The Ticker: Modern business life

On today's (oddly Melbourne-centric) blog:

- Why it's now more economical to use your air conditioner to heat your home

- Melbourne is Australia's pay rise capital

- The NT jobs market is booming

- Medibank IPO to raise up to $5.508bn

- Four graphs on why Melbourne will bear the brunt of Grattan's gas warning

- Could Fairfax and Ten pull off a merger?

- Three things you need to know this morning

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

3.15pm - Why it's now more economical to use your air conditioner to heat your home

Here's another take on today's Grattan Institute's report into the gas market. We've posted an excerpt from Tristan Edis' piece below:

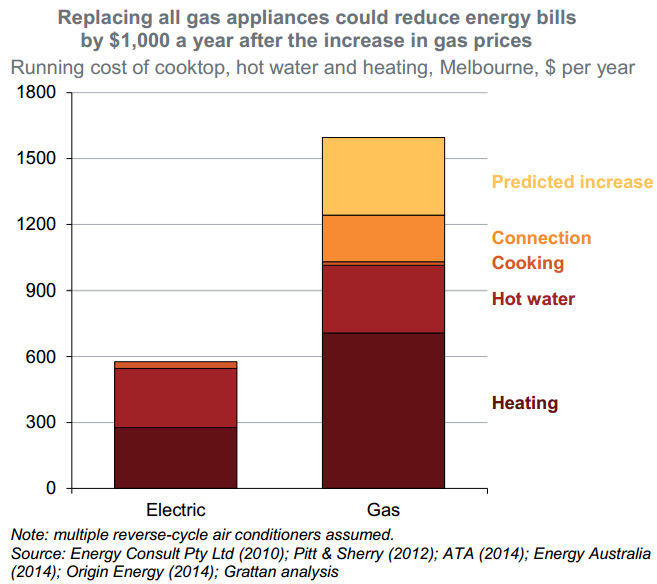

What many people fail to realise is that the advent of highly efficient, low cost reverse-cycle air conditioners (also known as heat pumps) has fundamentally altered the economics of whether it makes sense to use gas for heating your home. These are now widespread across many Australian homes creating an already-deployed competitor to natural gas.

The next battleground will be water heating, and heat pumps are threatening to do the same thing in this application as they have in home heating.

