The super rush, and Ten's fuzzy picture

Robert Gottliebsen

The super rush, and Ten's fuzzy picture

This weekend I want to take you back to June 2006, which is Australia's last experience of a rush to thrust money into superannuation before the rules changed. It is worth recalling what happened in the subsequent months as a note of caution.

And we can also learn from the adventures of Lachlan Murdoch and James Packer in their investments in the Ten Network, showing how it can be very dangerous for small investors when major players are pursuing big strategic objectives.

I remember 2006-07 very well, when I was involved in a website start-up and had invested in the project. In the years leading up to 2006-07, the rules for putting money into superannuation were very flexible and you could invest very large sums. But the then Treasurer Peter Costello wanted to restrict superannuation investment – tax paid or so called non-concessional contributions – to $150,000 a year. And, as a bonus, he allowed investors in the nine months to June 30, 2007 to invest $1 million each on a tax-paid or non-concessional basis. For a couple, that meant $2 million.

Lots of people could access $1 million, and a great many borrowed money on their house to take the opportunity to invest in superannuation which would be tax free for those in pension mode.

I don't think we have ever seen such a rush of money into superannuation in a short period of time, and it so happened that at that very time world stock markets were surging (the Dow reached a then peak of 14,000 in July 2007) and Australia hit highs that have not been reached since.

And so, given we were in a boom, a large amount of that superannuation money went straight into the stock market around June 30, 2007. Looking back there were signs that the US subprime market was in a very dangerous phase. The balloon went up in August 2007 and, in the months that followed, it led to the global financial crisis. Those that took up Peter Costello's invitation to put their savings and or borrowings into superannuation and then bundled their money into the share market lost a fortune.

Looming super changes, and market jitters

And so now, exactly a decade later, in the period leading up to June 30, 2017, we are about to further restrict the money that can be put into superannuation on a tax-paid or non-concessional basis. This time the limit is to be $100,000. But you can invest $540,000, or three years' contributions, at the current rate if you make the investment before June 30, 2017.

It is very clear that many thousands of Australians are doing just that, and have not waited until June 30. Some who have boosted their contributions are already buying shares in high-yielding banks and infrastructure stocks. It would seem that, as the superannuation buying pressure pushed up stock prices, so the shorters panicked and began to cover. I suspect short covering in the case of banks has eclipsed the super money demand.

A lot of international institutions are short Australian bank stocks, so would have been alarmed at the super driven buying. That cocktail triggered demand swings, so the upward thrust was interrupted during the week.

Once June 30 passes our stock market will perform in a more normal way and follow the US and local trends. At this point I can't see a global financial crisis about to hit us, but it is fascinating that the US bond market is reacting in a way that is totally different to what most predicted six months ago.

Federal Reserve chief Janet Yellen is lifting interest rates, but instead of the bond rate rising in response it fell this week because investors are jittery about President Trump's ability to ‘make America great again' by tax cuts, sucking US funds held offshore back to the US and create spending on infrastructure. American and global funds are pouring into the US bonds. In other words, the bond market is telling us the US revival is going to be much tougher than was expected, and that is not good for global share markets. My contacts in the US say that the car market is weak, and the burst of oil drilling in the US is receding with the fall in the oil price. Those fortunate enough to have $540,000 to invest in super should be careful about repeating the mistakes of 2007 and plunging it into the share market.

Ten troubles a warning to investors

Now to Lachlan and James. When you make investments with your friends, think of the lessons from the Ten Network. Lachlan Murdoch and James Packer were mates and clearly they reckoned that they could make Ten Network do well. Maybe they dreamed up their plan over a barbecue, which is the way a lot if these schemes are devised?

So, at first, they invested heavily in the equity of the Ten Network (Gina Reinhart thought that if the Packers and Murdochs thought it was good, she should have a slice). But it soon became apparent that Ten was harder than they thought. Then James and Lachlan guaranteed a $200 million Commonwealth Bank line of credit for the Ten Network. It is a big step from being a shareholder in the public company to then guaranteeing some of that public company's debt.

The fundamental problem with Network Ten is that there has been a significant change in the television audience. The Ten Network was extremely skilled in promoting the “young people market”, which was an area that other channels did not focus on. Unfortunately, the development of social media and other electronic outlets has sucked young people away from television (and also newspapers), so a very different strategy is now required.

Whenever you make an investment, always keep an eye on what is taking place in the industry. In today's environment, we are going to see many fundamental industry changes. Media problems, including television, are merely a forerunner of events to follow. I think it is reasonable to assume that the retail sector will go through a similar revolution to media. In other words, keep your eye out for fundamental industry changes. The US and European trends will transplant to Australia.

In the case of Network Ten the Murdoch family were particularly exposed, because it seems Lachlan had pledged part of his inheritance. On the other hand, if the TV laws ever changed Network Ten would be a very valuable acquisition to the News Corporation/Foxtel empire.

