The Ticker: Modern business life

On today's blog:

- Don't expect the corporate sector to drive an economic recovery: J.P. Morgan

- One graph which destroys Joe Hockey's latest climate blunder

- A surprising number of Australian companies already have an internal carbon price

- Time has proven Xenophon right on Qantas

- Three graphs on why Australia is still getting a raw deal on petrol

- Tracking fear: What Google's data has to say about Ebola in Australia

- China trade data continues to boost AUD

- Three things you need to know this morning

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.45pm - Don't expect the corporate sector to drive an economic recovery: J.P. Morgan

By Chris Kohler, BusinessNow

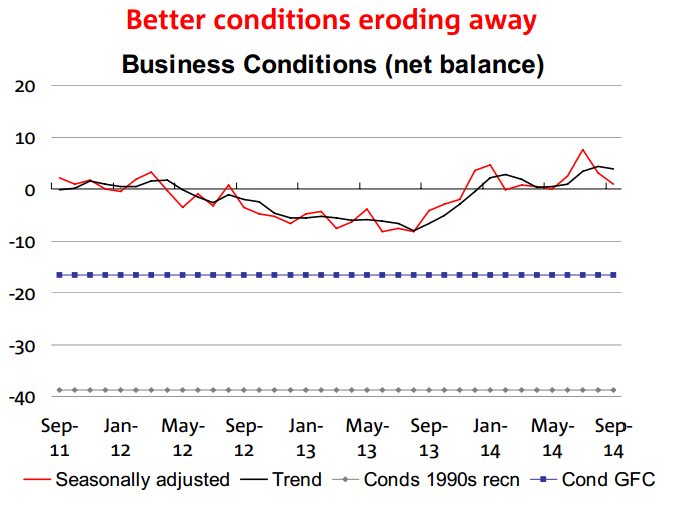

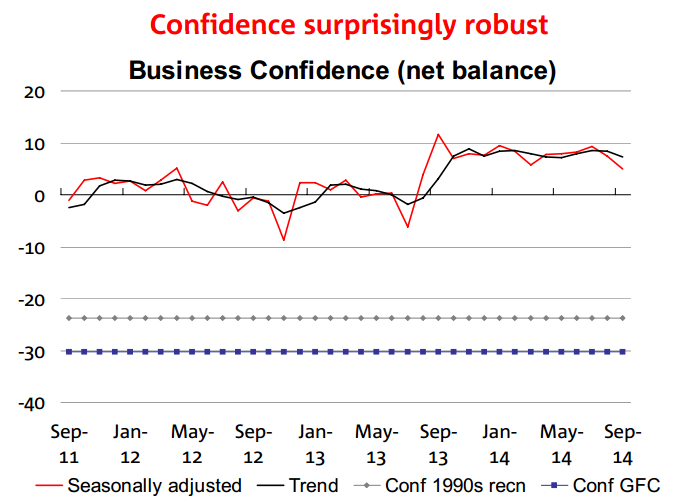

Today's NAB Business Confidence data shows the Australian corporate sector will continue to tread carefully, according to J.P Morgan.

“The RBA's official liaison program has characterised the sluggish transition of the economy back to trend growth as being driven by a lack of animal spirits in both the household and corporate sectors,” Ben Jarman of J.P. Morgan said.

“Households are cautious due to fears of rising unemployment, and firms are unwilling to hire or invest until they see compelling evidence that a demand recovery is in place.”

“From the corporate side, today's survey shows little signs of the corporate sector being willing to risk moving first, and driving a cyclical recovery. We don't have particularly high hopes for tomorrow's October WMI consumer survey either, given that domestic economic news has remained downbeat, and falling equities are weighing on household wealth.”

Read more about NAB's latest business confidence survey here.

2.35pm - One graph which destroys Joe Hockey's latest climate blunder

From Climate Spectator:

Treasurer Joe Hockey has told a British interviewer in London that it's 'absolutely ridiculous' to suggest Australia is one of the OECD's highest per capita carbon emitters, despite the Garnaut Climate Change Review saying the nation was in the No.1 position, Fairfax reports.

"We've got a small population and very large land mass and we are an exporter of energy, so that measurement is a falsehood in a sense because it does not properly reflect exactly what our economy is," Mr Hockey told the BBC, according to Fairfax. "Australia is a significant exporter of energy and, in fact, when it comes to coal we produce some of the cleanest coal, if that term can be used, the cleanest coal in the world."

And from Twitter:

@bencubby Show him the OECD website. pic.twitter.com/kohd0k8W0i

— Sir Robert Denmore (@MrDenmore) October 14, 2014

2.10pm - A surprising number of Australian companies already have an internal carbon price

The same company that has installed over 550,000 solar panels on its stores now has another climate feather in its cap. Yes, Swedish homewares company IKEA is now considering an internal carbon price for its operations.

