” he said. “It's not a military emergency, for instance, which is why we have contracted a private health provider to do this, which is in keeping with our response to other overseas health emergencies such as cholera in our region.”

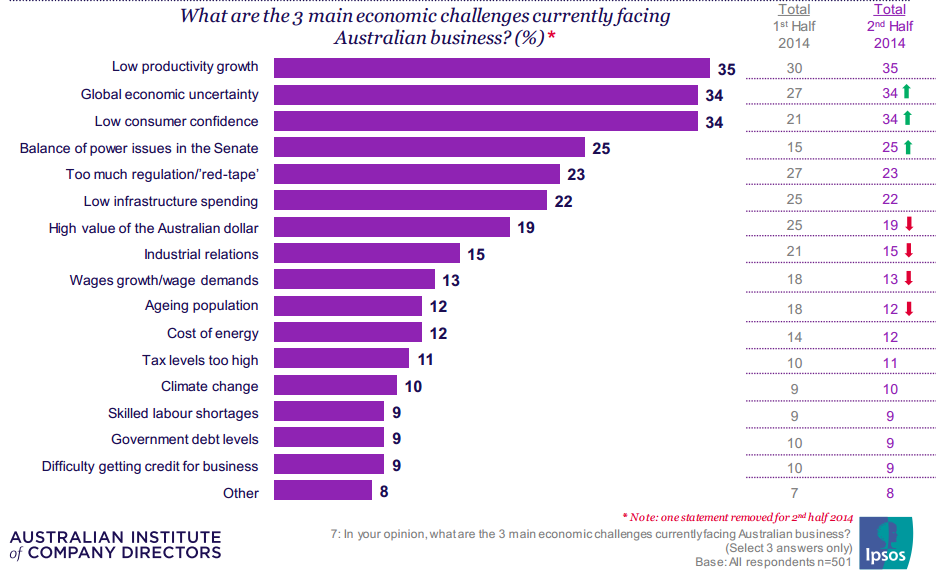

3.15pm – One graph on why business isn't happy with the Abbott government

We found this graph buried in today's latest Director Sentiment Index. You know, the same report that found the Abbott Government's satisfaction among business leaders now ranks among that of the Gillard government in its early days in power.

Perhaps the most telling aspect of the data is the stark rise in concerns around consumer confidence. It jumped 13 per cent in six months. So, what's changed? Well, the last Director Sentiment Index was released before the May budget.

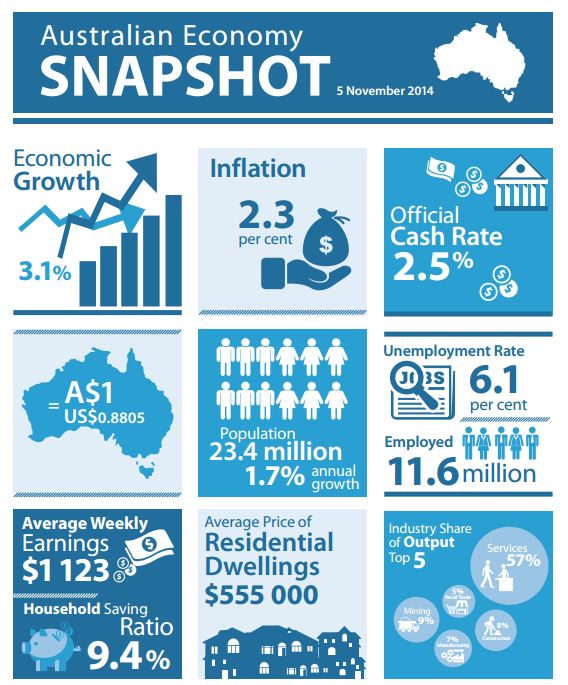

2.40pm – The state of the Australian economy in one RBA infographic

T

You can find the original here.

