The Ticker: Modern business life

On today's blog:

- Shareholders (and Nick Xenophon) lash out at Qantas' AGM

- New York doctor tests positive for Ebola

- Qantas' Alan Joyce is an expert at asking for a payrise

- Amazon posts its biggest operating loss

- Two graphs on NBN Co's connection growth challenge

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.35pm - Shareholders (and Nick Xenophon) lash out at Qantas AGM

Here's what some shareholders had to say about Qantas' recent performance.

You have to give a bit of credit to Alan Joyce for handling the majority of these questions with decorum and diplomacy. One question on Qantas' business class efforts however riled him. Here's what he had to say.

2pm - The food industry's next boom category? Gluten-free

By Chris Kohler, BusinessNow

For a rapidly growing number of people around the world the new number one mealtime enemy is gluten – delicate tummies everywhere have made themselves heard and sales of gluten-free food are going gangbusters.

According to The Economist, anti-gluten is replacing anti-meat with sales of meat alternatives flattening in America since 2008 and plunging by a third in Britain.

“Sales of gluten-free food and drink there have surged from $5.4 billion to $8.8 billion over the past two years,” The Economist reports.

Looking ahead, sales in America of gluten-free food are forecast to grow by a further 61% by 2017, with similar increases expected in other rich countries.

1pm - New York doctor tests positive for Ebola

A physician who had returned to New York City 10 days ago after treating Ebola patients in West Africa has tested positive for the disease, according to an official familiar with the findings.

Craig Spencer, a 33-year-old physician who worked with Doctors Without Borders and lives Upper Manhattan, is the fourth person to be diagnosed with the deadly disease in the US.

Dr. Spencer was diagnosed with the disease after treating patients in Guinea. He reported a fever and gastrointestinal problems Thursday morning and had quarantined himself in his Upper Manhattan apartment. He was rushed to Bellevue Hospital Center in an exposure suit, where he was quarantined in a specially designed hospital room.

Read more, including live coverage, on The Wall Street Journal.

12.50pm - Qantas' Alan Joyce is an expert at asking for a payrise

Today is Qantas' annual general meeting, which means that eyes will once again be focused on Alan Joyce's pay packet. As you may recall, he took a pay cut earlier this year.

And despite being a bit of an expert at asking for a payrise, he is yet to reach the base salary enjoyed by his predecessor Geoff Dixon.

Similarly, current Jetstar chief executive Jayne Hrdlicka is yet to earn a salary equal to that of Joyce during his tenure at Jetstar.

To keep it simple, we only graphed Alan Joyce's base salary, excluding additional benefits and bonuses. Joyce largely earns more than the figures indicated in the graphs below.

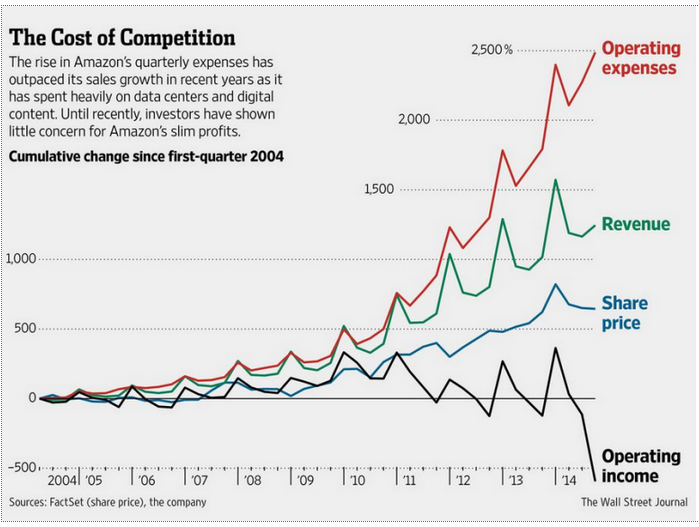

10.55am - Amazon posts its biggest operating loss

By Chris Kohler, BusinessNow

It wasn't all smiles and high fives as US company's continued to post third quarter profit results overnight.

Caterpillar and 3M's upbeat figures helped push Wall Street to a healthy close but retailing giant Amazon was more upset than upbeat.

Amazon.com reported its widest ever loss in the third quarter, despite a 20 per cent boost in sales, as the company's many investments continued to weigh on its bottom line.

The web retailer also projected slower sales growth in the current fourth quarter than analysts were expecting.

Amazon's shares, down about 4 per cent over the past 12 months, fell 11 per cent in after-hours trading to $US279.11. The stock also tumbled following each of its previous two quarterly reports.

The bottom-line losses reflect Amazon's heavy investments in new businesses and services that some investors worry are stretching the Seattle company too thin.

For the third quarter, Amazon reported a loss of $US427 million, or 95 cents a share, compared with a loss of $US41 million, or 9 cents a share, a year earlier.

The company's operating loss widened to $US544 million – its biggest such loss ever – from $US25 million a year ago.

10.25am - Two graphs on NBN Co's connection growth challenge

Meet NBN Co's 2020 connection goal. It's more daunting when you look at in a year-on-year connection graph, but NBN Co maintains that it's achievable given the network's serviceable premises growth rate. Now that the NBN is based off a multi-technology mix strategy, this figure could explode when NBN Co adds connections from Telstra's cable network (the HFC) to its rollout metrics. We could finally see the “exponential growth” in the network we have been promised for the past couple of years.

There is one point however that may be causing some stress for NBN Co. Despite the growth in the number of premises connecting to the network has remained fairly stable over the past 6 months. It's not ramping up.

Sure, this could improve as more households gain access to the network. However, the data hints at another challenge for NBN Co (and perhaps the telcos) -- increasing the connection growth rate by marketing the need for consumers to connect to the network.

Read more about NBN Co and it's deal with Telstra here.

9.05am - Interesting reads from around the web

It's been a busy week for business news. So much has happened, from gas price warnings through to the Medibank prospectus. We'll have a wrap of The Ticker's top posts for the week later today. For now, here's this morning's reading list:

What is ‘white-collar' crime? Here's a handy list of some of the worst offences.

Why wait until Apple Pay launches in Australia? It already works here.

We're predisposed to assume the worst. How disaster fiction like The Walking Dead and the movie Outbreak have affected our response to Ebola.

Why #GamerGate is a reflection of modern journalism. In an industry geared around driving web traffic, a hate-click is still a click.

Live with a smoker? This new study finds it's as bad as living in the midst of Beijing's smoke pollution.

Coming to a dealer near you. Elon Musk's Tesla is gearing up for an Australian launch.

Technology has quietly revolutionised the world of product placements. Placement ads are now being inserted into TV shows and movies after they have been shot.