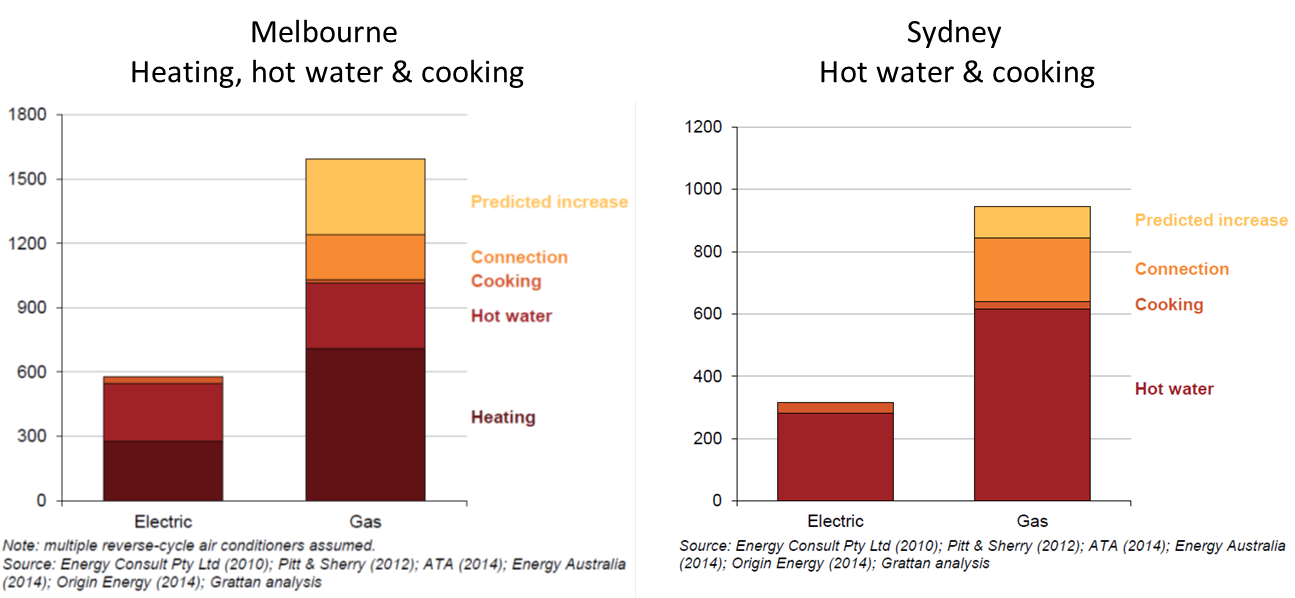

The chart below taken from the Grattan Institute's latest report, Gas at the Crossroads, illustrates that households – particularly in Melbourne – will see notable increases in their gas bills as a result of the LNG-induced price rises. Even without these price rises households could achieve significant annual bill savings by shifting heating, hot water and cooking to electrical appliances. But the jolt of LNG-related price rises could be the critical prompt to consider disconnecting gas to achieve $600 to $1000 in annual bill savings.

Figure: Grattan Institute estimates of household bill savings from substituting gas with electrical appliances

What are the implications for the rest of the gas market? Read more here.

12.40pm - Melbourne is Australia's pay rise capital

Of our five major five cities, Melbourne has been identified as Australia's pay rise capital, according to a new business survey by global workplace provider Regus.

The study also found that wage growth this year was most prominent among medium-size businesses.

Though, as Callam Pickering noted earlier, compared to previous years, wage growth has been somewhat sluggish in Australia. Across our five major capital cities, close to 60 per cent of the businesses surveyed chose to hold wages this year and another 8 per cent opted to cut wages.

If you are desperately after a pay rise, then perhaps you should consider a move to China. The same study picked it as the pay rise capital of the planet.

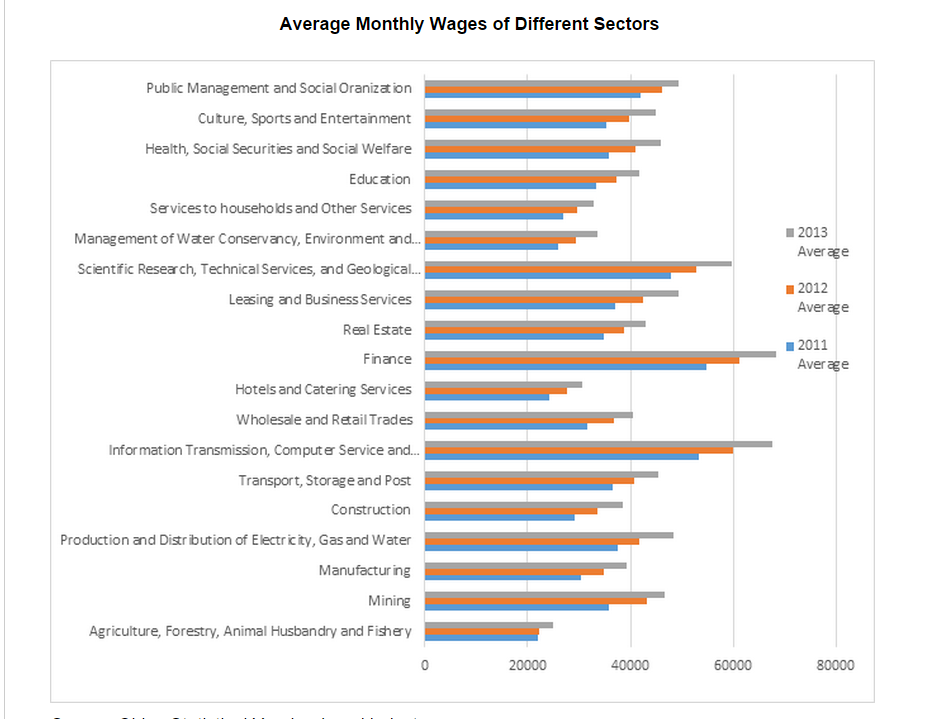

You may think that this data is simply a reflection of a rising minimum wage and improved living conditions. However, this graph from the China Labour Bureau shows that wages appear to be increasing across all industries.

12.15pm - The NT jobs market is booming

By Chris Kohler, BusinessNow

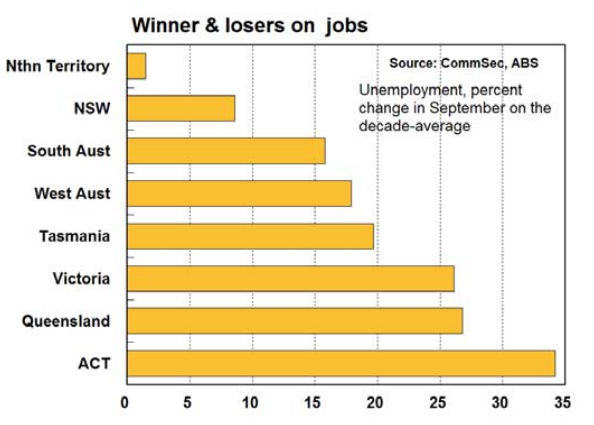

The Northern Territory has the strongest jobs market in the country, according to Commsec research.