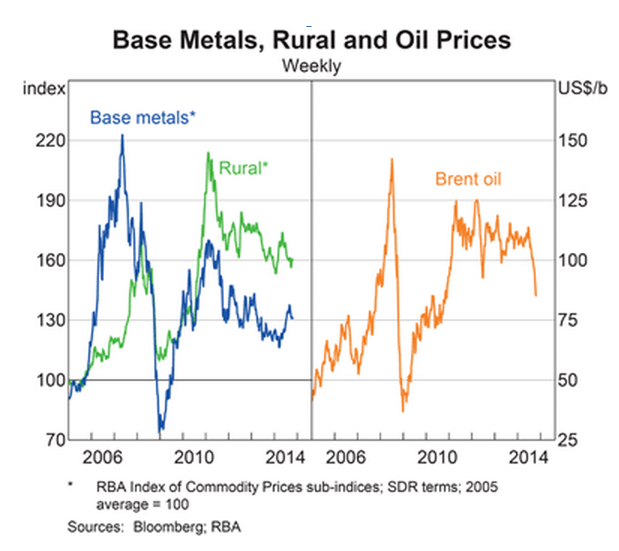

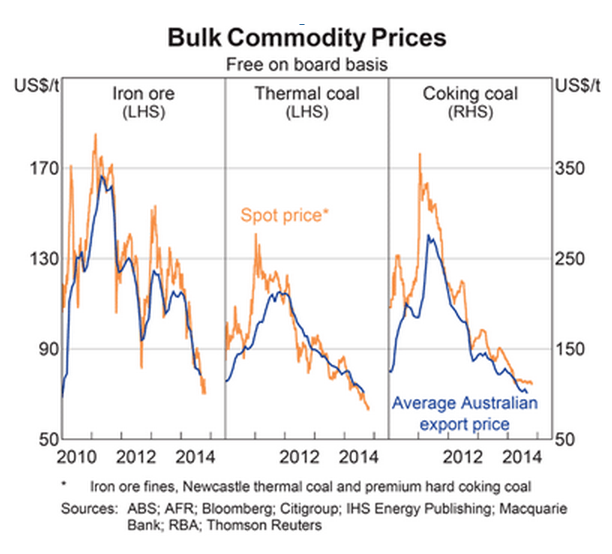

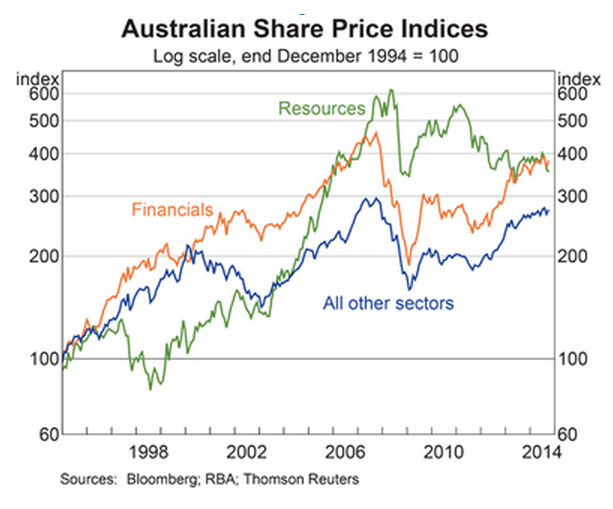

1.10pm - Three graphs on the depth of change in Australia's commodities

By Chris Kohler, BusinessNow

Today the Reserve Bank released its chart pack and while we all know the resources sector is heading for a sustained slowdown following the unprecedented mining boom, these graphs help show the real depth of the change.

Local resource sector stocks have certainly been doing it tougher lately, but given how severe the falls have been across almost all major commodities, it seems to be hanging on pretty well.