However, this move is not as uncommon as it sounds. Based off the Carbon Disclosure Project's latest report (pdf), here's a quick list of all of the Australian companies it found to be using a carbon price.

- Treasury Wine Estates Australia

- Wesfarmers Australia

- Woolworths Limited Australia

- Aquila Resources Australia

- Caltex Australia Australia

- Santos Australia

- Woodside Petroleum Australia

- Australia and New Zealand Banking Group Australia

- GPT Group Australia

- Insurance Australia Group Australia

- Macquarie Group Australia

- National Australia Bank Australia

- Westfield Group Australia

- Westpac Banking Corporation Australia

- Qantas Airways Australia

- Transpacific Industries Group Australia

- Amcor Australia

- Boral Australia

- Fortescue Metals Group Australia

- AGL Energy Australia

- APA Group Australia

And some notable international companies:

- SingTel (Optus)

- BP

- Deutsche Bank AG Germany

- Ernst & Young LLP U.K

- Rio Tinto

- Microsoft

- BHP Billiton

Essentially this means that these companies are ready for a carbon price, should it be legislated by government. As the report points out, it was axed by the Senate earlier this year.

It's worth noting that most don't actually disclose the price they put on carbon. In the report, Westpac is identified as the only company that discloses a price. It values carbon at $US10 a tonne.

12.35pm - Time has proven Xenophon right on Qantas

#Qantas Sale Act is a red herring - it's about bad decisions made by Joyce & Board with Jetstar in Asia. Qantas needs to open its books.

— Nick Xenophon (@Nick_Xenophon) March 3, 2014Back in March Senator Nick Xenophon also wrote in the SMH:

And what about the plans to revive the Qantas Group? Jetstar domestically proved a treat; Jetstar internationally has been a toxic black hole. Idle planes sitting on the tarmac in France for a stalled Jetstar Hong Kong are the most recent symbol of a botched strategy in Asia.

At Senate inquiries, Qantas Group executives were defensive when I asked whether the Jetstar Asia offshoots would be technically insolvent were it not for multi-million dollar injections from the parent company.

Given current Australian accounting rules, which allow cost-shifting from one entity to another within group accounts, we may never know how much the Jetstar offspring has drained from its Qantas parent.

But we do know that in 2008 Jetstar had 36 aircraft to Qantas' 188 planes. Today, it's 115 to 122. It seems that while Qantas could carry Jetstar, Jetstar cannot do the same for Qantas.

And the news today, as reported by Steve Creedy on BusinessNow:

Qantas will shoulder about $55 million of a $120m deficit at Jetstar Japan after the start-up saw its losses rise 26 per cent in the last financial year.

Start-up costs rose as the carrier grew from 13 to 18 aircraft but was unable to fully utilise the aircraft due to delays in opening its second base in Osaka and a delay in international services.

A Jetstar spokesman today confirmed figures which showed increased costs outpaced a doubling of revenue to 29.1 billion JPY to see losses rise to 11.1 billion JPY.

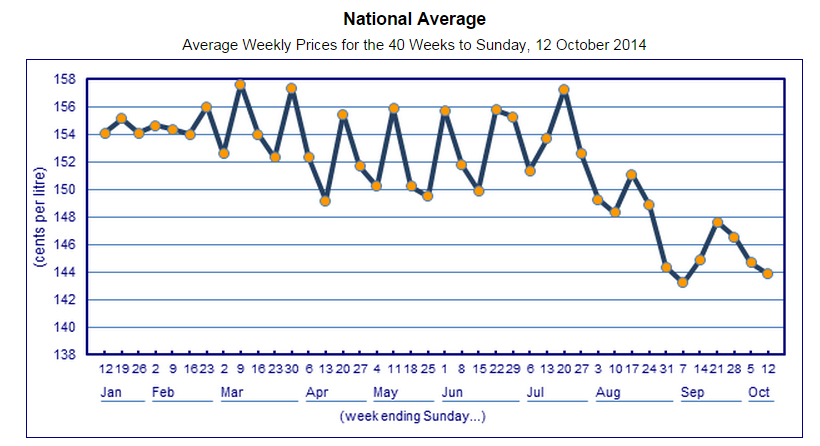

12.10pm - Three graphs on why Australia is still getting a raw deal on petrol

As this chart from Quartz shows, crude oil has seen a steady decline since June. According to this graph from the Australian Institute of Petroleum, it looks as if our petrol prices have followed suit.

Though, as always with petrol, whether we're receiving the full discount is questionable.