Just before going into administration Network Ten was going through a substantial reorganisation of its cost base, but it was dependent on the continuation of the loan guarantees to get it through this restructuring period.

When notice was given that the guarantees were to be withdrawn in December, Lachlan Murdoch wrote to the directors to say they could be personally liable. The administrator had to come in. Assuming the media changes go through Parliament, the Ten Network could end up being owned by Lachlan Murdoch, News Corp and/or another big stakeholder, Bruce Gordon.

Small shareholders have lost out. Exactly how all these things took place I have no doubt will be the subject of many articles. But those investing in high-risk companies like Network Ten face an extra risk when there are entrepreneurial shareholders who have personally guaranteed loans, a major corporate play involved, at the same time as the industry is changing rapidly. It is usually better to stay away from such situations.

Last week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

- Share markets were mixed over the last week with US shares up fractionally despite tech stocks remaining a drag but Eurozone, Japanese and Chinese shares down. Australian shares managed a decent rebound, as they were due a bounce after having fallen 5% from early May highs and fund flows into superannuation ahead of a June 30 deadline for some members are likely providing a strong source of demand for now and this may intensify until month end. Bond yields mostly declined, helped by low US inflation data. Prices for oil, gold and copper fell but iron ore managed a small gain. The $A also had a bounce despite a stronger $US, thanks to stronger Australian jobs data.

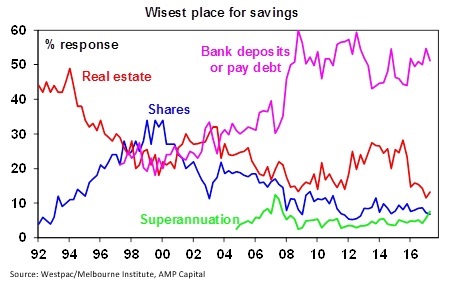

- On the superannuation boost to Australian shares this month, it's interesting to note that while Australian consumers remain sceptical about shares as the “wisest place for their savings” their interest in superannuation has picked up (albeit from a low base) presumably in response to recent super reforms which allow for large one-off contributions prior to June 30. Something similar was seen in mid-2007. It's also noteworthy how sceptical Australian's remain of real estate (relative to the historical norm) according to the survey. But this has been the case for more than a year now and it hasn't stopped further gains in Sydney and Melbourne property prices, at least until recently.

- Share markets were mixed over the last week with US shares up fractionally despite tech stocks remaining a drag but Eurozone, Japanese and Chinese shares down. Australian shares managed a decent rebound, as they were due a bounce after having fallen 5 per cent from early May highs and fund flows into superannuation ahead of a June 30 deadline for some members are likely providing a strong source of demand for now and this may intensify until month end. Bond yields mostly declined, helped by low US inflation data. Prices for oil, gold and copper fell but iron ore managed a small gain. The $A also had a bounce despite a stronger $US, thanks to stronger Australian jobs data.

- On the superannuation boost to Australian shares this month, it's interesting to note that while Australian consumers remain sceptical about shares as the “wisest place for their savings” their interest in superannuation has picked up (albeit from a low base) presumably in response to recent super reforms which allow for large one-off contributions prior to June 30. Something similar was seen in mid-2007. It's also noteworthy how sceptical Australian's remain of real estate (relative to the historical norm) according to the survey. But this has been the case for more than a year now and it hasn't stopped further gains in Sydney and Melbourne property prices, at least until recently.

- The Federal Reserve provided no surprises with its fourth rate hike this cycle, no change to the so-called dot plot path for expected future interest rate hikes, some details around how it will slow reinvesting in bonds as they mature to allow its balance sheet to start returning to normal and the usual assurances that the removal of easy money will be gradual and conditional on the economy behaving as expected. Our view is that the Fed will hike rates once more this year in September and commence balance sheet reduction in the December quarter. However, ongoing benign inflation is likely to see a slower path of rate hikes in 2018 and 2019 than the dot plot is implying. The absence of significant upside inflation pressures mean the Fed will remain benign and unlikely to pose a threat to US or global growth and hence share markets.

- The noise around President Trump and Russia links continues with talk that Trump was thinking of sacking Special Counsel Bob Mueller who is investigating the links and then news that Mueller was looking into a possible obstruction of justice by Trump the leak of which may have been motivated to get Trump to back off. All of which saw an amusing tweet from Trump: “They made up a phony collusion with the Russians story, found zero proof, so now they go for obstruction of justice on the phony story. Nice.” Mueller's probe will probably find something somewhere even if it is not related to the Russia link. Reminds me a bit of the twists that the investigation into President Clinton took from Whitewater to Monica Lewinsky. Our view remains that while the Democrats may find something to impeach Trump on when they get control of the House of Representatives after the November 2018 mid-terms, in the meantime the Republicans are unlikely to impeach Trump. Rather the likely loss of control of Congress after November next year will see Republicans pull together to pass their pro-business agenda including around healthcare and tax reforms. The shooting of Republican Congressional members only adds to this.