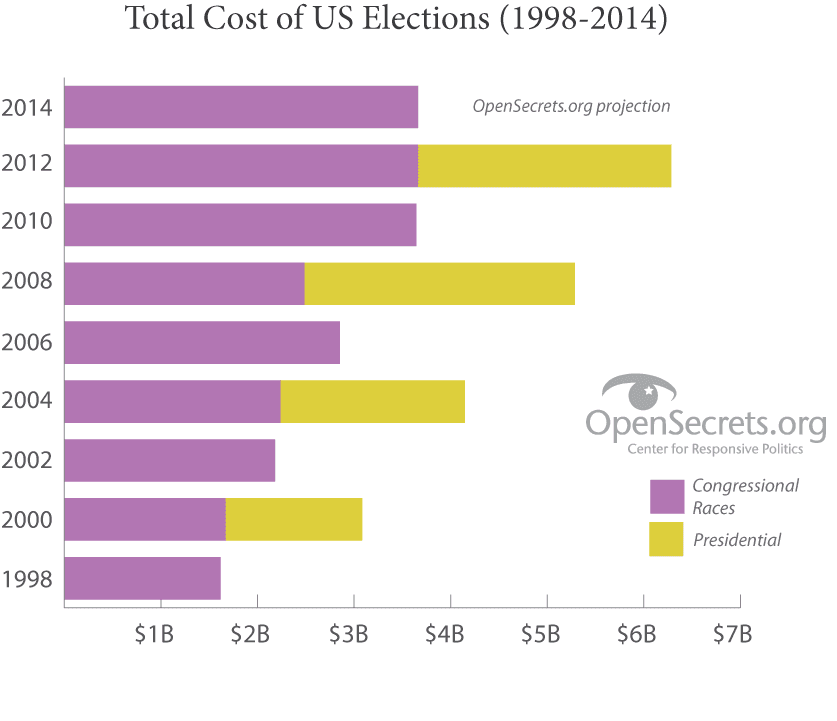

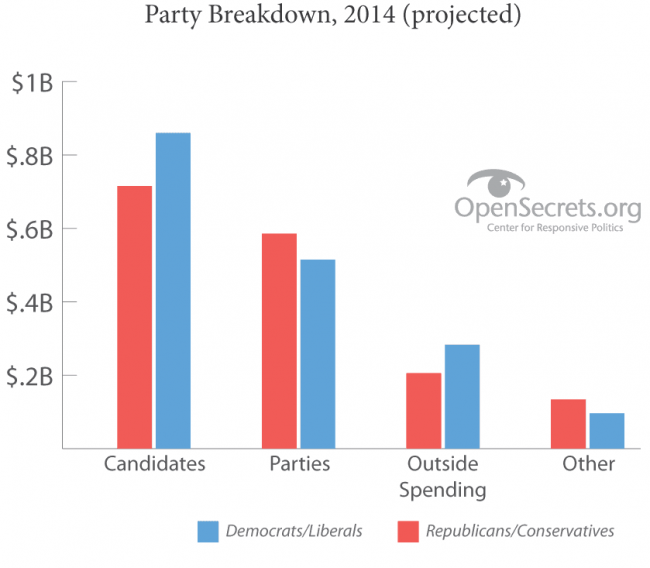

12.40am - More spending for a stable turnout: The crux of the US elections in two graphs

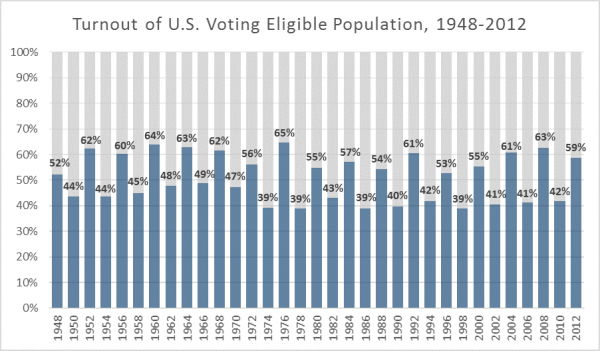

US voters head to the polls today for its mid-term elections. Two years on from the presidential election, this race determines the make-up of the US House of Representatives, a third of the Senate and the political representation of some states. You can read a quick primer on the poll here.