Chart: Tapis Crude ($A) v Australia National Fuel Price - 2014 #divergence #disparity @brookecorte @Ross_Greenwood pic.twitter.com/PBbMZEWZnx

— David Scutt (@David_Scutt) October 13, 2014There's one caveat on this chart. There is a lag time of several weeks from movements in spot to at the pump. Still, big disparity #ausbiz

— David Scutt (@David_Scutt) October 13, 201410.40am - Tracking fear: What Google's data has to say about Ebola in Australia

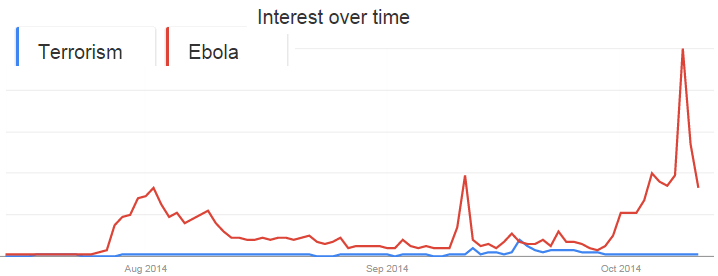

Google's search analytics tool has been used to chart flu outbreaks in the past. This time, we're putting it to a new use: tracking fear over Ebola in Australian society.

The disease is yet to hit Australian shores, but according to Google, concern over Ebola reached new highs following the scare involving Queensland nurse Sue Ellen Kovack, who was suspected of having contracted -- and later tested negative for -- Ebola.

Simply put: despite the government's rhetoric over terrorism, as a society we are significantly more worried about Ebola.

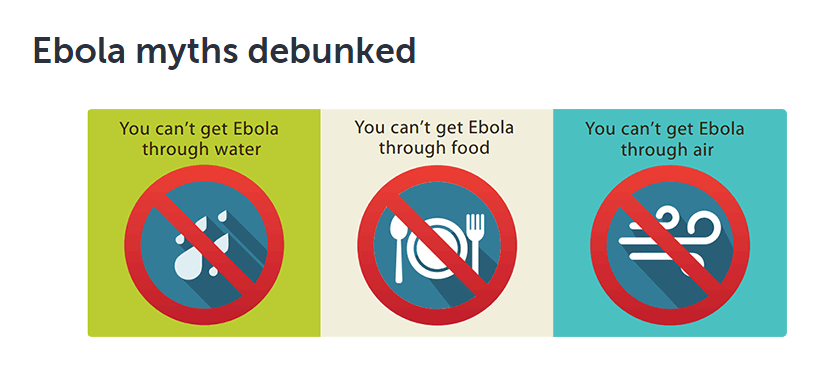

So why is this case? Well, part of it is likely due to misinformation. By now, we all know that Ebola has a mortality rate of between 25 and 90 per cent -- significantly higher than other diseases. As a society, we know far less about how it's spread and its symptoms. The ABC has put together a really handy Ebola myth busting kit, that's well worth a read if you are concerned about the disease.

The real battle revolves around containing Ebola and at the same time mitigating fear. It's an interesting balance, as the fear generated by the disease is possibly the only catalyst that will spark an international response. Though, as Brookings noted during the Swine flu outbreak in 2009, the same fear that will spark us into action has the potential to do more damage to markets and society than the disease itself.

9.40am - China trade data continues to boost AUD

By Chris Kohler, BusinessNow

The Australian dollar remains higher after better-than-expected Chinese trade figures gave the currency a boost.

At 8am (AEDT) the local currency was trading at US87.73c, up from US87.34c on Monday.

The figures gave the Australian dollar a boost on Monday which continued overnight, Westpac senior market strategist in Wellington Imre Speizer said.

“Yesterday's strong Chinese trade data gave the currency the boost,” Mr Speizer said.

“Equity markets in the states sold off heavily overnight and that may have an effect on the Australian dollar today.”

Read our partner blog The Australian's BusinessNow here.

9.10am - Three things you need to know this morning

Welcome to day two of The Ticker. If this is your first visit to this blog, you may want to read this quick explainer. Otherwise, here are today's top stories.

1. The cyber security firm that exposed Chinese hacking attempts on the US government last year has revealed that Australian companies are increasingly being targeted by elite Chinese hackers for the purpose of learning trade secrets.

2. Treasurer Joe Hockey has told European leaders to "lift their eyes" and engage more with Asia or risk being left behind.

3. Following moves by authorities in parts of Europe, the US will now start screening inbound travellers for signs of the Ebola virus at five airports around the country.

From elsewhere

Travel bans won't prevent the spread of Ebola. Here's why locking down countries will only make the matter worse.

Chinese are slowly, but surely buying out Italian businesses. And it's triggering a new wave of xenophobia and racism.

Meet the invisible umbrella. It keeps water off you using high-powered streams of air.

Want to become an internet celebrity? All you need is $68 and two hours of your time.

Prepare for ‘The Snappening'. Up to 200,000 nude images from SnapChat are about to be leaked onto the web.