- A likely parliamentary majority for President Macron's Republic on the Move party at Sunday's final round French parliamentary election is probably already factored in by markets. Nevertheless, it will be a momentous occasion with the French about to head down a market oriented reform path starting with labour market reforms, and clearing the way for France to work with Germany to strengthen the Eurozone. The French elections coming on the back of pro-Euro outcomes in Spain, Austria and the Netherlands and almost certainly in Germany highlight diminishing political risk in the Eurozone. While Italy remains a risk, the waning of populist support across Europe may have a spill over in Italy, the Eurosceptic Five Star Movement is unlikely to be able to form government and in any case the risk of a domino like flow on from Italy to the rest of the Eurozone looks to be in retreat. Similarly, while Catalonia in Spain is aiming to have another independence referendum in October it should be noted that polls of Catalonians show that most favour more autonomy within Spain, not independence. All of which along with attractive valuations and a supportive ECB is positive for Eurozone shares.

Major global economic events and implications

- US data was a bit messy but consistent with reasonable growth and continuing low inflation. May retail sales were soft but this was countered by an upwards revision to already solid April sales and in any case the New York & Philadelphia Fed manufacturing conditions surveys were strong in June, small business optimism remains very high, home builder conditions remain strong and unemployment claims remain around their lowest since the early 1970s. Against this core CPI inflation was weaker than expected in May at 1.7 per cent year on year. The US economy continues to look good but the lack of inflation pressure means the Fed can afford to remain gradual.

- The Bank of England left rates on hold but it was more hawkish than expected. The risk of a rate hike has gone up, but Brexit uncertainty will keep the BoE on hold for a while yet.

- The Bank of Japan remained on autopilot as expected as it has committed to continuing quantitative easing and targeting a zero 10-year bond yield until inflation exceeds 2 per cent.

- Chinese activity data and credit growth for May points to growth holding up. While fixed asset investment slowed a touch growth in retail sales and industrial production was unchanged. While money supply growth slowed owing to a slower shadow bank and mortgage lending overall credit growth edged up slightly to 14.7 per cent year on year. The overall picture is that Chinese growth has slowed after the acceleration seen earlier this year but that it remains solid at around 6.5 per cent.

- India saw a nice combination of stronger than expected industrial production in April and weaker than expected inflation. It remains a bright spot in the emerging world, although its share market valuations already reflect that.

Australian economic events and implications

- Australian data was a bit more upbeat over the last week. While consumer confidence fell further below its long term average highlighting the negative impact of poor wages growth, high underemployment, rising electricity prices, etc on households, business conditions and confidence remained solid and jobs data surprised on the upside for the third month in a row taking the unemployment rate down to its lowest since early 2013. While the boom in jobs over the last three months should be treated with some caution, it is consistent with forward looking labour market indicators and the jobs data along with solid business conditions provide a bit of an offset to other recent more negative data. The jobs data and the NAB survey support the RBA in leaving interest rates on hold for now. But given softer data for growth, consumer spending, housing construction, non-mining investment and wages growth, our view remains that there is more risk of another rate cut than a rate hike in the next 12 months or so.

- For a decade or more political dysfunction has played havoc with Australia's energy supply – as the uncertainty has led to underinvestment in new capacity by both clean and dirty sources of energy - and we are now paying the price. Not only in terms of getting our emissions down but also in terms of surging energy prices weighing on households and businesses. This is set to continue with price rises of up to 20 per cent this year. The problem is widely recognised but unless we can put politics aside and get agreement around energy policy – with the Finkel review providing a way forward - then the problem will only worsen and we will lose businesses and jobs to countries who have got their act together on this front.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Spattering of ‘second tier' economic indicators for release

There are no ‘top shelf' indicators like retail sales or economic growth to be released in Australia over the coming week. But there are still plenty of indicators that can round out our knowledge about the economy.

- In Australia, the week kicks off on Monday with the Reserve Bank Governor, Philip Lowe, providing comments in a panel discussion at the 2017 Crawford Australian Leadership Forum in Canberra. The scheduled comments are due at 9.30am, so a good way to start off the week with fresh insights on the economy.

- Also on Monday the Australian Bureau of Statistics (ABS) release the May data on new vehicle sales. Industry data has already been released and it showed that sales were the highest for any May month.

- According to the Federal Chamber of Automotive Industries, new motor vehicle sales totalled 102,901 in May, up 6.4 per cent on a year ago.

- Passenger vehicles in May were up 1.6 per cent on a year earlier while sales of sports utility vehicles (SUVs) were up by 9.4 per cent and other vehicles were up by 9.9 per cent.