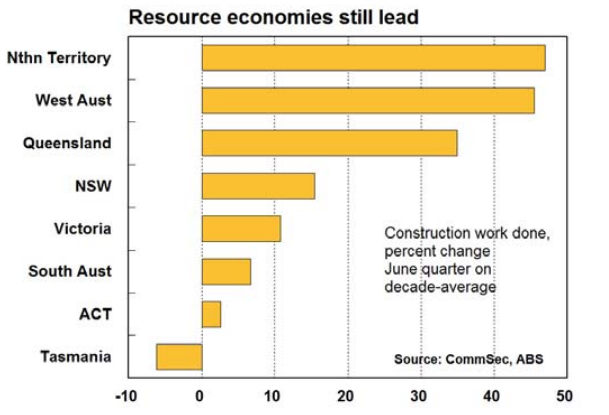

Not only is the Northern Territory leading the way on employment figures, it is the third-strongest economy in Australia, topping the other states and the ACT in overall construction work and coming in third in home building starts.

In jobs terms, the ACT is bringing up the rear with the data showing unemployment over 34 per cent above its decade-average level. In a small territory, the large cuts to the federal public service have hit the statistics hard.

Read more about how NSW pipped WA to become Australia's leading economy.

11am - Medibank IPO to raise up to $5.508bn

By Mitchell Neems

The federal government could reap over $5 billion from the privatisation of Medibank Private, according to its prospectus.

Finance Minister Mathias Cormann unveiled the prospectus in Melbourne today, revealing an indicative price range of $1.55 to $2 per share.

At the indicative price range, the indicative market capitalisation of Medibank Private would be between $4.269bn and $5.508bn, placing it among the top 100 companies on the ASX.

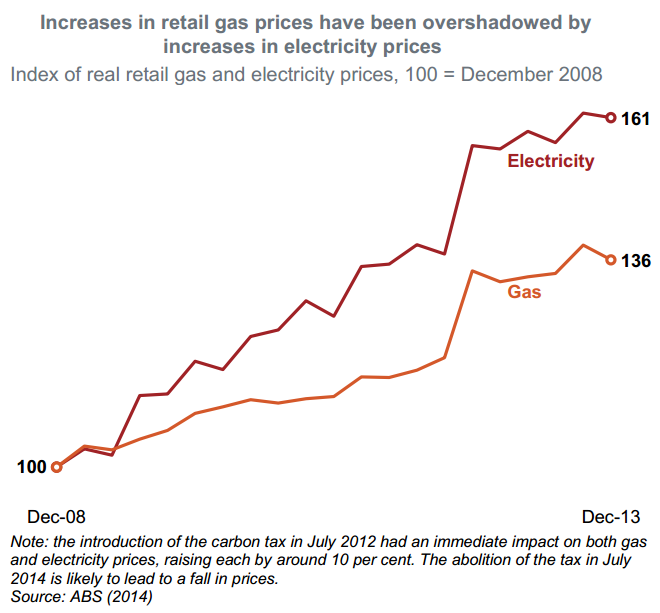

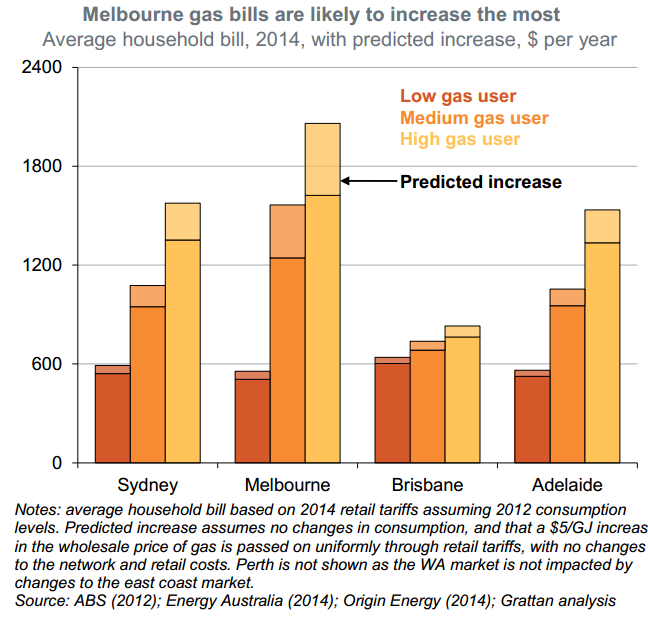

10.25am - Four graphs on why Melbourne will bear the brunt of Grattan's gas warning

Do you love endless hot water, cosy gas heating and cooking stir-fries on a high powered gas wok burner? Well, unless you want to pay a sky high gas bill, you may have to curb your consumption habits and switch to electrical appliances.