Voting is not compulsory in the US, so half the battle for the two major parties, the Democrats and the Republicans, is to encourage would-be supporters to the polling booths. But it's interesting to note that while donations and election spending for the presidential and mid-terms have increased substantially over the past decade…

… voter turn-out has remained stable at 40 per cent for the mid-terms and 60 per cent for the presidential race since the late 1940s.

And, in case you are wondering, here's a projection from OpenSecrets.org on the funds being spent on this latest poll.

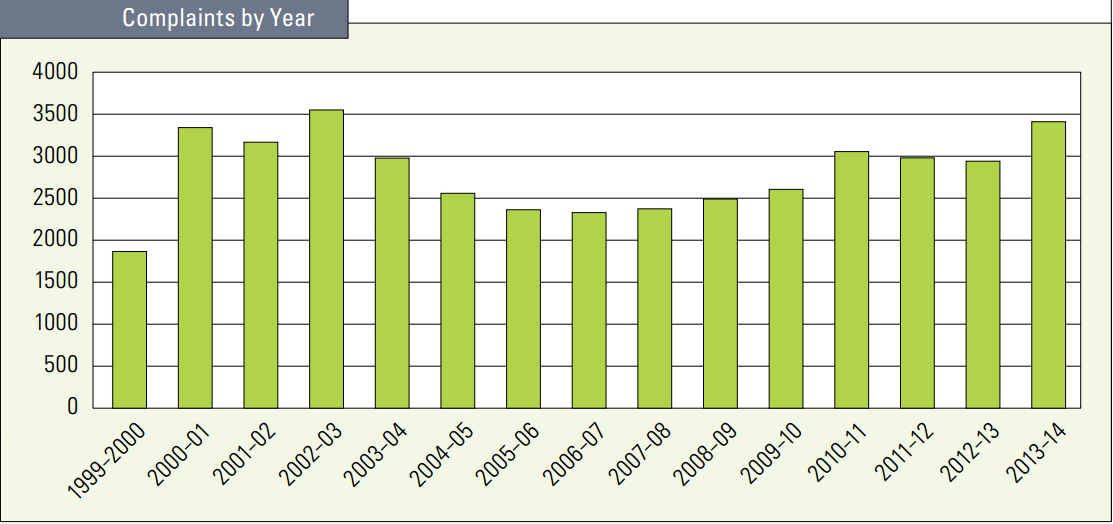

10.55am - Why rising health insurance complaints won't drag down Medibank

Private health insurance complaints have hit an 11-year high, but don't be fooled into thinking this will affect Medibank's prospects. In fact, a closer look at the data from the Private Health Insurance Ombudsman reveals that these figures are in fact good news for the soon-to-list company.

A historical look at the data reveals that the numbers actually fall in Medibank's favour. In terms of market share, Medibank has dominated the sector for the past six years, yet it only topped the charts in complaints in the 2010-2011 financial year, and it's fallen in the years since.

In contrast Medibank's nearest rival, BUPA saw a huge spike in complaints in the past year. It's not a good look, especially given the increased churn in the health insurance sector, largely brought on by the rise of comparison websites.

It's also interesting to note that despite ongoing talk and media rumblings around rising health insurance premiums, more consumers are frustrated by a lack of information from their provider. Again, this is good news given that health insurance premiums make up around 90 per cent of Medibank's overall revenue pool.

9am - Interesting reads from around the web

Betting 2.0. How Tabcorp is implementing a Minority Report-style technology blitz to please the punters.

Corporate journalism has hit a new low. How an attempt to wade into the world of online publishing backfired on US telco Verizon.

Facebook's experiment in democracy. The social media giant is encouraging its users to vote in the US midterm elections.

Shopping without borders? Inside Australia Post's ambitious plan to help you purchase from US vendors who won't ship to Australia.

Celebrity comedian vs one of the world's best bond managers, can you guess the author? How Bill Gross and Russell Brand have startlingly similar tone and writing styles in expressing their views on the global economy.