- On Tuesday, the CommBank business sales indicator is released together with the ABS data on residential prices while minutes of the last Reserve Bank Board meeting are also issued. And ANZ and Roy Morgan publish the usual weekly consumer confidence figures.

- The CommBank business sales index is a measure of economy-wide spending. Meanwhile the ABS data on home prices is a bit dated, covering the month of March. But the data includes estimates of the number of homes and the average number of people per home.

- Based on the data CommSec estimated that there were 2.476 people per home in December quarter 2016, down 0.4 per cent on a year ago. The number of people per home has been falling in annual terms for 2½ years.

- Surprisingly the number of homes in Australia grew by 172,800 in the year to December after recording annual gains of 185,800 in September and 182,400 in June. It was the smallest annual lift in homes for 15 months.

- The minutes of the Reserve Bank Board meeting are always closely dissected by analysts and investors. Comments on the job market, housing and the Federal Budget will attract most attention.

- And investors will monitor whether consumer confidence has continued its trend improvement over the past month.

- On Thursday, the ABS releases the usual detailed monthly data on the job market. However each quarter the ABS provides additional estimates on employment by industry, so the May data will be of interest.

- The May data should confirm that the Healthcare sector is the biggest employer in Australia.

Overseas: US Housing sector in focus

- The focus is very much on the housing sector in the coming week with new data to be released in China and the US in the coming week.

- The week begins on Monday in China with the May data on home prices. As has been the case across the globe, investors have been stepping up purchases of homes given the low interest rates on offer. Chinese home prices are currently 10.7 per cent higher than a year ago. Annual price growth peaked at 12.6 per cent in November and has been easing in the period since.

- In the US on Tuesday the broadest measure of trade – the current account – is released while the usual weekly data on chain store sales is also issued. The US trade accounts remain mired in red ink with the current account in deficit by US$112.4 billion in the December quarter. By comparison Australia's current account is close to balance.

- In the US on Wednesday the usual weekly data on mortgage applications is released together with data on existing home sales. Economists expect that sales edged up from a 5.57 million annual rate to 5.60 million in May. Home sales were at decade highs of 5.7 million in March this year.

- On Thursday in the US the usual weekly data on claims for unemployment insurance is released with the Federal Housing Finance Agency data on home prices, the leading index and the Kansas City Federal Reserve survey. Home prices have been growing at a near 6 per cent annual pace for around two years.

- And on Friday in the US, data on new home sales is released. Home sales were at 9½-year highs in March and are trending near the highs. And the Markit “flash” readings on manufacturing and services sectors are released in the US, Europe and Japan – timely gauges on activity.

Craig James is chief economist at CommSec.

Readings & Viewings

In a world where fake news is everywhere, we can't be certain if this news item is for real. But, then again, anything is possible in America. The results have even been reported in The Washington Post, so the story must be true.

Which brings us to our coverage this week, where Greece was thrown another financial lifeline. Is this the end of the Greek crisis? Don't necessarily believe what you read.

Staying in Greece, and in light of Australia's looming energy crisis, there are lessons to be learned from the island of Tilos – the first island in the region to run exclusively on wind and solar power.

Over in Canada, all provinces must be part of national climate change framework to access per capita funding. Manitoba and Saskatchewan are dragging the energy chain, it seems.

Meanwhile, after signing multi-billion-dollar arms deals with the US, now the Saudis want some payback on oil.

As The New York Times reports, the oil war between OPEC and the US is far from over.

But rising US interest rates could help to boost oil.

In the business world, winning the war usually comes down to giving up some ground. Hence, after more than 18 months, the $US130 billion merger between Dow and Dupont has finally been given the green light – subject to conditions.

Talking of wars, we know there's a big one underway across the global retail sector too. Australian retailers are not the only ones feeling the heat. German supermarket retailer Lidl is on the way here. And it has just arrived in the US, where it's hoping to win over the hearts and stomachs of Americans.

But that could be a challenge. Believe it or not, food giant Nestle is considering offloading its US operations because its sweets business there has turned sour.

To push home the food point, if you ever watched Seinfeld, you'll definitely remember “the soup Nazi”. Now, the Soupman has found itself in the financial soup.

Venerable business consulting firm Booz Allen is feeling the pinch, thanks to an investigation into its billing practices by the Justice Department.

Over in the tech sector, the sharp declines in the prices of various NASDAQ stocks (also known as FAANGS) this week sent shivers across global markets, ours included (at least for a couple of days). But despite fears stocks such as Amazon are overvalued, apparently that isn't so.

Which should give Amazon founder Jeff Bezos some comfort. He's turned to Twitter to get ideas for his philanthropy program.

He didn't turn to Snapchat, though. Recently listed Snap Inc., the mobile app developer behind Snapchat, saw its share price hammered this week.