That's one of the controversial messages at the centre of a new Grattan Institute report into the Australian gas market.

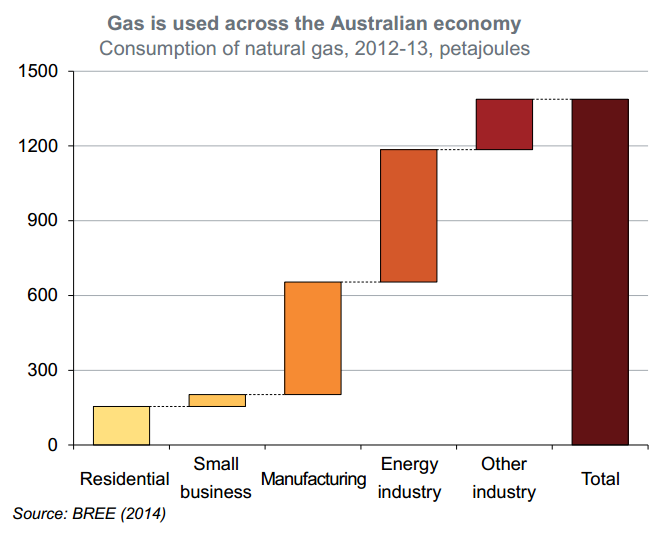

Gas prices are set to rise on the back of our impending LNG export boom, and the Institute is recommending that state and federal governments not intervene in a bid to keep domestic gas prices down.

Its argument is that ongoing economic benefits from the LNG boom outweigh the consumer costs incurred through higher gas prices. Melbourne residents may disagree: it appears they are going to bear the brunt of both an increase in wholesale electricity and gas prices.

Why is this the case? It appears cooler climate and easier access to gas pipelines has turned Melbourne into the gas capital of Australia.

What was once seen as a cheap way to heat the house may about to become very costly.

However, it is important to remember that these increased costs will weigh most heavily on the manufacturing sector.

Both of these factors may make it tough for politicians to stay out of the debate.

9.15am - Could Fairfax and Ten pull off a merger?

We've included an interactive real-time stock graph below so you can keep an eye on what happens to Ten's stock at market open. For now, here's a quick summary from BusinessNow's Chris Kohler on what we know about a potential Ten-Fairfax tie up.

Fairfax and Ten network executives met to discuss the possibility of a merger earlier this month, an exclusive in The Australian revealed.

The news is sure to see a spike in the struggling TV network's stock this morning, but could this deal really happen?

The combination would create a $2.3 billion group with revenues of $2.5bn but Australian media rules state that Fairfax would have to offload its AM radio network, which includes 2UE in Sydney and 3AW in Melbourne.

It was rumoured earlier this month that Fairfax was trying to find a new home for its underperforming radio arm so that seems quite possible.

Any merger deal would also need the all clear of its heavy-hitting major shareholders including Gina Rinehart, who owns 14.99 per cent in Fairfax and 10 per cent in Ten Network, James Packer, Lachlan Murdoch and Bruce Gordon.

And with sources saying Mrs Rinehart is enthusiastic about the deal, it seems like a real possibility at this early stage.

9am - Three thing you need to know this morning

Welcome to week two of The Ticker. Here are this morning's top stories:

1. New South Wales has leap-frogged Western Australia to become the strongest economy in Australia.

2. Fairfax Media has held high-level talks with Network Ten about a billion-dollar merger, compounding speculation around such a deal.

3. The government will today unveil the prospectus for the anticipated $4 billion Medibank float

From elsewhere

Is this the future of infection control? Researchers in the US are now considering using robots to treat Ebola patients.

Perhaps the most heart-warming thing you'll read this week: How one boy with autism became B.F.F.'s with Apple's Siri.

Disconnects abound. Why the IMF and The World Bank can't agree on a formal plan to address global poverty.

What's the secret behind Germany's excellent training regime? A strong company-supported apprenticeships program

Scientists have discovered a life-friendly ocean underneath one of Saturn's moons, which oddly enough looks like the Death Star from Star Wars.